12 Card Usage Options

The options described in this section reflect those available on the Card Usage tab in the Product Setup Form. They are defined per card usage group and determine how the card can be used.

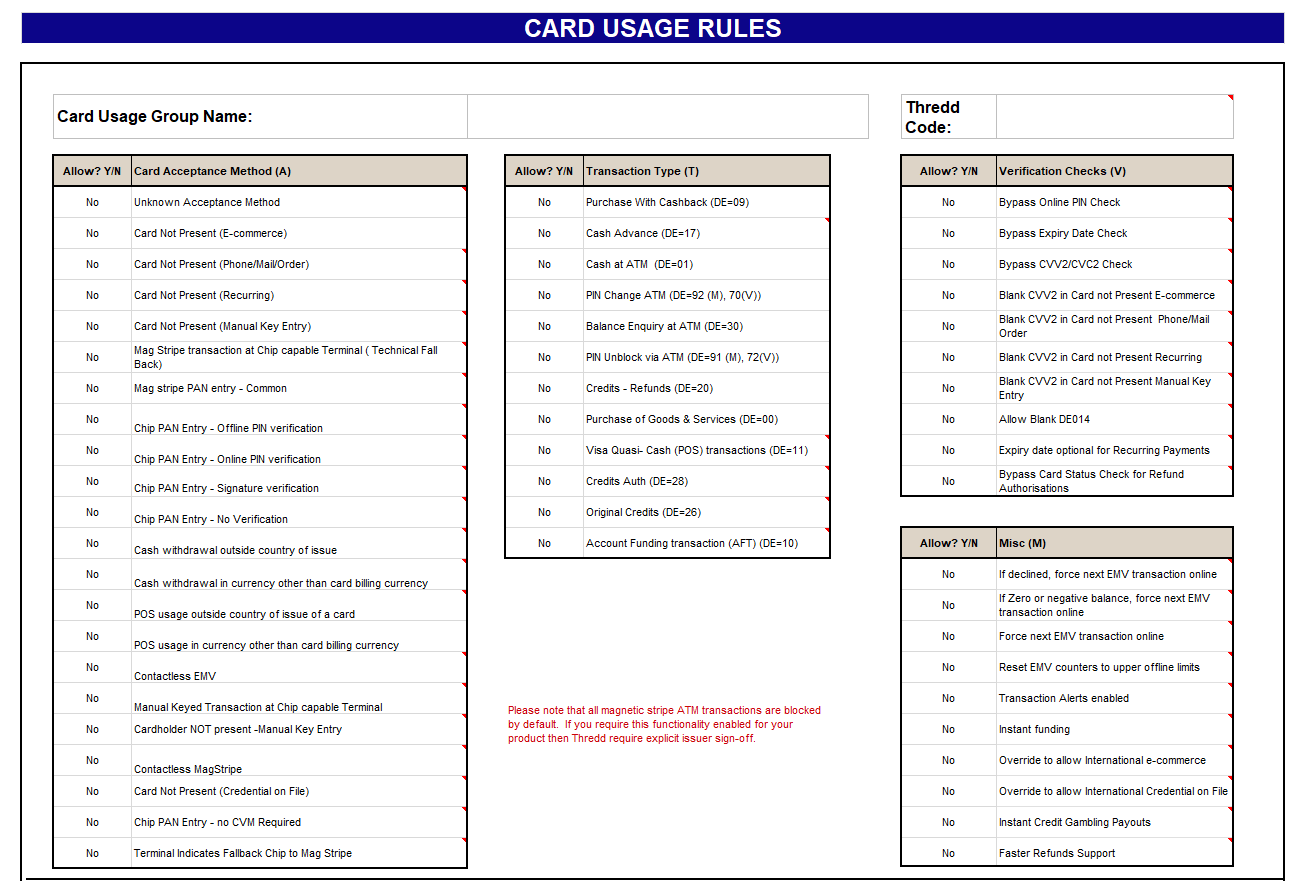

Figure 1: Card Usage tab in the Product Setup Form

Card acceptance methods

The table below describes the methods available to accept card payments. Each option can be set to Allow or Disallow.

|

Card acceptance method (A) |

Description |

|---|---|

|

Unknown acceptance method |

Allow card payments when the acceptance method is unknown (i.e., in non-regulated countries where the processing code is not updated). If this option is set to disallow, then card payments with an unknown acceptance method will be declined. |

|

Card not present - E-Commerce |

Allow card payments when the card cannot be physically presented to the merchant; in the case of e-commerce or internet-based payment services. If this option is set to disallow, then e-commerce card payments will be declined. |

|

Card not present - Phone/Mail Order |

Allow card payments when the card cannot be physically presented to the merchant, in the case of mail order or telephone payments. If this option is set to disallow, then phone or mail order card payments will be declined. |

|

Card not present - Recurring |

Allow recurring card payments when the cardholder has set up a regular payment schedule and the card cannot be physically presented to the merchant for each recurring payment, for example, magazine subscriptions. The card is automatically billed on the specified schedule date. If this option is set to disallow, then recurring card payments where the card is not present will be declined. |

|

Card not present - Manual key entry |

Allow card payments when the merchant enters the card details manually and does not use e-commerce, phone or mail order as transaction information. If this option is set to disallow, then card payments where the card is not present and manual key entry is used will be declined. |

|

Mag Stripe transaction at chip capable terminal (technical fallback) |

Allow chip card payments when the chip card fails at a terminal that is designed to support chip transactions. In this case, the terminal completes the transaction using the magnetic stripe. This is used as a fallback mechanism. If this option is set to disallow, then magnetic stripe card payments will be declined. |

|

Mag Stripe PAN Entry - Common |

Allow PAN entry using magnetic stripe card payments where DE22 = ‘02’ are approved providing other validations are successful. This is selected by default. When selecting this option, consider the level of risk in relation to magnetic stripe transactions. If this option is set to disallow, then magnetic stripe card payments using PAN entry will be declined. DE22 = ‘02’ denotes one of the following:

Do not select if PAN entry using magnetic stripe transactions is not allowed. |

|

Chip PAN entry - Offline PIN verification |

Allow offline verification of the PIN entered by the cardholder, for example where the market operates an offline PIN environment (i.e. the UK or Ireland). Cash machines still operate online PIN verification in these markets. If this option is set to disallow, then offline verification of the PIN will not occur and the card payment will be declined. |

|

Chip PAN entry - Online PIN verification |

Allow online verification of the PIN entered by the cardholder. Cash machines operate online PIN verification. If this option is set to disallow, then online verification of the PIN will not occur and the card payment will be declined. |

|

Chip PAN entry - Signature verification |

Select to request signature verification in the case of chip-capable EMV terminals where the PIN pad is not working or not present. If this option is set to disallow, then signature verification will not be requested and the card payment will be declined. The card may be set to signature verification instead of PIN under the Disability Discrimination Act. |

|

Chip PAN entry - No verification |

Allow chip card payments where the payment is authorised with no PIN or signature required, for example in unattended car parking payment terminals. If this option is set to disallow, then payment authorisation with no PIN or signature will not occur and the card payment will be declined. |

|

Cash withdrawal outside country of issue |

Allow cash withdrawals outside the country of issue. For example, a card issued in the UK can complete cash withdrawals in Spain. If this option is set to disallow, then cash withdrawals outside the country of issue will be declined. |

|

Cash withdrawal in currency other than card billing currency |

Allow cash withdrawals in currency other than the billing currency. For example where a card is billed in British Pounds (£) the cardholder can complete cash withdrawals in US Dollars ($). If this option is set to disallow, then cash withdrawals in currency other than the billing currency will be declined. |

|

POS usage outside country of issue of a card |

Allow card payments where the cardholder pays for purchased goods or services outside the country of issue. For example, a card issued in the UK can be used at a terminal in Spain. If this option is set to disallow, then card payments where the cardholder pays for purchased goods or services outside the country of issue will be declined. |

|

POS usage in currency other than card billing currency |

Allow card payments where the cardholder pays for purchased goods or services in a currency other than the billing currency. For example, a Polish card with a billing currency of Polish Zloty (PLN) can be used for purchases in Singapore Dollars (SGD). If this option is set to disallow, then card payments where the cardholder pays for purchased goods or services in a currency other than the billing currency will be declined. |

|

Contactless EMV |

Allow contactless EMV card payments. If this option is set to disallow, then contactless EMV card payments will be declined. |

|

Manual keyed transaction at chip capable terminal |

Allow card payments where the merchant manually enters the card details into a chip-capable terminal connected to a computer system. For example, restaurants that use specific computer software for placing orders, taking payments and printing receipts. If this option is set to disallow, then card payments where the merchant manually enters the card details into a chip-capable terminal connected to a computer system will be declined. |

|

Cardholder NOT present - Manual Key Entry |

Allow digital wallet card payments, where the physical card is not present. This must be selected for MDES usage groups. For example, mass transit systems, such as TFL in London, MRT in Singapore, NSW Transport in Sydney. If this option is set to disallow, then digital wallet card payments will be declined. |

|

Contactless Mag Stripe |

Allow contactless magnetic stripe card payments. This is used where both the card and the terminal do not support contactless EMV but support contactless mag stripe. If this option is set to disallow, then contactless magnetic stripe card payments will be declined. |

|

Card Not Present (Credential on File) |

Allow card payments where a cardholder saves their card details with a merchant for future transactions in the case of website or app transactions. If this option is set to disallow, then card payments where the details have been saved with a merchant will be declined. This method uses the following logic:

If this type of transaction is not permitted, but the above logic is true, the transaction is declined with the following note text appended:

|

|

Chip PAN entry - No CVM required |

Allow card payments where the cardholder verification method (CVM) is not required, for example, when the terminal does not request PIN entry from the cardholder. The last 6 digits of CVM results are (DE055.9F34 1st byte is 011111). If this option is set to disallow, then card payments where the cardholder verification method (CVM) is not required will be declined. |

|

Terminal Indicates Fallback Chip to Mag Stripe |

Allow fallback to magnetic stripe card payments when the chip card fails at the terminal. The terminal detects chip to magnetic stripe fallback has occurred and communicates to Thredd that fallback has explicitly happened. If this option is set to disallow, then fallback to magnetic stripe card payments will be declined when the chip card fails at the terminal. |

Transaction types

The table below describes the types of card payment available. Each option can be set to Allow the transactions or Decline when not selected.

|

Transaction Type (T) |

Description |

|---|---|

|

Purchase with Cashback (DE=09) |

Allow the cardholder to receive cash as part of a purchase transaction, in addition to purchase of goods or services, If this option is set to disallow, then the cardholder cannot receive cash as part of a purchase transaction. |

|

Cash Advance (DE=17) |

Allow the cardholder to withdraw cash over the counter at a bank or other financial agency. The cash advance can only be attempted up to a certain limit, for example, over the counter at a Bureau de Change. If this option is set to disallow, then the cardholder cannot withdraw cash over the counter at a bank or other financial agency |

|

Cash ATM (DE=01) |

Allow the cardholder to withdraw cash at a cash machine. If this option is set to disallow, then the cardholder cannot withdraw cash at a cash machine. |

|

PIN Change ATM (DE=92 (M).70 (V)) |

Allow the cardholder to change their online PIN at a cash machine. If this option is set to disallow, then the cardholder cannot change their online PIN at a cash machine. When selecting this option, consider the rules for the prevention of common number patterns, such as 1111 or 1234 or the cardholders date of birth (ddmm or mmyy). |

|

Bal Enquiry ATM (DE=30) |

Allow the cardholder to view the available balance at a cash machine. If this option is set to disallow, then the cardholder cannot view the available balance at a cash machine. |

|

PIN Unblock (via ATM) (DE=91 (M).72 (V)) |

Allow successful processing of PIN based card payments after a PIN has been blocked. Use Thredd Portal or Smart Client to reset the online PIN, it cannot be reset at the cash machine. If this option is set to disallow, then PIN based card payments will be declined after a PIN has been blocked. |

|

Credits - Refund (DE=20) |

Allow refunds to be applied to a cards in the card usage group. If this option is set to disallow, then refunds cannot be applied to cards in the card usage group. |

|

Purchase Goods & Services (DE=00) |

Allow the purchase of physical goods (such as books, pens, shoes) and services provided by other people, for example doctors or barbers. If this option is set to disallow, then the cardholder cannot purchase physical goods. |

|

Visa quasi-cash (POS) transactions (DE=11) |

Allow the cardholder to make Quasi Cash card payments. Quasi Cash is the use of a prepaid card to purchase money orders, travellers checks, foreign currency, lottery tickets, casino chips, vouchers which are redeemable for cash, crypto or racetrack wagers. A percentage (%) of the amount of each transaction is applied to the card as a fee. If this option is set to disallow, then the cardholder cannot make Quasi Cash card payments. |

|

Credits Auth (DE=28) |

Allow authorisations of credit to be applied to cards in the card usage group. These refer to any money credited to the cardholders account that is not a refund, for example, gambling credits, refund or disbursement of online betting winnings. If this option is set to disallow, then credit authorisations are not permitted. A credit authorisation is a refund or push of credits to the cardholders account, it has a settlement period, during which time the settlement occurs and the funds are made available to the cardholder. Selected by default, as an acquirer may send an authorisation to as if Credit Auth (DE=28) is permitted. |

|

Original Credit (DE=26) |

For Visa only, allow authorisations of original credit to be applied to cards in the card usage group. Original Credit refers to any money credited to the cardholders account that is not a refund, for example, gambling credits, refund or disbursement of online betting winnings. If this option is set to disallow, then original credit authorisations are not permitted. A credit authorisation is a refund or push of credits to the cardholders account, it has a settlement period, during which time the settlement occurs and the funds are made available to the cardholder. Selected by default, as an acquirer may send an authorisation to as if Credit Auth (DE=28) is permitted. |

|

Account Funding transaction (AFT)(DE=10) |

Allow account funding transactions. Account funding transactions from Mastercard are based on MCC groups; if you want these to be blocked then you will need an MCC block. Allowed by default by Mastercard. Visa has mandated Issuers support this transaction type so must be selected for all Visa programmes. This is not mandatory for Credit. |

Additional Transaction Types for MNE

The following additional transaction types are supported for transactions on the STAR Network via Mastercard Network Exchange (MNE):

|

Transaction Type (T) |

Description |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Bill Payment |

Bill payment transaction on the STAR Network (processing codes 50xxxx or 54xxxx). This is always a debit to the cardholder's balance. If initiated as a recurring transaction via Card/Credential on File method, the transaction will have a DE022 value of 81 and CVV2 may not be present. |

||||||||||||

|

Payment Credit (P2P) |

Declined credit card transaction on the STAR Network (processing codes 56xxxx).

|

||||||||||||

|

Envelope-less Check Deposit |

Cash deposit at an Automated Teller Machine (ATM) on the STAR Network (processing codes 25xxxx). The ATM scans and verifies the bills, eliminating the need for envelopes and manual processing.

|

||||||||||||

|

Payment from Third Party |

Transaction where funds are received from an external source other than the customer’s bank account (STAR Network processing codes 55xxxx). Third-party payment processors facilitate these transactions, acting as intermediaries between the merchant’s website or point-of-sale system and the customer’s bank.

|

||||||||||||

|

Deposit Memo |

Transaction related to Image Cash Letters (ICLs), (STAR Network processing codes 21xxxx). These are electronic files used by banks for automated processing of check deposits. |

||||||||||||

|

Envelope-less Check Deposit |

Cash deposit at an Automated Teller Machine (ATM) on the STAR Network (processing codes 24xxxx). The ATM scans and verifies the bills, eliminating the need for envelopes and manual processing.

|

Verification

The table below describes the verification options available for card payments. Each option can be set to Allow the transactions or Decline when not selected.

|

Verification (V) |

Description |

|---|---|

|

Bypass Online PIN Check |

Allow the card terminal to bypass the Thredd PIN verification and send the transaction (using the EHI) to the Program Manager for PIN verification. If this option is set to disallow, Thredd verifies the PIN. Only available in EHI 1.4 or later (modes 1, 2 and 4). |

|

Bypass Expiry Date Check |

Allow the card terminal to bypass the expiry date check. Used when the Program Manager must verify the expiry date instead of Thredd. When selected, the transaction is sent (using the EHI) to the Program Manager for the expiry date verification. If this option is set to disallow, then Thredd verifies the expiry date. Only available in EHI 1.4 or later (modes 1, 2 and 4). |

|

Bypass CVV2/CVC2 Check |

Allow the card terminal to bypass the card verification value (CVV2) or the card validation code 2(CVC2) check. Used when the Program Manager must verify the CVV2 instead of Thredd. When selected, the transaction is sent (using the EHI) to the Program Manager for CVV2 verification. If this option is set to disallow, then Thredd verifies the CVV2. Only available in EHI 1.4 or later (modes 1, 2 and 4). |

|

Blank CVV2 in Card not Present E-commerce |

Allow the approval of e-commerce transactions where card is not present and the CVV2 is blank. If this option is set to disallow, then these transactions are declined. For Visa, the scheme level advanced permission "Allow if Merchant Provides no CVV2" must be enabled, or transactions will decline with no CVV2. |

|

Blank CVV2 in Card not Present Phone/Mail Order |

Allow the approval of phone / mail order transactions (MOTO) where the card is not present and the CVV2 is blank. If this option is set to disallow, then these transactions are declined. For Visa, the scheme level advanced permission "Allow if Merchant Provides no CVV2" must be enabled, or transactions will decline with no CVV2. This only applies to the initial authorisation, which is flagged as recurring. The subsequent recurring payments are flagged as presentments. Subscription services such as Amazon Prime will not have CVV2. |

|

Blank CVV2 in Card not Present Recurring |

Allow the approval of recurring transactions where the card is not present and the CVV2 is blank. If this option is set to disallow, then these transactions are declined. For Visa, the scheme level advanced permission "Allow if Merchant Provides no CVV2" must be enabled, or transactions will decline with no CVV2. This only applies to the initial authorisation, which is flagged as recurring. The subsequent recurring payments are flagged as presentments. Subscription services such as Amazon Prime will not have CVV2. |

|

Blank CVV2 in Card not Present Manual Key Entry |

Allow the approval of card not present - manual key entry transactions where the CVV2 is blank. If this option is set to disallow, then these transactions are declined. For Visa, the scheme level advanced permission "Allow if Merchant Provides no CVV2" must be enabled, or transactions will decline with no CVV2. |

|

Allow Blank DE014 |

Allow to approve transactions without checking the expiry date present in the DE014 field. If this option is set to disallow, then the expiry date present in the DE014 field is checked when approving transactions. The default setting for this option is disallowed. Thredd recommends the default setting. |

|

Expiry date optional for Recurring Payments |

Allow recurring payment transactions where the expiry date is omitted. If this option is set to disallow, then recurring payment transactions where the expiry date is omitted are declined. If the expiry date is present and incorrect, the transaction will be declined. |

|

Bypass Card Status Check for Refund Authorisations |

Allow for the card terminal to bypass the card status check for refund authorisations. In this case, a card which is NOT in all good status will accept ONLY Refund Authorisations. If this option is not set to allow, the card terminal will not bypass the card status check for refund authorisations. |

Miscellaneous

The table below describes the miscellaneous options available for card payments. Each option can be set to Allow the transactions or Decline when not selected.

|

Misc (M) |

Description |

|---|---|

|

If declined, force next EMV transaction online |

For Mastercard only, allow to force online authorisation of next EMV transaction where the transaction is declined. This occurs if the cardholder has reached the level of offline transactions and then attempts an ATM transaction. Counters are reset and the cardholder can continue to make offline transactions; however, the card has a zero or negative balance. Requires Mastercard M/Chip 4.1 or M/Chip Advance, and only receives this information in EMV contact transaction (not EMV contactless). For Visa, VIS Cryptogram does not support this feature, therefore it is not currently available. When available, use VIS Cryptogram version number 18. |

|

If Zero or negative balance, force next EMV transaction online |

For Mastercard only, allow to force online authorisation of next EMV transaction where the balance of the transaction is zero or a negative value. In this case, ensures the next authorisation is NOT approved offline. For Mastercard, this feature requires Mastercard M/Chip 4.1 or M/Chip Advance, and only receives this information in EMV contact transaction (not EMV contactless). For Visa, VIS Cryptogram does not support this feature, therefore it is not currently available. When available, use VIS Cryptogram version number 18. |

|

Force next EMV transaction online |

For Mastercard only, allow to force online authorisation of the next EMV transaction. If this flag is selected, it always takes effect, if the current transaction is approved or declined. VIS Cryptogram does not support this feature, therefore it is not currently available. |

|

Reset EMV counters to upper offline limits |

For Mastercard only, allow to reset the EMV counters to the upper offline limits. In this case, the ARPC response code byte 2 will have lowest 2 bits set to "01" instead of current "10" VIS Cryptogram does not support this feature, therefore it is not currently available. |

|

Transaction Alerts enabled |

For Mastercard only, allow to enable transaction alerts, the alert mechanism of international e-commerce transactions. |

|

Instant funding |

For Mastercard, Visa Fast Funds and MoneySend Instant Funding, allow to enable Instant Funding. |

|

Override to allow International e-commerce |

For Mastercard and Visa, allow international e-commerce. If e-commerce is enabled, but international transactions are blocked, this flag will Override to allow International e-commerce. |

|

Override to allow International Credential on File |

For Mastercard and Visa, allow international credentials on file. This is required for overseas wallet usage by Apple. If Yes, then Credential on File merchant (e.g. Apple & Amazon) can be outside of country of issue. This option is only applicable if "POS usage outside country of Issue of card" is NOT enabled. |

|

Faster Refunds Support |

For Mastercard and Visa, allow for support of Faster Refunds. For a Fast Refund inbound authorization request, the cardholder account is credited within a certain time frame. When the Faster Refund criteria is met the cardholder will be updated within 30 minutes of successful authorisation processing. Mastercard have mandated that Instant Credit Gambling Payouts must be credited within a certain time frame from receipt of the authorization. |

|

Instant Credit Gambling Payouts |

For Mastercard, allow instant credit gambling payout. This option only applies to gambling payouts. must be enabled for ALL products in the Mastercard Europe Region (mandated by Mastercard); it may be enabled for products outside of this region at the issuers' request. When enabled, cards receiving cash disbursement authorisations matching the appropriate conditions will be credited immediately if approved. For Visa, only applies to Payment Transactions where MCC = 7995 ( Gambling Merchants) |