5 API Usage Fees

Fees can be applied to a card when specific Thredd APIs are used. Examples of use of Thredd API include card balance enquires, card replacement, card load and bank transfer fees (for a list of API Usage fee processing codes, see Appendix 2: Fee Processing Codes).

API Usage Fees are only available for Thredd’s SOAP web services

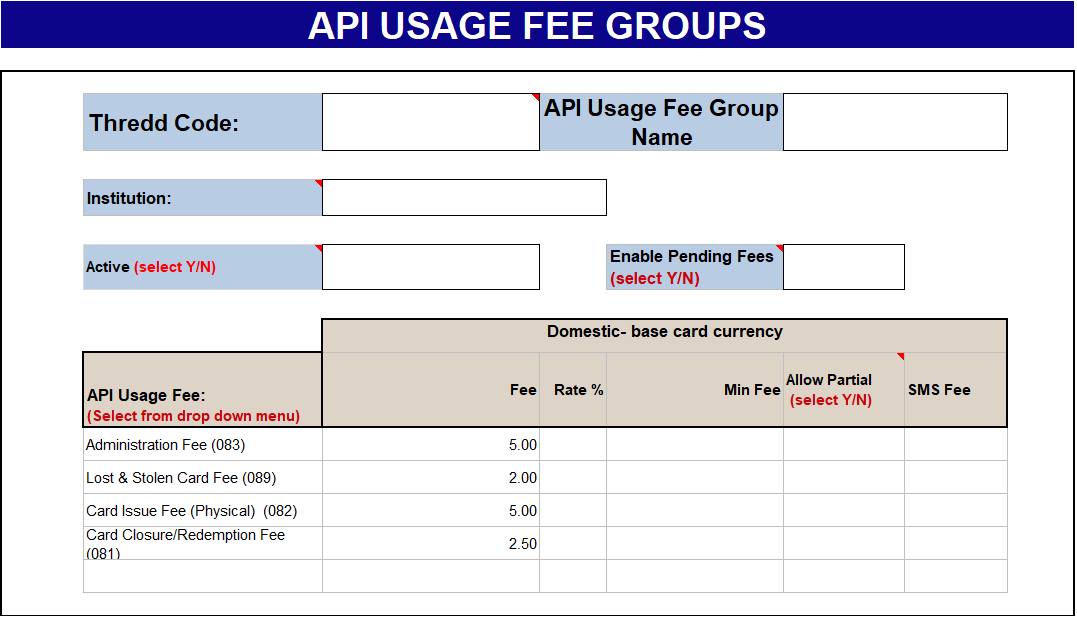

Below is an example of one of the API Usage fee groups set up on the 0.8 API Usage Fee tab. You can have multiple fee groups set up for your program.

Figure 11: API Usage Fee Group

The Group Name is the unique name of the fee group, to be used when linking a card to the fee group. API Usage fees are set up in the card’s domestic currency.

You can define the following fees for each API usage fee type:

-

Fee — fixed fee to be applied to that transaction

-

Rate (%) fee — a percentage of the transaction is charged

-

Minimum fee — a minimum fee to apply to a transaction if you are using a rate fee.

-

Allow Partial Fee — whether to allow a partial fee of the required fee to be charged based on the available balance (less than the fee) on the card.

-

SMS Fee — if the API triggers an SMS message that is sent to the cardholder.

How to use the API Usage Fee Groups Form

Your implementation manager completes this form:

-

The Group Name field displays the unique name of the fee group.

-

The Thredd Code field displays the internal Thredd fee code.

-

The Enable Pending field indicates whether pending fees are enabled1.

-

API usage fee types are listed in column C, in the row under API Usage Fee (select from drop-down menu). For a list of fee processing codes, see Appendix 2: Fee Processing Codes.

-

Each API usage fee type is listed as its own row in column C. The down

arrow enables you to view and select additional API types if required.

arrow enables you to view and select additional API types if required. -

For each row, the fees and fee options that apply to this API type are shown.