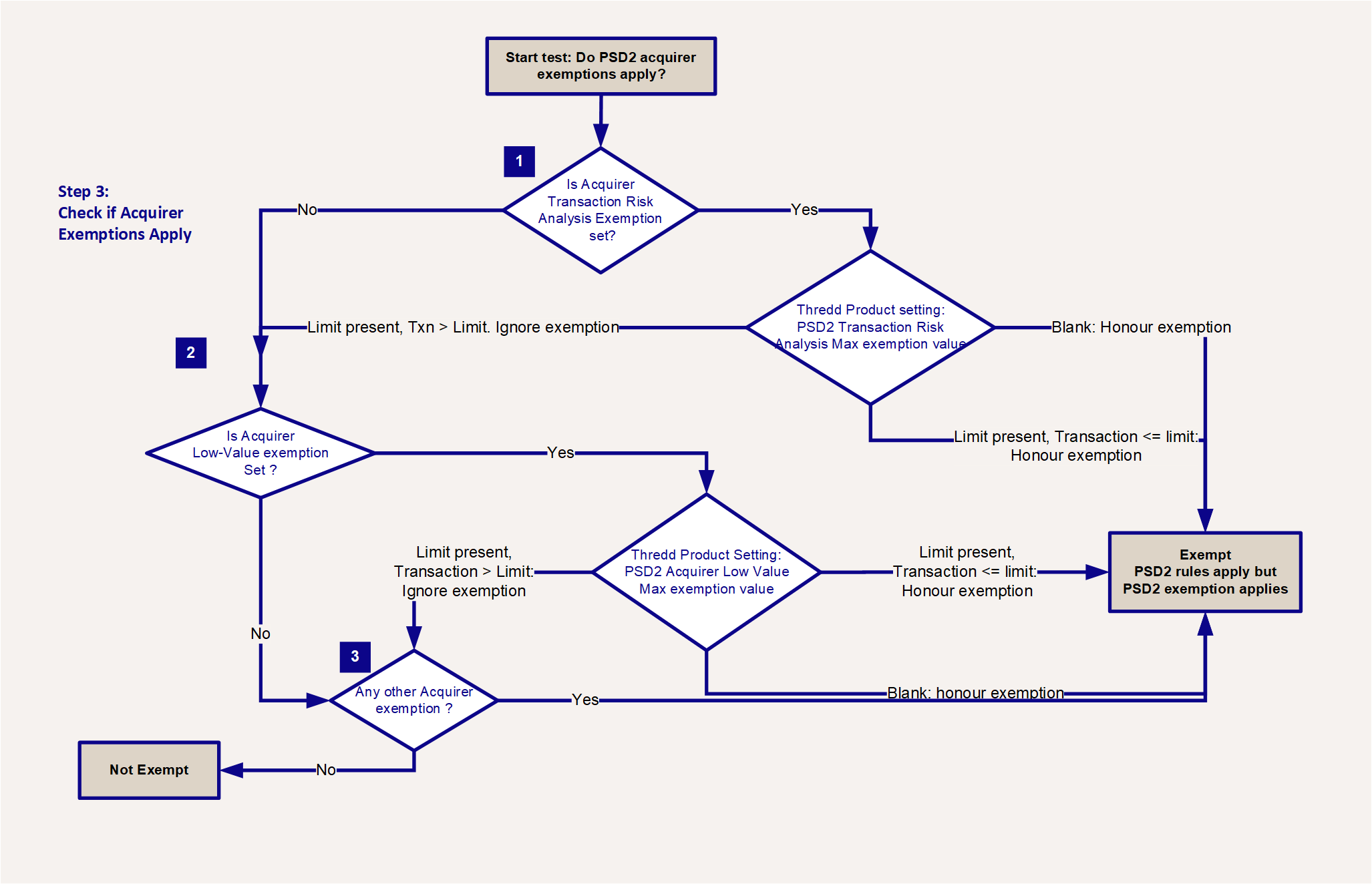

Step 3: Check for PSD2 Acquirer Exemptions

In this step Thredd checks for any PSD2 Acquirer Exemptions. Acquirer exemptions include low value transactions, transaction risk analysis and recurring transactions, which enable the acquirer to process as many transactions as possible without Strong Customer Authentication.

Figure 6: PSD2 Checks Step 3: Acquirer Exemptions

The numbers in orange in the figure above correspond to the steps described below.

The following acquirer exemption checks are made:

-

Is the Acquirer Transaction Risk Analysis Exemption specified in the transaction?

If no, then the next check is carried out (see step 2 below).

If yes, then Thredd checks your product's Acquirer Transaction Risk Analysis Exemption transaction limit:

-

If this limit is blank (Thredd has not set a limit) for your product, then the transaction is exempt

-

If the transaction value is below or equal to the limit, then the transaction is exempt

-

If the transaction value is above the limit, then the exemption is ignored and the next check is carried out (see step 2 below).

-

-

Is the Acquirer Low-Value Exemption set for your product?

If no, then the next check is carried out (see step 3 below).

If yes, then Thredd checks your product's Acquirer Low-Value Exemption transaction limit:

-

If this limit is blank (Thredd has not set a limit) for your product, then the transaction is exempt

-

If the transaction value is below or equal to the limit, then the transaction is exempt

-

If the transaction value is above the limit, then the exemption is ignored and the next check is carried out (see step 3 below).

-

-

Are there any other acquirer exemptions? (see PSD2 Acquirer Exemptions)

-

If no, then the transaction is not exempt

-

If yes, then the transaction is exempt

-

What happens after exemption checking is complete?

For a transaction that was not strongly authenticated, then after exemption checking is complete:

-

If no exemptions apply, then Thredd soft declines the transaction. See Soft Declines.

-

If any exemptions apply, then Thredd can approve the transaction (provided there are no other reasons to decline).

For details of the full end-to-end transaction checking process, see PSD2 Transaction Checks.