Appendix F: Transaction Details Fields

This section describes the fields available in Thredd Portal: Cards and Transaction Management for each transaction. The information displayed when Viewing Transactions depends on the type of transaction. For example, more information is shown about authorisations than about presentments.

Summary Details

This section displays summary information related to the transaction.

Summary Details displays for all transactions.

|

Field |

Description |

|---|---|

|

Transaction Date |

Date and time the transaction occurred. The time relates to where the Thredd servers are located, for, GMT timezone for the UK. |

|

Transaction Status |

Transaction status, such as Settled. |

|

Transaction Type |

Type of transaction, such as authorisation, balance adjustment, presentment, and auth reversal. |

|

Response Status (DE039) |

The response code that Thredd provided back to the scheme. |

|

Transaction Amount (DE004) |

Transaction amount (in the transaction currency). |

|

Billing Amount(DE006) |

Bill amount (in the currency of the card). |

|

Settlement Amount(DE005) |

Settlement amount and currency. |

|

Blocked Amount |

Blocked amount (pending payments) after the transaction. |

|

Available Balance |

Available balance after the transaction. |

|

Actual Balance |

Actual balance after the transaction. |

|

Netword ID |

The ID of the network associated with the card on the transaction. For example, Visa, Mastercard, or Discover Global Network (DGN). |

|

Transaction Note |

Note for the transaction. Notes are taken from transaction details appended during each type of transaction. For example, for declined transactions, there could be text explaining why the transaction was declined. The Notes field is a useful source of information about a transaction, particularly for declines, as it can identify the reason. For example, in the case of a decline, an incorrect PIN or the transaction exceeding the maximum permitted limit. Scroll right on the View Transactions screen to display it. |

Amount and Fees Details

The Amount and Fee Details section displays information on additional fees related to the transaction.

Amount and Fees Details displays for all transactions.

|

Field |

Description |

|---|---|

|

Calculated Total Fee Applied to Card Holder |

The combined value of all fees related to the transaction. |

|

MCC Padding |

Financial padding applied to transactions in specific MCCs (typically used for hotels and rental cars where cardholders might be charged a little more than authorised for). |

|

FX Padding |

Financial padding (to allow for currency fluctuations). |

|

Fixed Fee |

Fixed fees levied against the transaction based on specific amounts. |

|

Rate Fee |

Rate-based fee. Fees levied against the transaction based on a percentage charge. |

|

Domestic Fixed Fee |

Fixed amount to apply as a fee to a domestic transaction. |

|

Domestic Rate Fee |

Percentage of the domestic transaction amount to apply as a fee. |

|

FX Fixed Fee |

Fixed amount to apply as a fee to an FX transaction. |

|

FX Rate Fee |

Percentage of an FX transaction amount to apply as a fee. |

|

Non Domestic Fixed Fee |

Fixed amount to apply to the transaction for non-domestic transactions. |

|

Non Domestic Rate Fee |

Percentage of a non-domestic transaction amount to apply as a rate fee. |

|

Additional Amounts (DE054) |

Contains additional amount information for the transaction, if relevant. For example, for purchase with cashback transactions, the additional amounts field is present with the cashback amount. For more information, see Additional Amount field in the EHI Guide. |

Merchant Details

The Merchant section of the page describes information on the merchant for the transaction.

Merchant Details only displays for Authorisation, Auth Reversal, Auth Advice and Presentment transaction types.

|

Merchant Name |

The name of the merchant. |

|---|---|

|

Merchant Name |

The name of the merchant. |

|

City |

Where applicable, the city where the transaction took place. |

|

County |

Where applicable, the county where the transaction took place. |

|

Postcode |

Where applicable, the postcode where the transaction took place. |

|

Region |

Where applicable, the region where the transaction took place. |

|

Street |

Where applicable, the street where the transaction took place. |

|

Phone |

The Merchant telephone number. Can include non-digits. For example, "+18001112345" |

|

Contact |

The Merchant contact details. For example, a phone number or email address. |

|

Merchant Website |

Where applicable, the website of the merchant for the transaction. |

|

POS Entry Mode (DE022) |

How the transaction was created, for example, contactless at a machine, ecommerce, online, ATM. ICC indicates the card was physically inserted into a machine and the PIN entered. |

|

Network Reference |

A unique identifier for a transaction, allowing for tracking and referencing during subsequent interactions, such as inquiries or disputes related to the transaction |

|

Merchant Category Code (MCC) |

Code that describes a merchant's primary business activities. For a full list of available MCCs, see Merchant Category Codes in the EHI Guide. |

|

Card Acceptor Name Location (DE043) |

Merchant’s details. |

|

Till Time |

Time of the transaction as provided by the merchant on the customer’s receipt. This value may differ from the time when the transaction is processed. This is because the transaction might be processed in a different timezone. |

|

POS Data (DE061) |

For Mastercard authorisation-related messages: This holds additional POS condition codes. For more information, see POS_Data_DE61 field in the EHI Guide. For Visa Authorisation-related messages: this is empty. For Financial and all other messages: this is empty |

|

AID |

The Acquiring Bank ID as assigned by the network. Note that the format differs depending on whether this is an Authorisation or a Financial type message. For Authorisation messages:

For Financial messages:

|

|

Card Acceptor ID Code (DE042) |

Code relating to the specific Point of Sale (POS) terminal. |

|

Card Acceptor Terminal ID (DE041) |

Uniquely identifies the terminal which accepted the card. Always present if the card data was read by a terminal. |

|

Tax ID |

The merchant's Tax ID (from Base II TCR6 31-50 (len 20), Mastercard GCMS - from IPM DE48 PDS 596 subfield 1) is the unique code assigned to a business by the processor or acquiring bank. |

Other Details

The Other Details section describes a variety of different fields related to the transaction.

Other Details only displays for Authorisation, Auth Reversal, Auth Advice and Presentment transaction types.

|

Field |

Description |

|---|---|

|

Message Type |

The type of transaction, such as an authorisation or presentment. |

|

STAN (DE011) |

System Trace Audit Number. This links the authorisation and presentment (note this number is not unique). |

|

Function Code |

The code indicating the specific purpose of the message in the message class |

|

Additional Authorization Data DGN |

|

|

Processing Code |

Transaction processing code, for example, recurring fees, balance inquiry. |

|

Transaction ID |

Identifier for tracing a specific transaction and narrowing a search. This is a unique identifier generated by Thredd to help identify and search for transaction in the Thredd platform. |

|

Transaction Originating Institution |

The merchant or store where the transaction was made. |

|

Retrieval Reference Number(DE037) |

The number supplied by Thredd. Retains the original source document of the transaction and assists in locating the source document. |

|

Transaction Destination IIC |

The Transaction Destination Institution Identification Code (IIC) data element is the code identifying the institution that is the transaction destination. |

|

Transaction Originator IIC |

The Transaction Originator Institution Identification Code (IIC) data element is the code identifying the institution that is the transaction originator. |

|

Recap Number |

The settlement group number, used in the Settlement Recap ID data element for the Discover Global Network. Discover members send financial transaction data grouped under recaps separately for each member. |

|

Currency Code |

The currency of the transaction (3 digit ISO currency code). |

|

Authorisation Code |

Authorisation code generated by Thredd for approved and declined authorisation requests. |

|

Additional Response Data (DE044) |

Response data for transactions where the content can differ depending on the network. For example, for Mastercard, the details it provides depends on the response code only (where it is only populated in the case of a decline). For payment networks such as Visa, this field includes the response for transaction data validations. For more information, see Visa_ResponseInfo_DE44 in the EHI Guides. |

|

Additional Data (DE048) |

This is extra details on a transaction, which you should not use unless agreed with Thredd. |

|

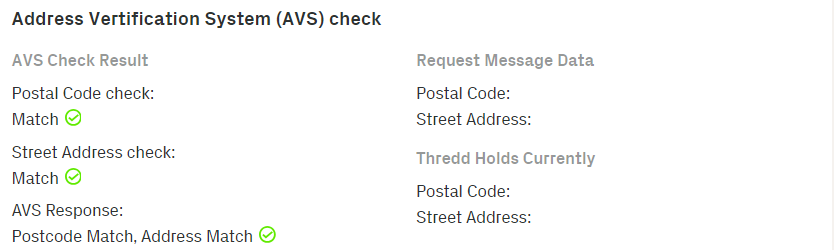

AVS Response |

The Address Verification Service (AVS) response to the transaction. This verifies the cardholder in order to avoid fraudulent transactions by comparing the cardholder inputted address against the address on file.

|

|

Expiry Date |

The expiry date provided at the time of the transaction (useful to check in case the cardholder has entered an incorrect expiry date). |

|

FID |

Forwarding Institution Identification Code. Identifies the acquiring institution forwarding a Request or Advice message. |

|

Thredd POS Data |

Information on the transaction at the POS terminal, including details such as how the transaction was authenticated, the cardholder present/not present status and fraud details. Click the expand button to display the Thredd POS Data Decoded Values. The following fields display.

|

|

Network Refer ID (DE123) |

The network that processed the transaction. This field will contain data only if the Network Type is Discover. |

|

Response Reason |

Indicates the reason why the Response Source sent a response to the terminal. Normally present only for some Authorisation advices and Authorisation reversals. |

|

Request Time |

The time when Thredd receives this authorisation, in the local time zone of the Thredd servers. |

|

Response Source |

Indicates which system sent the 0110 or 0210 response to the terminal. Normally present only for some Authorisation advices and Authorisation reversals. |

|

Response Time |

The time when Thredd sends the response (the difference between the request and response times is shown below in milliseconds), in the local time zone of the Thredd servers. Note that the response time in milliseconds is the time for the entire transaction to complete across all parties. |

|

Recap Date |

The settlement group date, used in the Settlement Recap ID data element for the Discover Global Network. Discover members send financial transaction data grouped under recaps separately for each member. |

|

Difference (in Milliseconds) |

The difference, in milliseconds, between the request time and the response time of the transaction. |

|

Network Data |

Also known as DE48, this a unique transaction number that is generated by the payment network for linking authorisations and presentments. |

|

Acquirer Reference Data |

Acquirer Reference Number/Data. ISO 8583 field 31. The acquirer reference number exists for clearing messages only (Financial advices/notifications, and Chargeback advices/notifications (and reversals of)). |

|

ICC Data (DE055 - 0100) |

Data from the card’s chip. |

|

Advice Reason Data |

Mastercard Authorisation Advice Reason Code. Explains why Mastercard Stand-In processing (STIP) occurred or why an advice was created. This field will only be present for transactions received by Thredd from Mastercard. |

|

Record ID |

A unique Thredd identifier used to link transactions to other tables in the Thredd database. |

|

Payment Token ID |

Unique Thredd identifier of the payment token. Only present if transaction relates to a payment token (for example, Apple Pay). |