2.2 Transaction Matching

A typical card payment transaction generates multiple messages during its life cycle. The GetTransaction message types you receive for a transaction must be linked to the previous messages for that transaction. This matching enables you to track the history of the transaction, compare the financial effect of a new messages with previous messages and re-calculate card balances.

In Full Service Processing (mode 3) and Cooperative Processing (mode 2), Thredd manages transaction matching.

2.2.1 Matching Overview

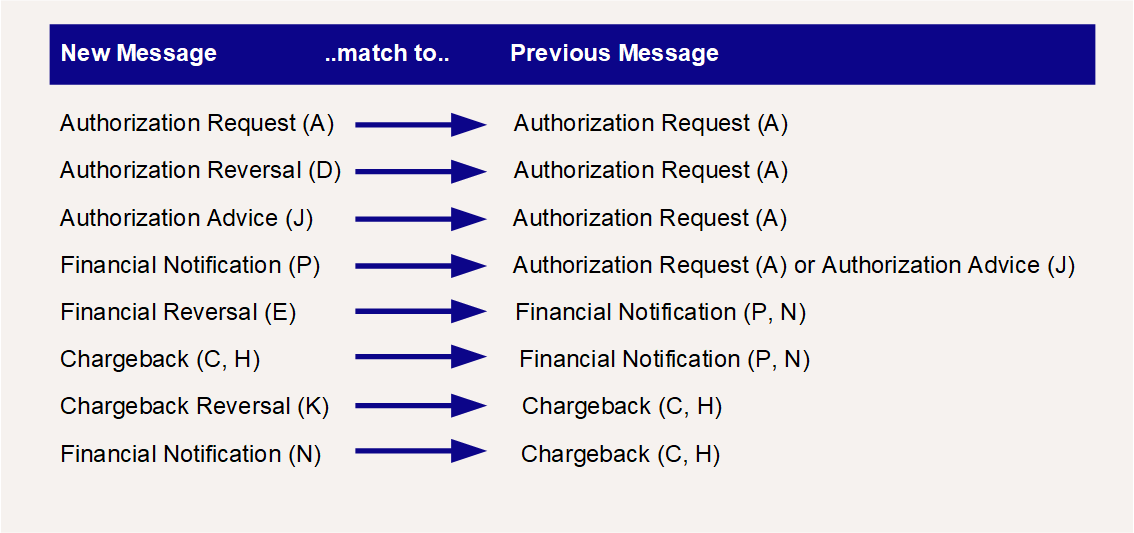

Your systems should match new to previous transactions as follows:

Figure 18: Transaction Matching Criteria

For further details, see the Transaction Matching Criteria below.

Where 3D Secure authentication applies, additional transaction matching should be performed to match details in the authorisation to the 3D Secure authentication details. For detail see Transaction Matching - Authentications and Authorisations.

Matching Criteria and Accuracy

Matching a transaction to its original (e.g., Presentment to matching Authorisation, or Authorisation Reversal to matching Authorisation) is based on the information received. In most cases transactions match. However, acquirers do not always send accurate information, so mistakes can occur.1

You can use the following options to find a match:

-

The matching criteria recommended in the section Transaction Matching Criteria

-

Your own matching criteria

-

A combination of both the above.

As a general rule, the more matching fields that correctly match, the more reliable the match. If some fields match and some do not, this indicates an ‘unreliable’ match.

Transaction Matching Criteria

The table below provides best-practise guidelines on how to match transactions.

Match Criteria:

-

If “Match to” is “-“, this means there is nothing to match against.

-

“THIS” = this transaction (i.e., the one with

MTID+Txn_Typefrom the same row) is the transaction you have just received in the EHI message -

“OTHER” = the other transaction (in the “Match to” column) that is being found by matching (to match to THIS)

-

Syntax: OTHER.other_field_name = THIS.this_field_name where the field names refer to the GetTransaction Message Fields.

|

MTID |

Txn_Type |

Description |

Match to? |

Match Criteria |

|---|---|---|---|---|

|

0100 |

A |

Authorisation Request |

- |

OTHER.token=THIS.token AND OTHER.traceid_lifecycle = THIS.traceid_lifecycle

For an incremental authorisation, check for a transaction of |

|

- |

D |

Automatic Authorisation Reversal |

Authorisation Request |

OTHER.token=THIS.token AND OTHER.trans_link = THIS.trans_link |

|

0101 |

A |

Authorisation Repeat (Visa Only) Note: This transaction is uncommon as only a few acquirers use it. You should respond to a repeat request in the same way as you respond to an original authorisation request. If you decline the repeat authorisation, the terminal may send a new 0100 authorisation, however, you should not assume that this will always occur. |

Authorisation Request |

OTHER.mtid=’0100’ AND OTHER.traceid_lifecycle=THIS.traceid_lifecycle AND OTHER.trans_link=THIS.trans_link AND OTHER.Ret_Ref_No_DE37=THIS.Ret_Ref_No_DE37 AND OTHER.TXN_Time_DE07=THIS.TXN_Time_DE07 AND OTHER.POS_Termnl_DE41=THIS.POS_Termnl_DE41 AND OTHER.Token=THIS.Token |

|

0120 |

J |

Authorisation Advice |

Authorisation Request (Auth request may not exist) |

OTHER.token=THIS.token AND (if THIS.traceid_lifecycle exists) OTHER.traceid_lifecycle = THIS.traceid_lifecycle OR (if THIS.Auth_Code_DE38 exists) OTHER. Auth_Code_DE38 = THIS.Auth_Code_DE38 OR (if THIS.trans_link exists) OTHER.trans_link = THIS.trans_link Note: If neither THIS.traceid_lifecycle or THIS.trans_link is present, then there is no match. Normally traceid_lifecycle will always be present if an authorisation exists. |

|

0120 |

D |

Authorisation reversal due to a 0120 Automated Fuel Dispenser Advice |

Authorisation Request |

OTHER.token=THIS.token AND (if THIS.traceid_lifecycle exists) OTHER.traceid_lifecycle = THIS.traceid_lifecycle AND (if THIS.Auth_Code_DE38 exists) OTHER. Auth_Code_DE38 = THIS.Auth_Code_DE38 AND (if THIS.trans_link exists) OTHER.trans_link = THIS.trans_link Note: If neither THIS.traceid_lifecycle or THIS.trans_link is present, then there is no match. Normally traceid_lifecycle will always be present if an authorisation exists. |

|

0400 |

D |

Authorisation Reversal Request |

Authorisation Request |

OTHER.token=THIS.token AND (if THIS.traceid_lifecycle exists) OTHER.traceid_lifecycle = THIS.traceid_lifecycle AND (if THIS.Auth_Code_DE38 exists) OTHER. Auth_Code_DE38 = THIS.Auth_Code_DE38 AND (if THIS.trans_link exists) OTHER.trans_link = THIS.trans_link Note: If neither THIS.traceid_lifecycle or THIS.trans_link is present, then there is no match. If the reversal is due to timeout at the acquirer, THIS.traceid_lifecycle may not exist. Note: The Auth_Code_DE38 is not mandatory for Visa authorisation reversal transactions and therefore acquirers can choose to send it or not.; In some cases, the auth code is sent in the original request but not in the authorisation reversal. In this case treat Auth_Code_DE38 = '000000' as you would do when it is blank. |

|

0420 |

D |

Authorisation Reversal Advice |

Authorisation Request |

OTHER.token=THIS.token AND (if THIS.traceid_lifecycle exists) OTHER.traceid_lifecycle = THIS.traceid_lifecycle AND (if THIS.Auth_Code_DE38 exists) OTHER. Auth_Code_DE38 = THIS.Auth_Code_DE38 AND (if THIS.trans_link exists) OTHER.trans_link = THIS.trans_link Note: If neither THIS.traceid_lifecycle or THIS.trans_link is present, then there is no match. If the reversal is due to a timeout at the acquirer, THIS.traceid_lifecycle may not exist. |

|

1240 05pp 06pp 07pp

(p=space) |

A |

Authorisation Advice Notification (New dummy authorisation created if a financial notification has no matching authorisation.) 1240 for Mastercard 05pp, 06pp or 07pp for Visa where p=space |

- |

This message should be ignored. It indicates an offline transaction where Thredd has not received a previous authorisation request. See First Presentment for an Offline Transaction.

You will receive the financial notification corresponding to authorisation advice, which has all the information required.

|

|

1240 |

E |

Financial Reversal Some credit/refund transactions may be reported as MTID ‘1240’, Txn_type 'P' (with processing code 20xxxx). |

Financial Notification |

OTHER.Acquirer_Reference_Data_031 = THIS.Acquirer_Reference_Data_031 AND OTHER.token=THIS.token AND OTHER.Txn_Amt=THIS.Txn_Amt AND OTHER.Txn_CCy=THIS.Txn_CCy AND OTHER. Auth_Code_DE38 = THIS.Auth_Code_DE38 AND OTHER.POS_Time_DE12=THIS.POS_Time_DE12 AND OTHER.Ret_Ref_No_DE37=THIS. Ret_Ref_No_DE37 Note: In some cases both OTHER.Auth_Code_DE38 and THIS.Auth_Code_DE38 are not present. |

|

1240 |

C |

Chargeback Notification |

Financial Notification |

OTHER.Acquirer_Reference_Data_031 = THIS.Acquirer_Reference_Data_031 AND OTHER.token=THIS.token AND OTHER. Auth_Code_DE38 = THIS.Auth_Code_DE38 AND OTHER.trans_link = THIS.trans_link Note: In some cases both OTHER.Auth_Code_DE38 and THIS.Auth_Code_DE38 are not present. |

|

1240 |

H |

Chargeback Notification (Non-Credit) |

Financial Notification |

As above (see MTID=1240, Txn_Type=’C’) |

|

1240 |

K |

Chargeback Reversal |

Chargeback |

As above (see MTID=1240, Txn_Type=’C’), except that OTHER (the original to match) will have Txn_Type of ‘C’ or ‘H’) |

|

1240 |

N |

Financial Notification (Second Presentment) |

Financial Notification and/or Chargeback Notification (Txn_Type H or N) |

As above (see MTID=1240, Txn_Type=’C’) |

|

1240 |

P |

Financial Notification (First Presentment) |

Authorisation (0100 or 0120) |

Rule 1: (reliable match if found, Thredd and acquirer matching data) OTHER.token=THIS.token AND (if THIS.traceid_lifecycle exists) OTHER.traceid_lifecycle = THIS.traceid_lifecycle AND (if THIS.Auth_Code_DE38 exists) OTHER.Auth_Code_DE38 = THIS.Auth_Code_DE38 AND OTHER.trans_link = THIS.trans_link AND OTHER.TXn_ID = THIS.Matching_Txn_ID AND OTHER.Txn_CCy = THIS.Txn_CCy (see notes below )

Rule 2: (run if no match on rule 1, AND THIS.traceid_lifecycle exists. Uses Acquirer matching data only) OTHER.token=THIS.token AND OTHER.traceid_lifecycle = THIS.traceid_lifecycle AND (if THIS.Auth_Code_DE38 exists) OTHER. Auth_Code_DE38 = THIS.Auth_Code_DE38 AND OTHER.Txn_CCy = THIS.Txn_CCy (see notes below too)

Rule 3: (run if no match on rule 1. Uses Thredd matching data only) OTHER.token=THIS.token AND (if THIS.Auth_Code_DE38 exists) OTHER.Auth_Code_DE38 = THIS.Auth_Code_DE38 AND OTHER.trans_link = THIS.trans_link AND OTHER.TXn_ID = THIS.Matching_Txn_ID AND OTHER.Txn_CCy = THIS.Txn_CCy (see notes below)

NOTES

2. OTHER.trans_link may not exist if matching to a MTID=0120. So rule 2 is useful here. 3. Other fields that should normally match include:

3. If rule 2 matches and rule 3 does not, (or vice-versa), this indicates an unreliable match. It is up to you if you use the found match or not. 4. Normally traceid_lifecycle will always be present if an authorisation exists. However, if this is a refund, then there will not be an authorisation with a matching traceid_lifecycle. |

|

05pp

(p = space) |

N |

Financial Notification of a Purchase (from Visa) (Second Presentment) |

Prior Financial Notification or Chargeback |

As above (see MTID=1240, Txn_Type=’N’) |

|

06pp

(p = space) |

N |

Financial Notification of a Refund or Credit-to-cardholder (from Visa) (Second Presentment) Some credit/refund transactions may be reported as MTID ‘05pp’, Txn_type 'P' (with processing code 20xxxx). |

Prior Financial Notification or Chargeback |

As above (see MTID=1240, Txn_Type=’N’) |

|

07pp

(p = space) |

N |

Financial Notification of a Cash Withdrawal or disbursement (from Visa) (Second Presentment) |

Prior Financial Notification or Chargeback |

As above (see MTID=1240, Txn_Type=’N’) |

|

05pp

(p = space) |

P |

Financial Notification of a Purchase (from Visa) |

Authorisation |

As above (see MTID=1240, Txn_Type=’P’) |

|

06pp

(p = space) |

P |

Financial Notification of a Refund or Credit-to-cardholder (from Visa) (First Presentment) |

Authorisation |

As above (see MTID=1240, Txn_Type=’P’) |

|

07pp

(p = space) |

P |

Financial Notification of a Cash Withdrawal or disbursement (from Visa) (First Presentment) |

Authorisation |

As above (see MTID=1240, Txn_Type=’P’) |

|

25pp

(p = space) |

E |

Financial Reversal of a Purchase (from Visa) (First Presentment) |

Prior Financial notification (MTID=05) |

As 1240 Financial Reversal above (see MTID=1240 Txn_Type=’E’) Note: If you cannot match on Acquirer_Reference_Data_031 then try matching on traceid_lifecycle and trans_link. If you cannot match on these, then try Auth_Code_DE38 and Merch_ID_DE42. |

|

26pp

(p = space) |

E |

Financial Reversal of a Refund/Credit-to-cardholder (from Visa) |

Prior Financial notification (MTID=06) |

As 1240 Financial Reversal above (see MTID=1240 Txn_Type=’E’) Note: If you cannot match on Acquirer_Reference_Data_031 then try matching on traceid_lifecycle and trans_link. If you cannot match on these, then try Auth_Code_DE38 and Merch_ID_DE42. |

|

27pp

(p = space) |

E |

Financial Reversal of a Cash Withdrawal/disbursement (from Visa) |

Prior Financial notification (MTID=07) |

As 1240 Financial Reversal above (see MTID=1240 Txn_Type=’E’) Note: If you cannot match on Acquirer_Reference_Data_031 then try matching on traceid_lifecycle and trans_link. If you cannot match on these, then try Auth_Code_DE38 and Merch_ID_DE42. |

|

- |

L |

Load |

- |

- |

|

- |

U |

Unload |

- |

- |

|

- |

G |

Payment |

- |

- |

|

- |

B |

Balance Adjustment |

- |

- |

|

- |

Y |

Card Expiry |

- |

- |

|

- |

F |

Fee |

- |

- |

Resolving Transaction Matching Issues

For more information on resolving matching issues, see Troubleshooting FAQs: Transactions and Matching.

2.2.2 Blocking and Unblocking of Card Funds

When processing and matching transaction messages, you should appropriately apply or remove any card blocks. Below are some guidelines:

-

If the authorisation request is for a debit, you should apply a card block to the full billing amount, plus any fees that you or Thredd has applied to the transaction.

-

If the authorisation request is a reversal, you should remove the card block for the amount that has been reversed.

-

If the authorisation request is for a credit, you can choose to not change any card blocks.

It is important to understand who sent the message before you update the block. Did these originate from the Acquirer, the Network or Thredd?

2.2.3 Transaction Processing Summary

The following table summarises how you should process the different types of transactions sent via EHI to the external host. For additional information, see Transaction Type Decoding.

|

MTID |

Txn_Type |

Description |

Action |

|---|---|---|---|

|

0100 |

A |

Authorisation request. |

Process normally. Note: if the |

|

|

D |

Automatic authorisation reversal. Thredd automatically reverses a transaction if it does not receive a presentment transaction from the network within the hanging filter In the EHI message, all the transaction data fields normally sent by the acquirer (e.g., STAN, RRN, AID and FID) will be identical to the original authorisation request (MTID=0100, Txn_Type=’A’). |

Match to the original authorisation request (MTID=0100, Txn_Type=’A’) and process accordingly. |

|

0101 |

A |

Authorisation repeat (Visa only) |

Match to see if an 0100 original message existed (see above matching criteria table.)

|

|

0120 |

J |

Also provided in the following cases:

|

Match to the original authorisation request (MTID=0100, Txn_Type=’A’) and process the advice normally. Before blocking any funds you should check the

For more information, see Transaction Matching Guidelines.

Note: If a matching authorisation request exists (that needed to be cancelled), then you will separately receive a reversal (e.g. if the original response to the original authorisation request was not sent to the terminal). The following fields give more information on the advice:

|

|

0120 |

D |

Authorisation reversal due to an Automated Fuel Dispenser (AFD) 0120 Advice message. (An AFD sends a 0120 advice to confirm how much fuel was actually dispensed. Thredd sends this to you as a reversal, to reverse the unspent part of the original authorisation from the AFD.) |

Match to the original authorisation request (MTID=0100, Txn_Type=’A’) and process this reversal accordingly. |

|

0400 |

D |

Authorisation reversal request This is a reversal received from the network, to reverse a prior authorisation request (MTID=0100, Txn_Type=’A’).

|

Check you have not already received and processed this reversal. If so, ignore it. Match to the original authorisation request (MTID=0100, Txn_Type=’A’) and process accordingly (unblock the reversal amount) Note: if the Txn_Amt in the reversal matches the Txn_Amt in the original authorisation request, then this indicates a full reversal. Unblock whatever was originally blocked. (The Bill_Amt in the reversal may slightly differ to the Bill_Amt in the original due to exchange rate fluctuations.) Note: it is important to apply any blocks due to an 0120 Auth Advice before applying the 0400 reversal. Never unblock more than was currently blocked due to all the messages for the same transaction set. For more information, see Transaction Matching Guidelines. |

|

0420 |

D |

Authorisation reversal advice This is a reversal received from the network, to reverse a prior authorisation request (MTID=0100, Txn_Type=’A’). This is effectively identical to to above (MTID=0400, Txn_Type=’D’), only the MTID is different. The only reason for the difference is that we are sending the MTID as received from the network, and some network specifications for reversals use 0400, and others use 0420. But there is no effective difference – both should be treated as a reversal advice (as in you cannot decline.) (Note: Visa use 0400 and 0420. Mastercard use 0400 when originated by the acquirer, and 0420 when originated by the network.) |

Check you have not already received and processed this reversal. If so, ignore it. Match to the original authorisation request (MTID=0100, Txn_Type=’A’) and process accordingly (unblock the reversal amount) Note: if the |

|

1240 05pp 06pp 07pp

(p = space) |

A |

Authorisation advice notification (Dummy authorisation created if a financial notification has no matching authorisation.) 1240 if from Mastercard 05pp, 06pp, or 07pp if from Visa. (p = space) |

Discard – this is not needed. (The purpose of this message is to provide a dummy authorisation to match to a financial notification.) |

|

1240 |

E |

Financial reversal |

Match to a financial notification (MTID=1240, Txn_Type=’P’ or Txn_Type=’N’) and process accordingly |

|

1240 |

C |

Chargeback notification |

Process normally. (Optionally match to a financial notification (MTID=1240, Txn_Type=’P’) or (MTID=1240, Txn_Type=’N’)) |

|

1240 |

H |

Chargeback notification (Non-Credit) |

Process normally. (Optionally match to a financial notification (MTID=1240, Txn_Type=’P’) or (MTID=1240, Txn_Type=’N’)) |

|

1240 |

K |

Chargeback reversal |

Process normally. This reverses the effect of a chargeback (e.g., if the chargeback changed the account balance, this reverses the effect on the account balance.) Optionally match to the chargeback (MTID=1240, (Txn_Type=’C’ or Txn_Type=’H’)) |

|

1240 |

N |

Financial notification (Second Presentment) |

Process normally. (Optionally match to a financial notification (MTID=1240, Txn_Type=’P’) or Chargeback (MTID=1240, Txn_Type=’H’ / ‘C’) |

|

1240 |

P |

Financial notification (First Presentment) |

Match to the original authorisation request (MTID=0100, Txn_Type=’A’) and process accordingly. Note that not all financial notifications will have a matching authorisation. |

|

05pp

(p = space) |

N |

Financial notification (Second Presentment) |

Process normally. (Optionally match to a financial notification (MTID=05pp, Txn_Type=’P’) or Chargeback (MTID=1240, Txn_Type=’H’ / ‘C’) |

|

06pp

(p = space) |

N |

Financial notification (Second Presentment) |

Process normally. (Optionally match to a financial notification (MTID=06pp, Txn_Type=’P’) or Chargeback (MTID=1240, Txn_Type=’H’ / ‘C’) |

|

07pp

(p = space) |

N |

Financial notification (Second Presentment) |

Process normally. (Optionally match to a financial notification (MTID=07pp, Txn_Type=’P’) or Chargeback (MTID=1240, Txn_Type=’H’ / ‘C’) |

|

05pp

(p = space) |

P |

Financial notification of a purchase (from Visa) |

Match to the original authorisation request (MTID=0100, Txn_Type=’A’) and process accordingly. Note that not all financial notifications will have a matching authorisation. |

|

06pp

(p = space) |

P |

Financial notification of a Refund/Credit-to-cardholder (from Visa) |

Match to Auth request (MTID=0100, Txn_Type=’A’) and process accordingly. Note that not all Financial Notifications will have a matching Authorisation. |

|

07pp

(p = space) |

P |

Financial notification of a cash withdrawal/disbursement (from Visa) |

Match to Auth request (MTID=0100, Txn_Type=’A’) and process accordingly. Note that not all Financial Notifications will have a matching Authorisation. |

|

25pp

(p = space) |

E |

Financial reversal of a purchase (from Visa) |

Match to financial notification (MTID=’05’, Txn_Type=’P’ or Txn_Type=’N’) and process accordingly |

|

26pp

(p = space) |

E |

Financial reversal of a refund/credit-to-cardholder (from Visa) |

Match to financial notification (MTID=’06’, Txn_Type=’P’ or Txn_Type=’N’) and process accordingly |

|

27pp

(p = space) |

E |

Financial reversal of a cash withdrawal/disbursement (from Visa) |

Match to financial notification (MTID=’07’, Txn_Type=’P’ or Txn_Type=’N’) and process accordingly |

|

- |

L |

Load |

Process normally. |

|

- |

U |

Unload |

Process normally. |

|

- |

G |

Payment |

Process normally. |

|

- |

B |

Balance Adjustment |

Process normally. |

|

- |

Y |

Card Expiry |

Process normally. |

|

- |

P |

Fee |

Process normally Amounts are in the Fee fields (Bill_Amt will be zero) |

2.2.4 Incremental Authorisations

Visa and Mastercard allow certain merchants — such as hotels, car rental companies and cruise liners — to obtain an estimated initial authorisation when the final amount of the purchase is unknown and to request incremental funds if needed.

You can match incremental authorisations using the traceid_lifecycle value; each incremental authorisation will have a different txn_ID.

Under normal circumstances Thredd expects, in the same life cycle:

Final presentment transaction amount = SUM(all approved transaction amounts) – SUM(all reversed transaction amounts)

Example 1

The following scenario illustrates how incremental authorisations work:

-

Assume starting blocked amount is zero

a. First Authorisation: £20 - blocked amount now £20

b. Incremental Authorisation: £30 – blocked amount now £50

c. Partial Reversal: £40 – blocked amount now £10

d. Presentment would be for £10

Note that there is no guarantee the above sums will always add up:

-

In all cases, on receipt of the presentment you should unblock the amount that was blocked

-

the final presentment amount may be less than expected

-

the final presentment amount may be more than expected

Incremental authorisations will have:

-

Same Thredd token

-

Same currency

-

Different

txn_ID -

Same

traceid_lifecycle

You can decline any of the incremental authorisations (or all).

2.2.5 Exception Transactions

Some transactions may have slightly different rules than expected. This is normally due to waivers granted by the card scheme to permit this.

Below are some examples that Thredd are aware of. For more information on any of the below, or to see if there are any other situations, contact your Issuer.

Transport for London (United Kingdom of GB and NI) Merchant Transactions

Transport for London (TFL) (London's Public Transport network) have various waivers on authorisation requirements, in order to permit more offline transactions![]() This is often used in scenarios where the merchant terminal is not required to request authorisation from the card issuer (for example for certain low risk, small value transactions used by airlines and transport networks).

The card CHIP EMV determines if the offline transaction is permitted; if not supported, the terminal declines the transaction. Note: Since the balance on the card is not checked in realtime, there is a risk that the card may not have the amount required to cover the transaction. and for amounts larger than usually permitted, after a single approved authorisation request.

This is often used in scenarios where the merchant terminal is not required to request authorisation from the card issuer (for example for certain low risk, small value transactions used by airlines and transport networks).

The card CHIP EMV determines if the offline transaction is permitted; if not supported, the terminal declines the transaction. Note: Since the balance on the card is not checked in realtime, there is a risk that the card may not have the amount required to cover the transaction. and for amounts larger than usually permitted, after a single approved authorisation request.

Example 2

The following example is from Mastercard:

(All of the below have the same traceid_lifecycle)

-

MTID=0100 authorisation for GBP 6.60, which was approved

-

MTID=1240 presentment for GBP 6.60

-

MTID=1240 presentment for GBP 5.80

-

MTID=1240 presentment for GBP 5.30

Rules differ for UK and non-UK BIN ranges. Check with your Issuer for the latest network rules.

Other merchants

There may be other examples of merchants with waivers to the normal process.

Contact your Issuer or the network for more information.