Address Verification Service (AVS)

An AVS check compares the cardholder's billing address used in an online transaction with the issuing bank’s address information on file for that cardholder.

The AVS check is typically initiated by a merchant during an online e-commerce purchase transaction. Depending on whether the address provided by the cardholder matches fully, partially, or not at all to the address information stored by the issuer, the merchant can use that information in their decision on whether or not to accept or cancel the order. AVS is one of the most widely used fraud prevention tools in card-not-present transactions.

Program Managers can use the Thredd Web Services or cards API to populate address details in the card record. These address details will be used for any AVS checks.

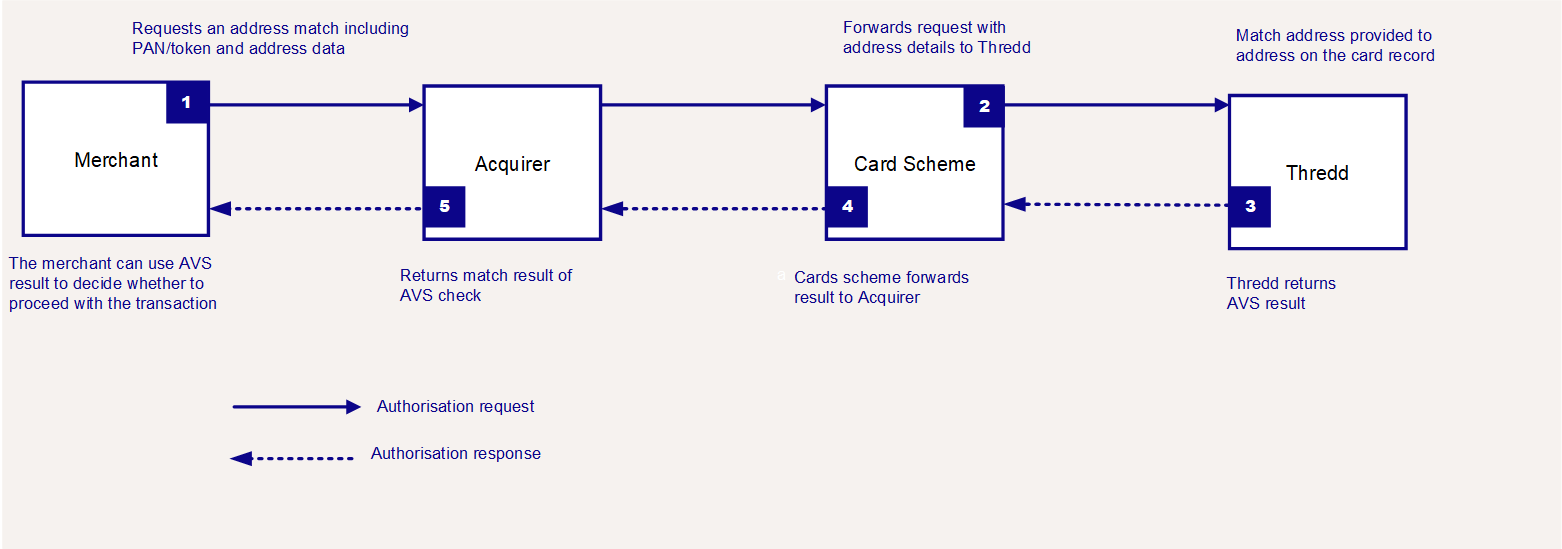

The figure below describes the typical process during an online authorisation request where an AVS check is also requested.

Click the image to expand.

Figure: Address Verification Service (AVS)

Further details of the steps are described below.

-

The merchant requests an address match to the Card Scheme through the Acquirer. The request includes the PAN/token and the address details.

-

The Card Scheme forwards the address match request to Thredd for verification. Thredd matches the address details provided in the authorisation request with the address details held on record for that card (the Postcode and Street address details are matched).

-

Thredd returns a normal authorisation approve or decline response to the Card Scheme, which includes an extra indicator giving the result of the AVS check. For details see AVS Results in the External Host Interface Guide. (AVS check failures do not normally result in a decline from Thredd , unless specifically configured for your programme; see Auto-decline for AVS check.)

-

The Card Scheme forwards the results to the Acquirer.

-

The Acquirer returns the AVS result to the merchant. If there is a normal approve response, with AVS response indicator saying the address details do not match, then the merchant can choose to treat this as a decline. If they treat as a decline, since Thredd sent approve, the merchant can send Thredd a reversal immediately afterwards. This ensures the blocked amount placed on the account is removed.

If the AVS check returns a match, then the merchant can process the approved amount (capture the funds) and provide their customer with the goods or services.

The merchant can submit the authorisation message as either a normal authorisation purchase or as an Account Verification/Account Status Inquiry (ASI) request for a zero amount.

If the original authorisation request was an Account Verification or Account Status Inquiry (ASI) request, the merchant would need to submit a subsequent purchase authorisation for the required transaction amount.

Auto-decline for AVS check

A Thredd advanced permissions option enables you to configure your programme so that if an address verification check does not match on postcode and street address, this results in an automatic decline. This check will only be carried out if the merchant provides AVS data.

You should be aware that this option could potentially result in large numbers of declines.

AVS Results

The following table shows the AVS results that are verified during AVS for Mastercard and Visa:

|

Value |

Description |

|---|---|

|

A |

Address matches, postal code does not. |

|

N |

Both postal code and address not matching. |

|

R |

Retry, system unable to process. If the AVS response does not contain data to enable you to match, respond with a retry. |

|

U |

No data received. |

|

W |

The postal code matches, address does not. This is used for both US and non-US addresses. |

|

X |

9-digit postal code and address match. |

|

Y |

Both postal code and address matching. |

|

Z |

Postal or ZIP codes match, street addresses do not match or street address not included in request. |

AVS Opt-out

For cards issued in countries where AVS is not available, Thredd can enable opt-out of AVS checks. This can help to prevent the frequency of authorisation reversals, where merchants reverse transactions that have not passed AVS checks. For further information, please check with your Thredd Account Manager or Implementation Manager.

AVS Availability

Issuers are required to support AVS verification requests when they are sent by merchants in the following regions:

|

Mastercard |

Visa |

Discover |

|---|---|---|

|

|

|

Refer to the Mastercard, Visa or Discover official documentation for the most up-to-date and region-specific requirements regarding AVS usage.