New Products and Services

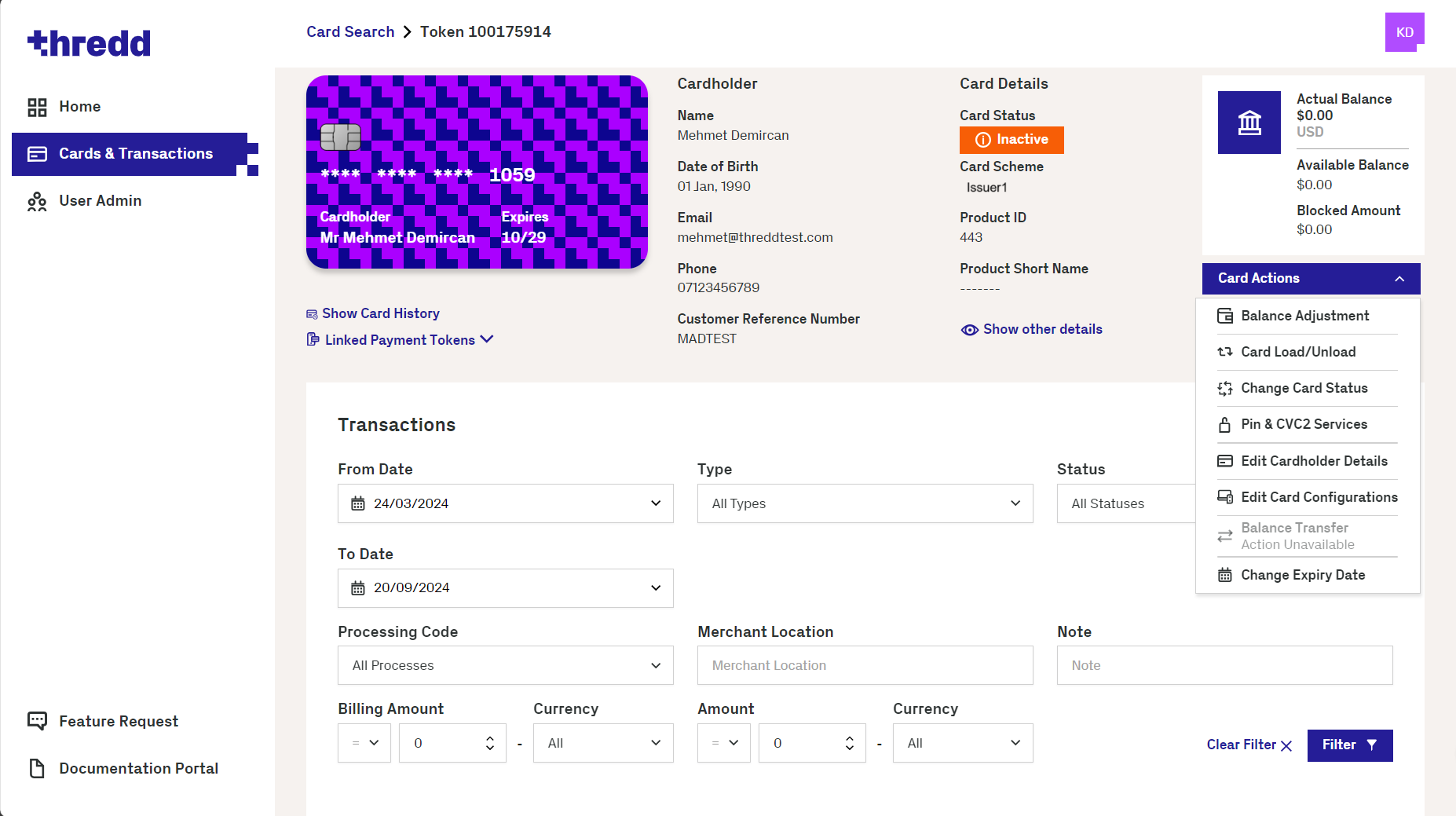

Thredd Portal: Card and Transaction Management

Thredd Portal provides a feature-rich dashboard where Customer Services/Operations team users can use card and transaction management functions, and provides full visibility of your customer's transactions and card activity.

Using Thredd Portal, you can view details about card activity, view customer balances and drill down into the details of specific transactions. You can also alter card statuses, update card configurations, load funds and adjust amounts.

Figure: Thredd Portal

Release status: available. For details, please contact your account manager.

Find out more:

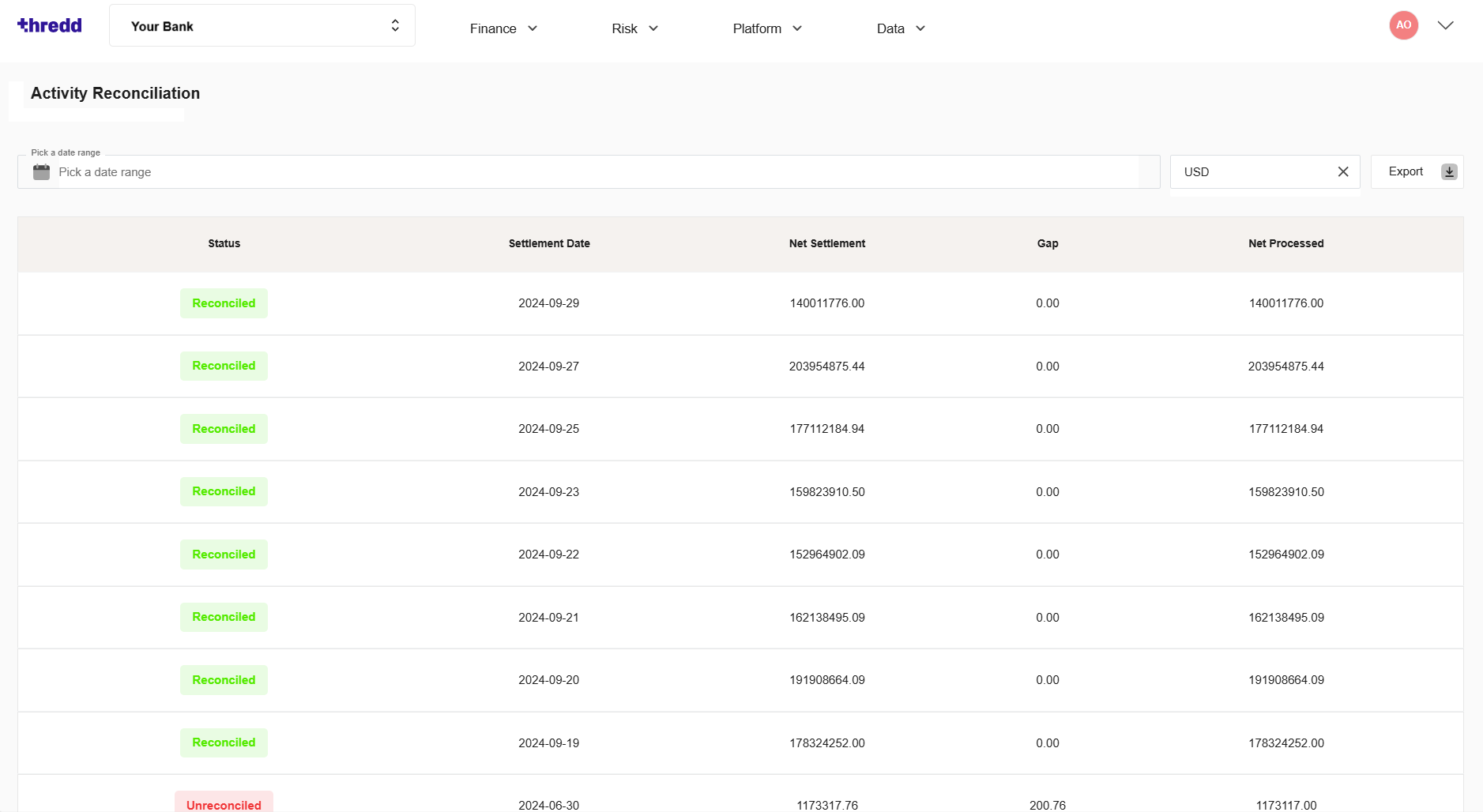

Automated Back Office

The Thredd Automated Back Office is a service for Card Issuers, BaaS providers and BIN Sponsors1, which simplifies and automates complex operational tasks to save time and money and meet compliance requirements with confidence. The service offers reliable data on the transaction lifecycle, reduces compliance and reconciliation issues, and helps you automate and modernise your backend programme management functions so you can focus on building innovative products for the payment’s ecosystem.

Available Services

- Transaction Reconciliation. Identifies discrepancies and reconciles transactions in near real-time to ensure accurate records, enable fast resolution, and support seamless compliance.

-

Network Fees. Break down the complicated Card Scheme invoice into line items that are easy to understand, and highlight non-compliance and optional fees. A dashboard provides high-level summaries to understand your card programme’s activity at a glance.

-

Scheme Reporting. Generate Quarterly Management Reports (QMRs) and Quarterly Operating Certificates (QOCs) for Mastercard and Visa in a Scheme-approved format, for downloading and sending to the Scheme.

Figure: Automated Back Office - Activity Reconciliation screen

Release status: available. For details, contact your account manager.

Find out more:

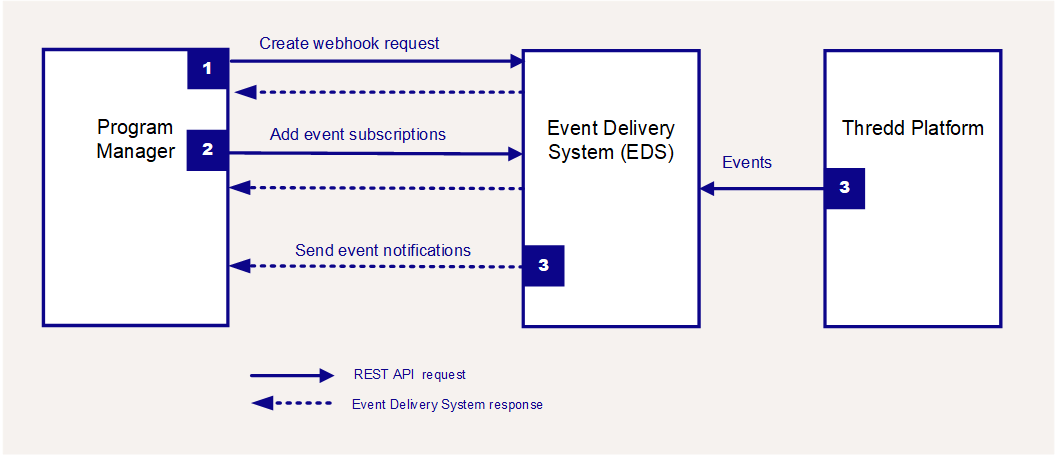

Thredd Event Delivery System (Webhooks)

Webhooks is a comprehensive service designed to facilitate real-time event subscription and notification delivery.

You can use the Thredd REST API to create and update webhook endpoints, and specify desired events for notification for the endpoints. Additionally, you can retrieve historical or missed events on demand, update your details, and manage event subscriptions.

Webhooks provide a robust platform for efficient event-driven interactions, retrieving notification details, subscribing to events, and re-sending notifications. The Event delivery system automatically provides you with updates related to the events you have registered for.

Figure: Webhooks Process

Release status: available. For details, please contact your account manager.

Find out more:

Scam Transaction Monitoring

Scam Transaction Monitoring provides enhanced fraud protection on top of existing fraud controls — tracking the fraud missed by banks that evades existing defences. The solution offers maximum protection with minimal investment, working out-of -the-box from day one, offering a solution that keeps you ahead of changing PSR regulations, saving time and saving money.

Features:

- Works without historical data

- Requires no sensitive data - only the payment message

- Monitors inbound and outbound payments

You can purchase Scam Transaction Monitoring as an add-on to Fraud Transaction Monitoring, or as a standalone purchase.

Release status: available. For details, please contact your account manager.

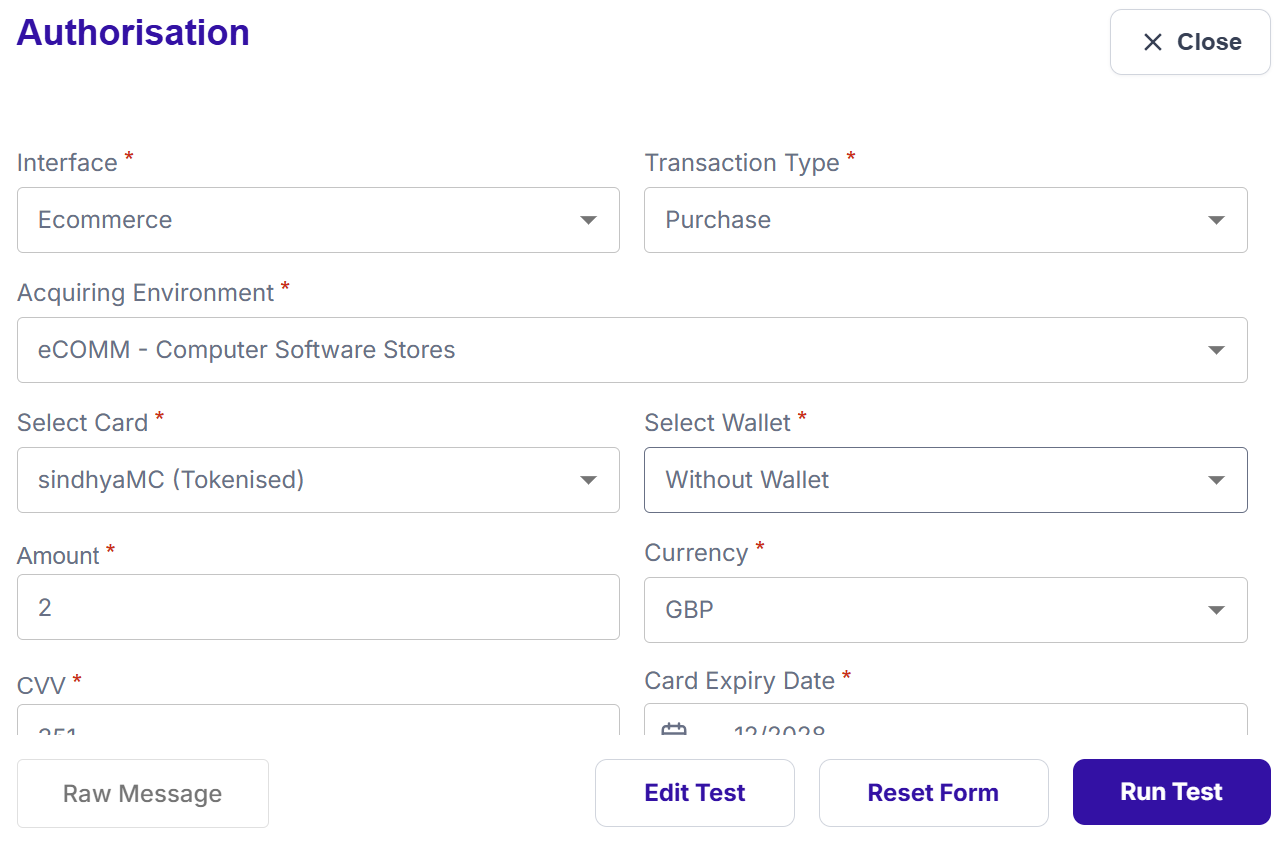

Payment Simulator Tool

The Payment Simulator Tool enables you to test your system’s integration before you move into a production environment. It allows you to generate card transactions and validate your setup within a test (UAT) environment. A simple dashboard provides built-in standard test cases and a transaction history screen. The Payment Simulator Tool replaces our Card Transaction System product, providing more features and enabling you to complete a wider range of test scenarios.

Figure: Payment Simulator Tool - Example of configuring an authorisation test

Release status: available. For details, please contact your account manager.

Find out more:

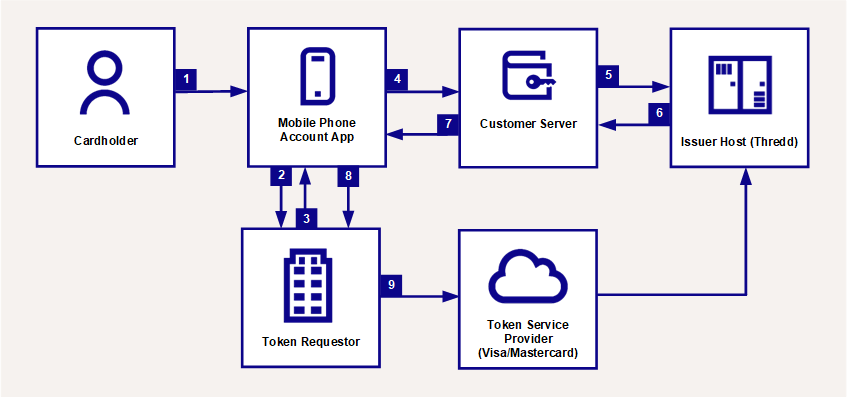

Thredd's In-App Push Provisioning Solution

In-App Push Provisioning allows a cardholder to request a token for their device directly from the Programme Manager's mobile app, removing the need to manually enter the PAN details into the mobile wallet Token Requestor's app (the cardholder must be logged into their account on their Programme Manager mobile app to be able to authenticate). Since it originates from inside the mobile app the Program Manager can pre-authenticate the cardholder through entry to their mobile app before a request for a token is sent to the Token Service Provider (Visa/Mastercard).

Push provisioning requires you to share sensitive card data with the Token Service Provider via the mobile wallet Token Requestor. This data needs to be encrypted to standards of both the Token Service Provider (Visa/Mastercard) and the mobile wallet Token Requestor (Apple Pay/Google Pay). Thredd's role is to provide an encrypted payload that can be returned to your mobile app and passed into the relevant mobile wallet app regardless of your PCI compliance status.

Figure 1: Integration for In-App Provisioning

Release status: available. For details, please contact your account manager.

Find out more:

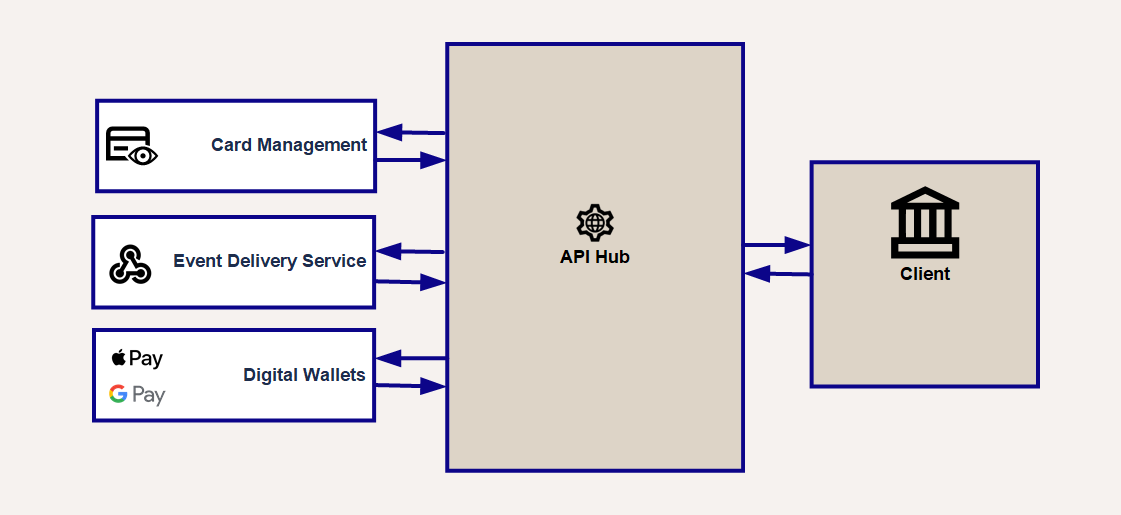

API Hub

The API Hub provides access to Thredd's API suite using a single URL. You can access services across all environments using this single URL, which will then send you automatically to the correct service and environment. Using a single URL provides you with a single, consistent interface for accessing the Thredd platform, simplifying integration and enabling seamless scalability.

The figure below shows some of the different services that API Hub connects to:

-

Card management enables you to create and manage cards

-

Event delivery service enables you to use Thredd's webhooks, enabling you to send notifications to your customers

-

Digital wallets enables you to set up Google and Apple In-App Push Provisioning

Figure 2: Integration for API Hub

Release status: available. For details, please contact your account manager.

Find out more: