Overview

This guides describes how you can start configuring fraud rules using the Fraud Transaction Monitoring System. The document includes:

- A definition of a fraud rule

- Descriptions of what you need to consider before creating a fraud rule

- Examples of how to create fraud rules

What is a Fraud Rule?

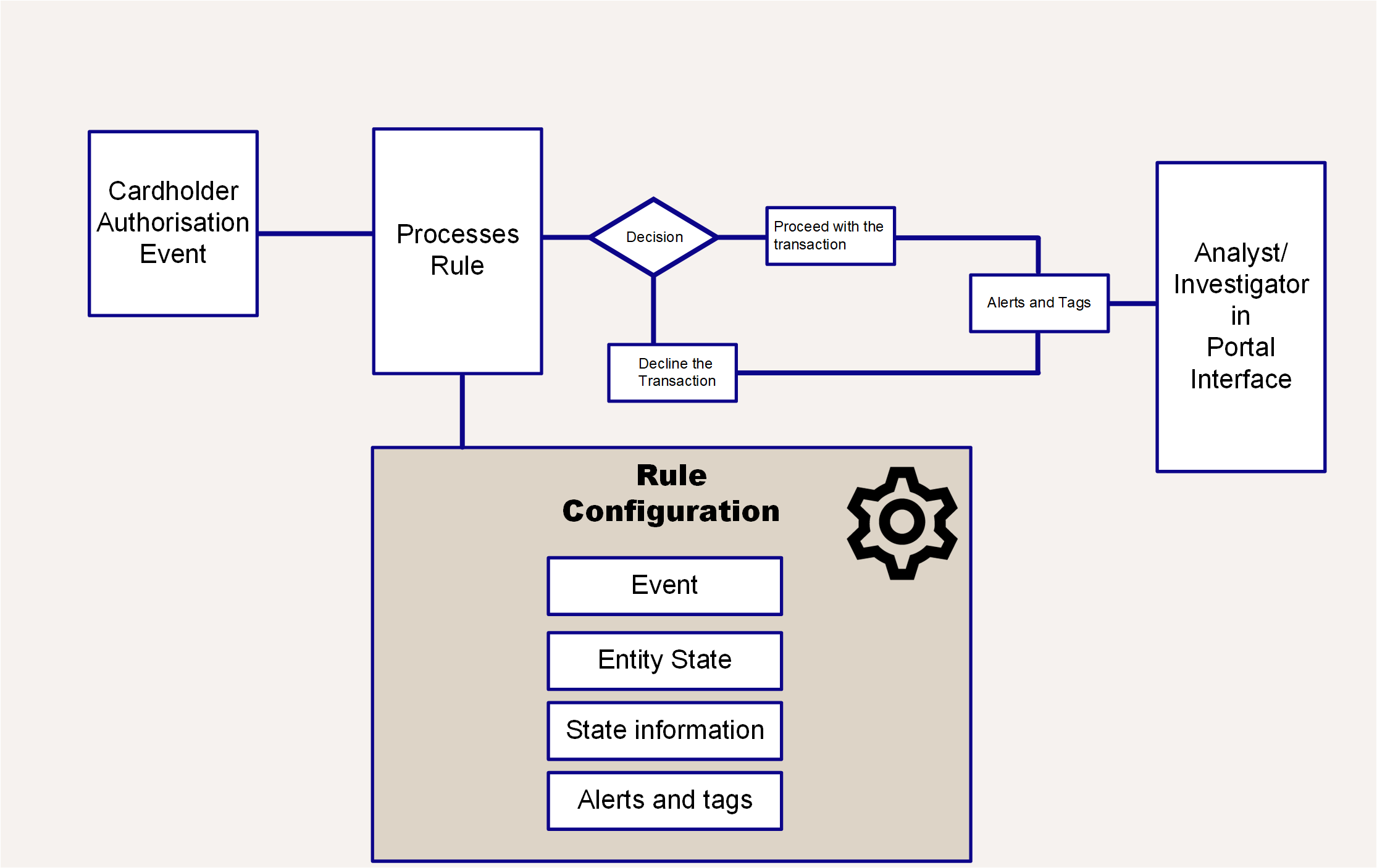

A fraud rule is an essential component in the Fraud Transaction Monitoring System for managing and preventing fraud. As a rule builder, you configure rules for identifying fraud and reducing the number of occurrences where legitimate transactions are flagged as suspicious, or where transactions are inadvertently stopped and the cards have been locked.

You create rules using AMDL (ARIC Modelling Data Language) on card transactions through the portal interface of the Fraud Transaction Monitoring System. These rules can trigger an incident based on an event, for example, authorisations on card transactions, meeting the criteria of the rule. An Investigator can then use the portal interface to review incidents where the fraud rules have been applied.

Fraud Rule Components

When you configure a rule, there are several components that you define using AMDL expression variables. These include the:

-

Event: — The activity that can cause a fraud rule to trigger, for example, a transaction.

-

Entity: — An object associated with an event that allows it to take place. For example, in a card transaction event, the card and the customer are considered entities.

-

Entity State:— Information about the entity that the system has accumulated over time. The entity states that are stored against multiple events over time, or events where the values are added up across a proportion of the population. Every event processed by the system can update an entity’s state, adding more information for the Fraud Transaction Monitoring System to build a behavioural profile of, for example, a card. This allows the rule engine to decide on an outcome using in-depth analysis.

-

Alerts and Tags: — Definition of the outputs of a rule in the form of alerts and tags.

Figure 1: Rules and Rule Components in the Fraud Transaction Monitoring System

Considerations Before Creating Fraud Rules

Before configuring a rule using Fraud Transaction Monitoring, you should consider the following:

- The customer base and segment of your card programme based on factors like transaction history, risk profile, and the types of products or services that they use.

- The role that is set up for you in the Fraud Transaction Monitoring System. Creating and editing fraud rules, as well as publishing to the Live environment, requires the Risk Manager role.

- There exists a sandbox environment in the Fraud Transaction Monitoring System for testing the rules that you create. The environment allows you to adjust the rules before they are published to the Live environment.

- You should have some familiarity with the syntax and logic of declarative programming languages. AMDL is a declarative programming language.