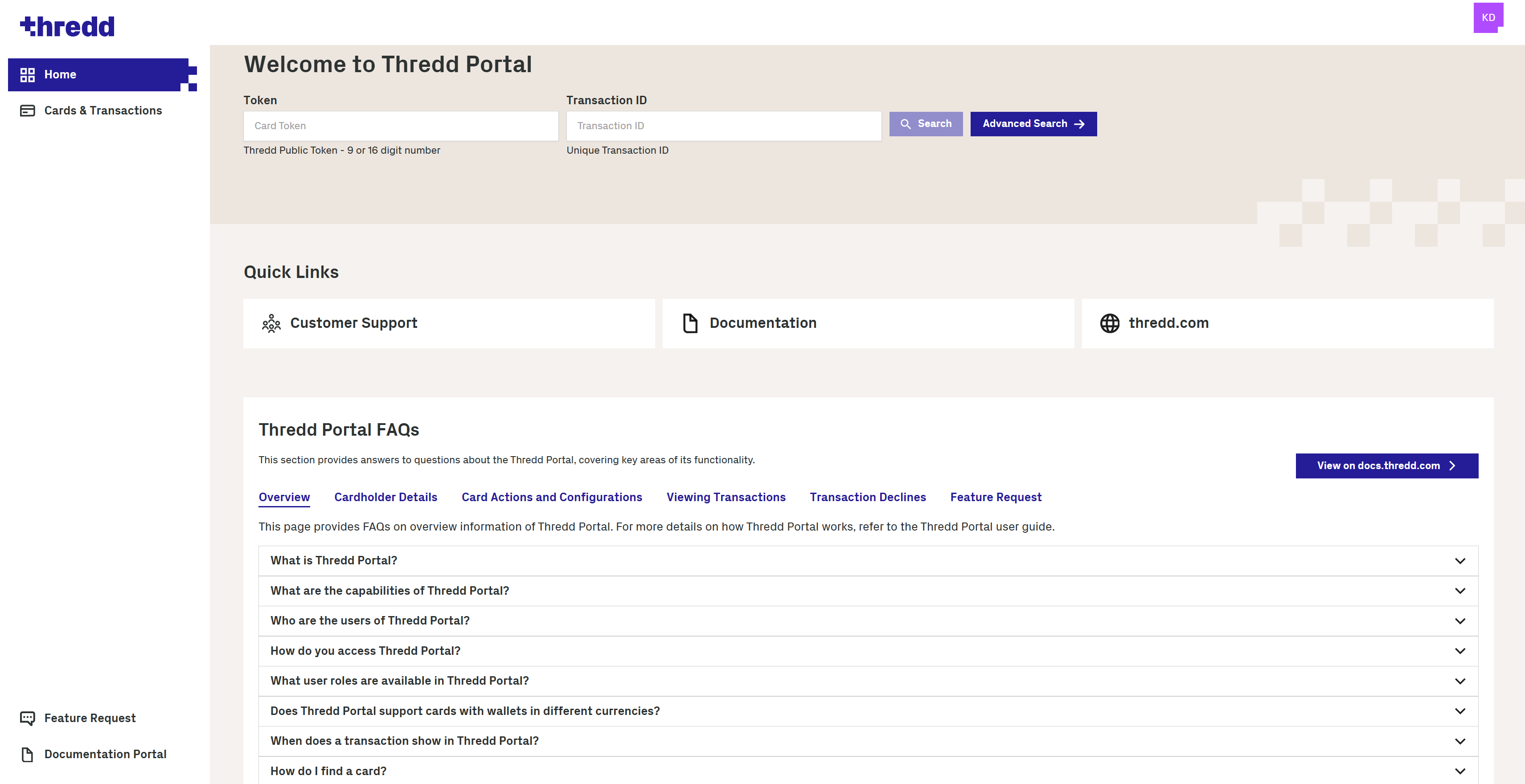

Thredd Portal FAQs

This section provides answers to questions on Thredd Portal.

Overview

Thredd Portal is a web-based application that enables programme managers to manage the full lifecycle of their customer's transactions and card usage. Card programme users can use card and transaction management functions through its interface.

Using Thredd Portal, you can display details about card activity, transaction types, customer interactions and drill down into the details of specific transactions from a vast dataset. You can also alter card statuses, update card usage groups, load funds and adjust the balance.

Thredd Portal users include Customer Support Agents who can update details of a cardholder's account, view transactions, and change card statuses. Users of Thredd Portal also include Programme Managers who can perform all the functions of regular Customer Support Agents, but can also load and unload cards, edit card details, transfer and adjust balances.

Your company's Organisation Administrator must first set up your account under a specific user role, and enable you to access Thredd Portal through Single Sign On (SSO). SSO ensures that you can log in to the Thredd Portal without needing to enter a password.

When your account is ready, the Organisation Administrator will send a link to your email address. Click the link to sign on.

Your company's Organisation Administrator would have assigned you with one of the following roles in Thredd Portal. These include:

|

Role |

Permissions |

|---|---|

|

Admin |

Full access to Thredd Portal. |

|

Manager |

|

|

Read-Only User |

|

|

Card Operations Specialist |

|

|

Card Configuration Manager |

|

|

Card Balance Manager |

|

Thredd Portal has been set up with the same ‘Cards and Transaction’ functionality as Smart Client. Thredd Portal has a much improved user interface which is intuitive and easy to learn - making finding the necessary information simple and easy to onboard new users. Additionally, you can find other documentation in the in-app FAQs.

A transaction shows in Thredd Portal as soon as a cardholder for your programme has made a card transaction at a merchant.

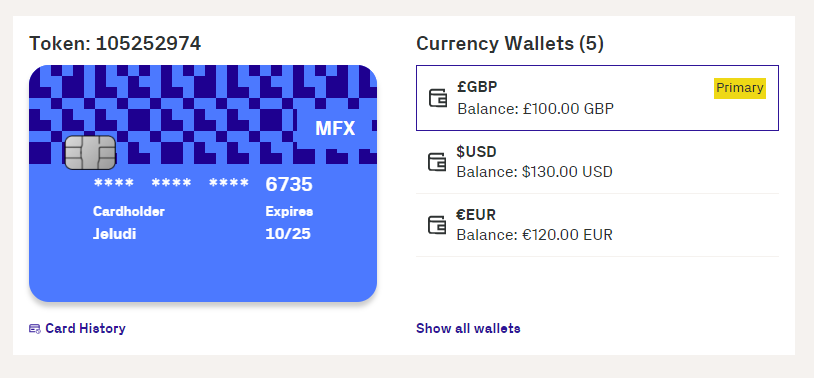

Yes, Thredd Portal supports Multi-FX (or MFX) cards, which contain more than one wallet of different currencies. Multi-FX cards allows cardholders to manage and transact in different currencies.

- If you know the token number, click Token ID and enter it from the Home page and Click Search.

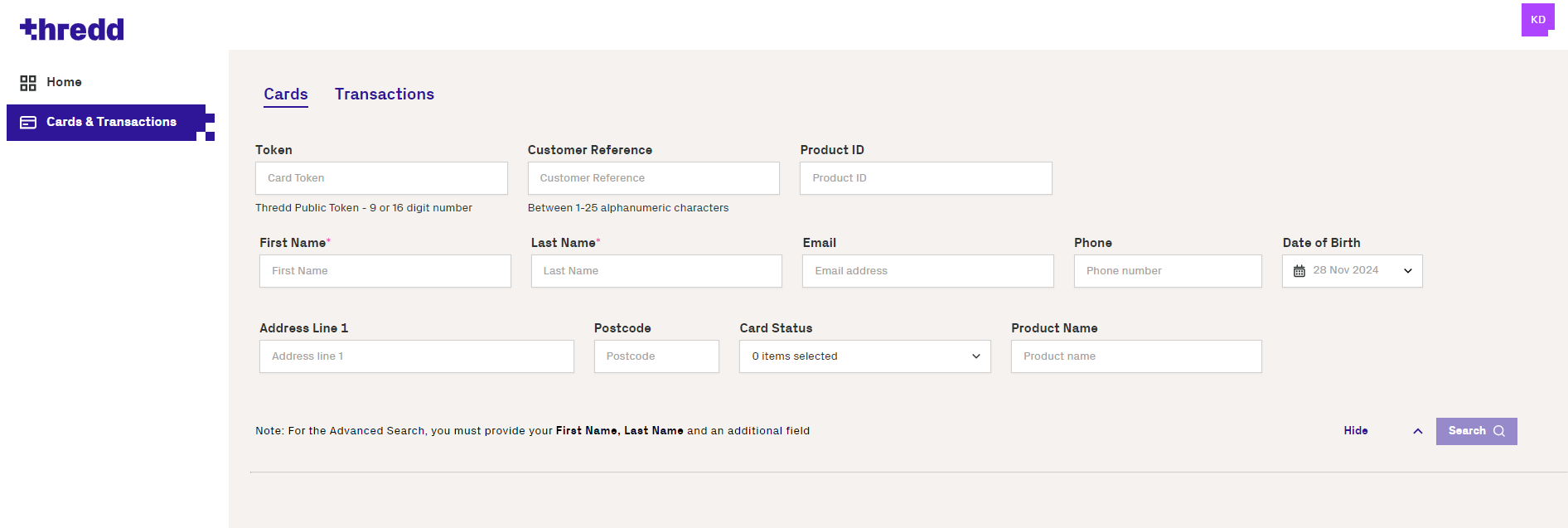

- To perform an advanced card holder search, Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

- Click Search. One or more search results appear.

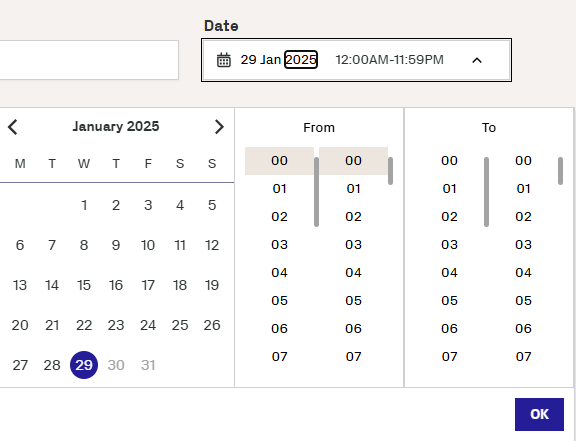

You can search a transaction from a given day and/or filter through an advanced search.

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period.

-

To further filter the search, click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

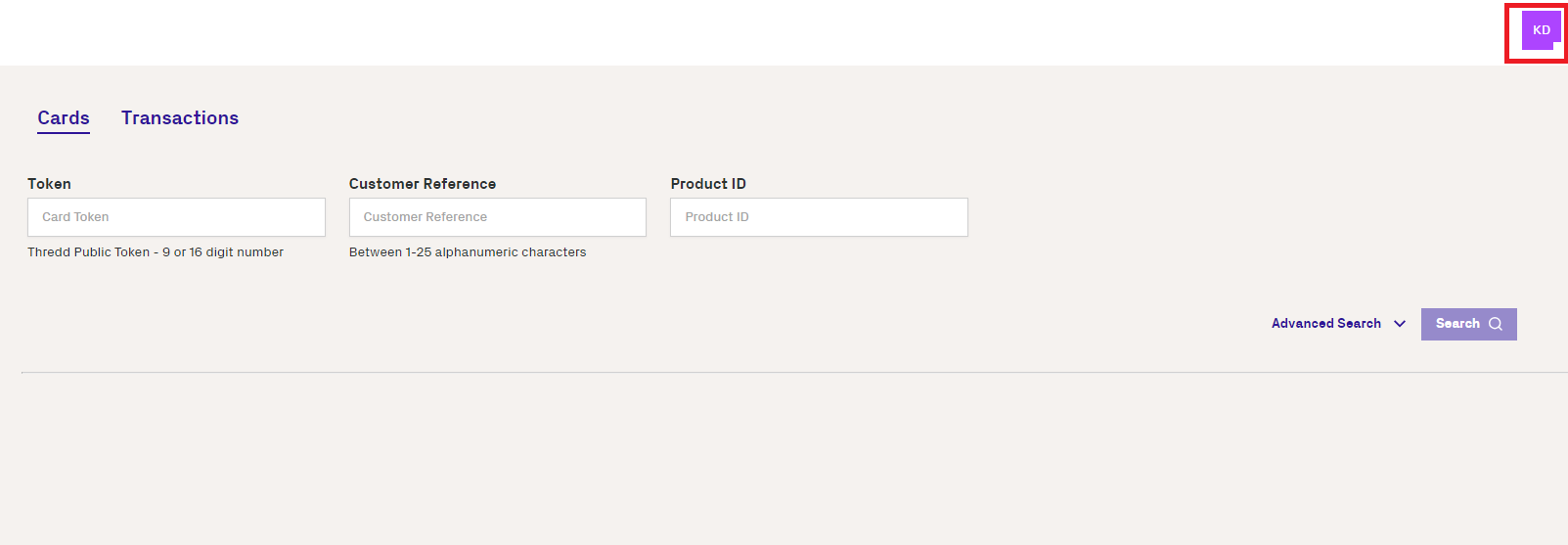

You can find details of your user profile information on the top-right of the dashboard homepage, as indicated by the initials of the user.

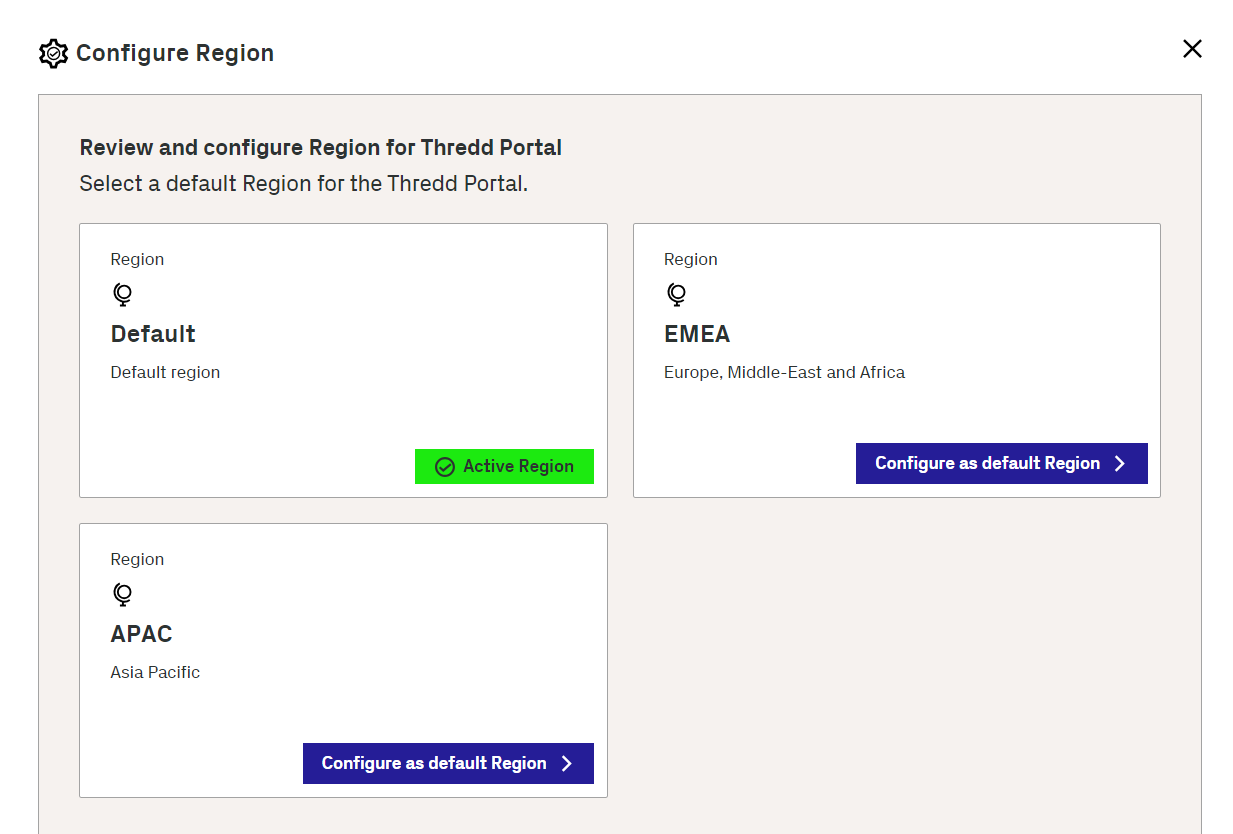

You can configure the server to provide search results relevant to your region.

-

Click your user profile icon.

-

Choose the Configure Region option from the pop-up menu.

-

Click Default. The Configure Region screen appears with the currently selected region as the Active region.

-

In the Configure Region screen, select the region that you want to connect to.

-

Click Save.

To ensure that you remain in the same region for the login session, make sure you use the same browser session and do not clear the browser cache.

You can use both Thredd Portal and the Thredd APIs to manage card functions. When using APIs, you can choose between the Thredd API (SOAP) as well as the Cards API (REST).

You can find more information on Thredd Portal in various sections of this user guide. Other information is available in docs.thredd.com, including technical information in the EHI guides.

Thredd Portal has been designed with users in mind - which makes it easy and intuitive to access and learn. It should not require additional training. Additionally, comprehensive online documentation can be found in the in-app FAQs. However, if you have training requirements, reach out to an Account Manager to discuss further.

Cardholder Details

This section provides overview information on how cardholder details work within Thredd Portal. This is essential for helping you to find information on your cardholders. For more detailed information on using cardholder details, refer to the Searching for a Card and Viewing Card Details.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

- Click Search

- Select an entry.

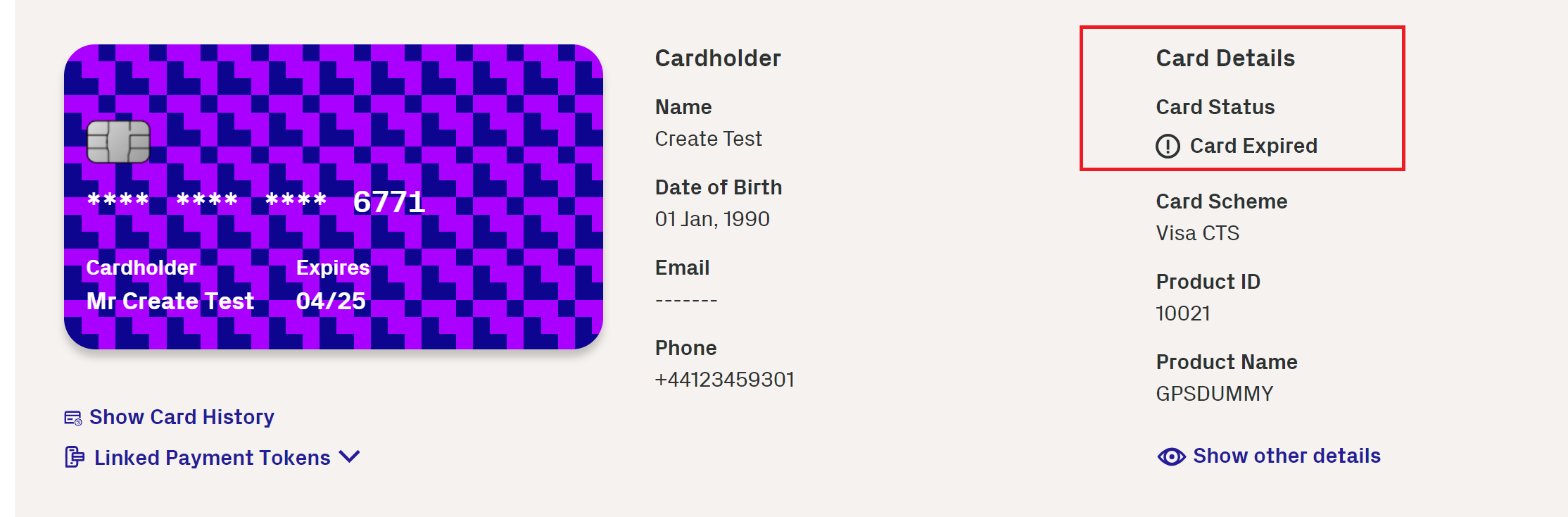

- From the Card Details section, check the Card Status.

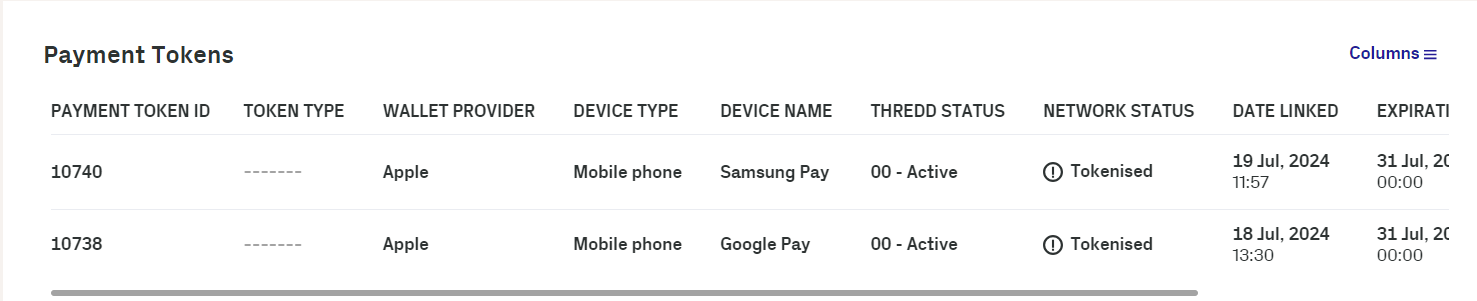

You can view multiple tokens linked to a card.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

- Click Search

- Select an entry.

- Click Linked Payment Tokens.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

- Click Search

- Select an entry.

- Click Show Other Details. The Show Other Details window appears.

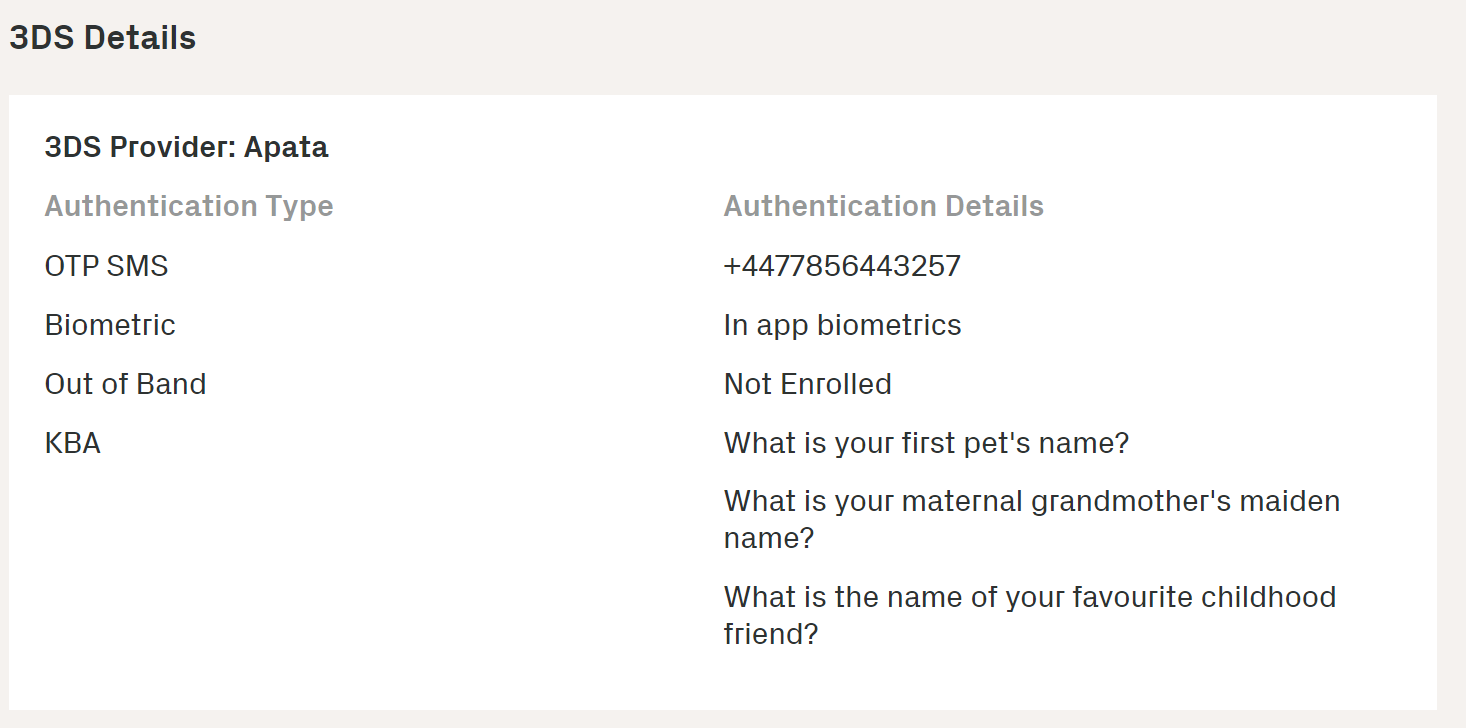

- Scroll down to the 3DS Details section. The section shows information on the 3DS Provider, as well as the enrolled and unenrolled authentication types of the cardholder.

You can view details on the token, such as when it expires.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

- Click Search

- Click on an entry.

- Click Linked Payment Tokens.

- Click on an entry.

- View the information in Payment Token Details.

Note that, if you know its number, you can also enter the card token in Token from the Home page.

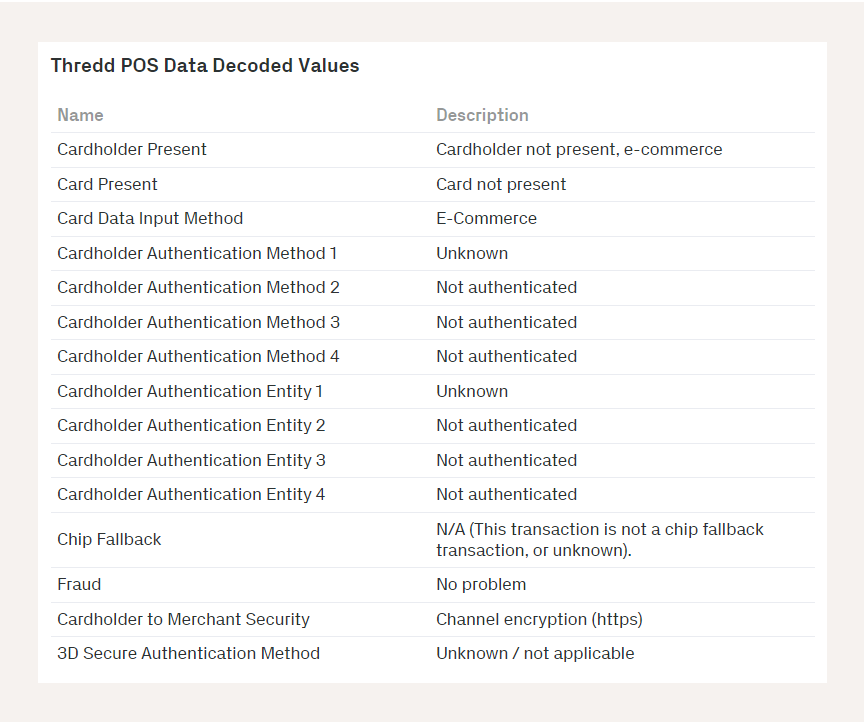

You can view details on the transaction that was captured at the terminal, such as the cardholder present/not present status.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

- Click Search

- Click on an entry.

- In the screen showing details of the transaction, scroll down to the Merchant section.

- Click on the icon next to Thredd POS Data.

- View details on the transaction.

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

- Click Search

- Click on an entry.

- Click the Show other details link.

-

Scroll to the Card Configuration Details section.

-

Click the Fees and Amount Configuration link. The Fee Configuration page appears with details of fees. The following example shows recurring fee configuration.

Note that, if you know its number, you can also enter the card token in the Token field from the Home page

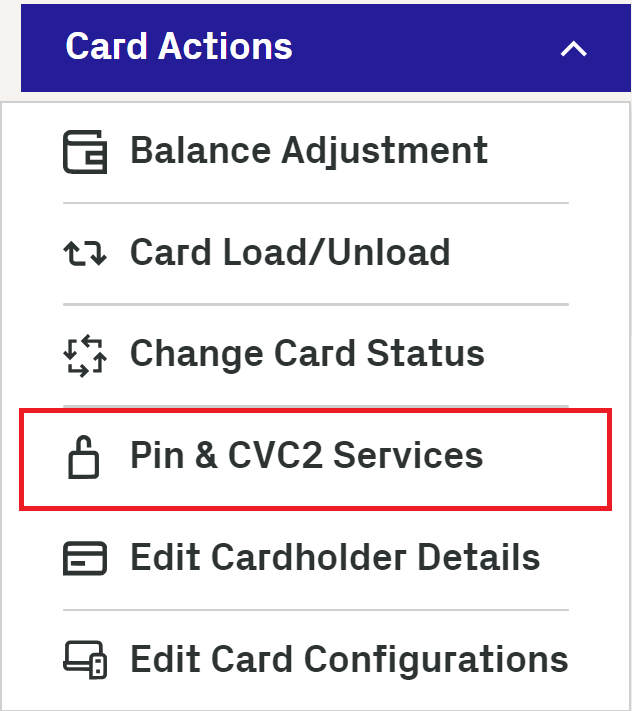

Card Actions and Configurations

This section includes details on various actions and configurations that you can perform on cards.

If a cardholder loses their card, you can change its status to lost until they receive a new replacement card. The status of the card must be Active before it is marked as Lost.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click an entry.

-

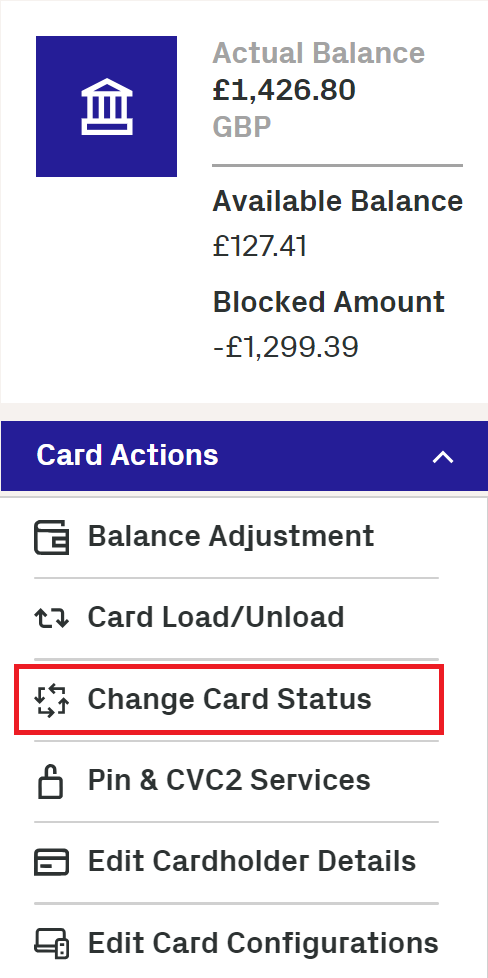

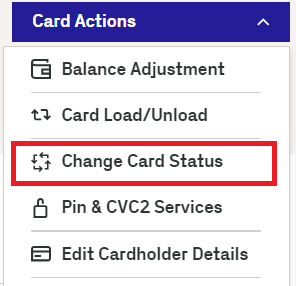

Go to Card Actions > Change Card Status.

-

Click Next on the page showing the current card status.

-

Select the following item from the drop-down list: 41 - Lost Card

-

Click Next on the displayed page that shows the status the card will change to.

-

Enter some notes on the change and click Save.

You can activate a card in Thredd Portal that is currently in the inactive state.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click on an entry for a card in the inactive state.

-

Click on Card Actions > Change Card Status.

-

In the displayed page, observe the card status as Inactive.

-

Click Next.

-

Select Active 00 in the Change Card Status to menu.

-

Click Next.

-

Enter some notes and click Save.

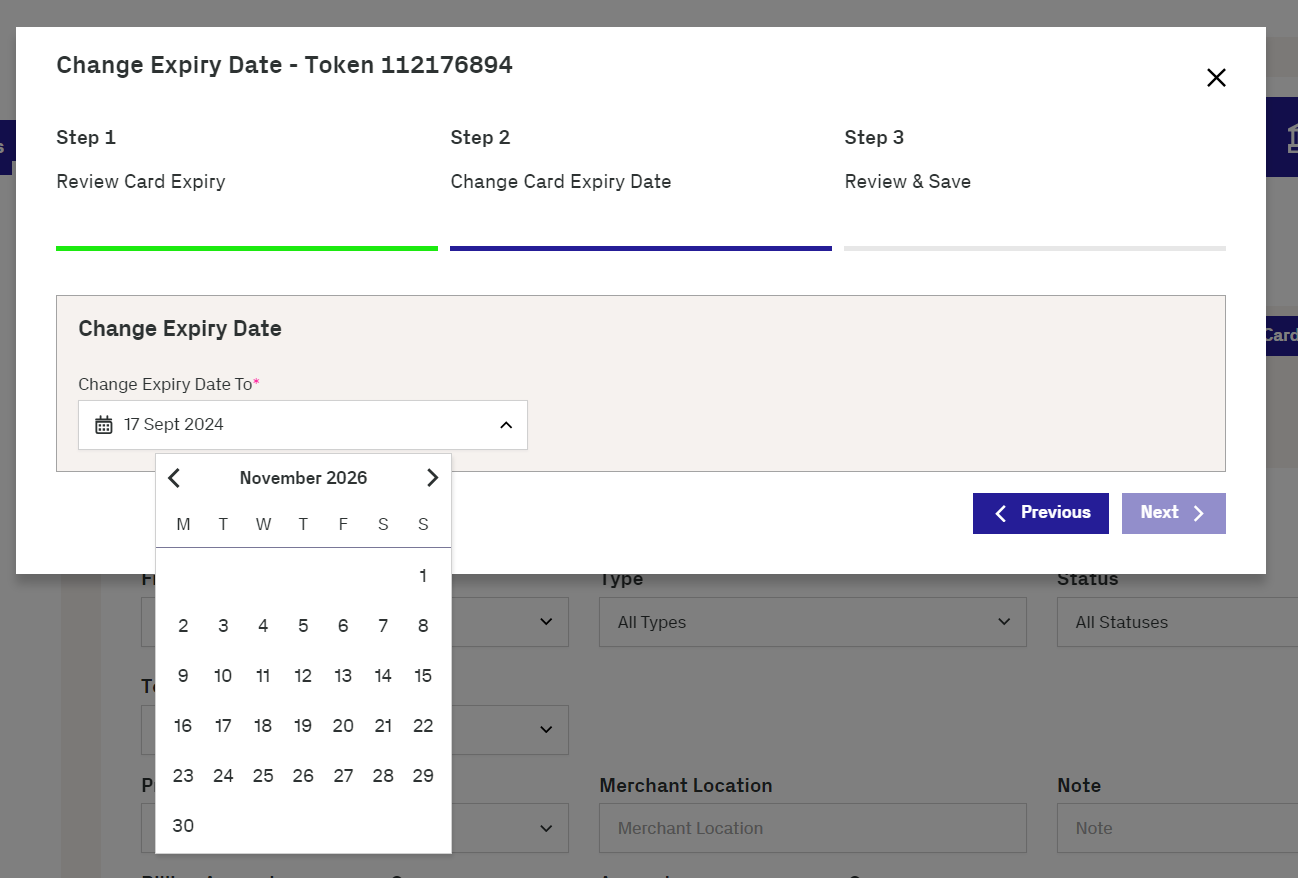

You can change the current expiry date for an active card. Changing the expiry date applies to a physical card with an embossed date and a non-physical physical card. For a physical card, you can only extend the expiry date within the date embossed on the card. Setting a date outside the period requires you to renew the card. A non-physical card does not have the same restrictions on setting dates

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Select an entry.

-

Go to Card Actions > Change Expiry Date.

-

Review the current expiry date and click Next.

-

Select another expiry date from the date picker in the Change Expiry Date To menu.

-

Click Next.

-

Enter some notes and click Save.

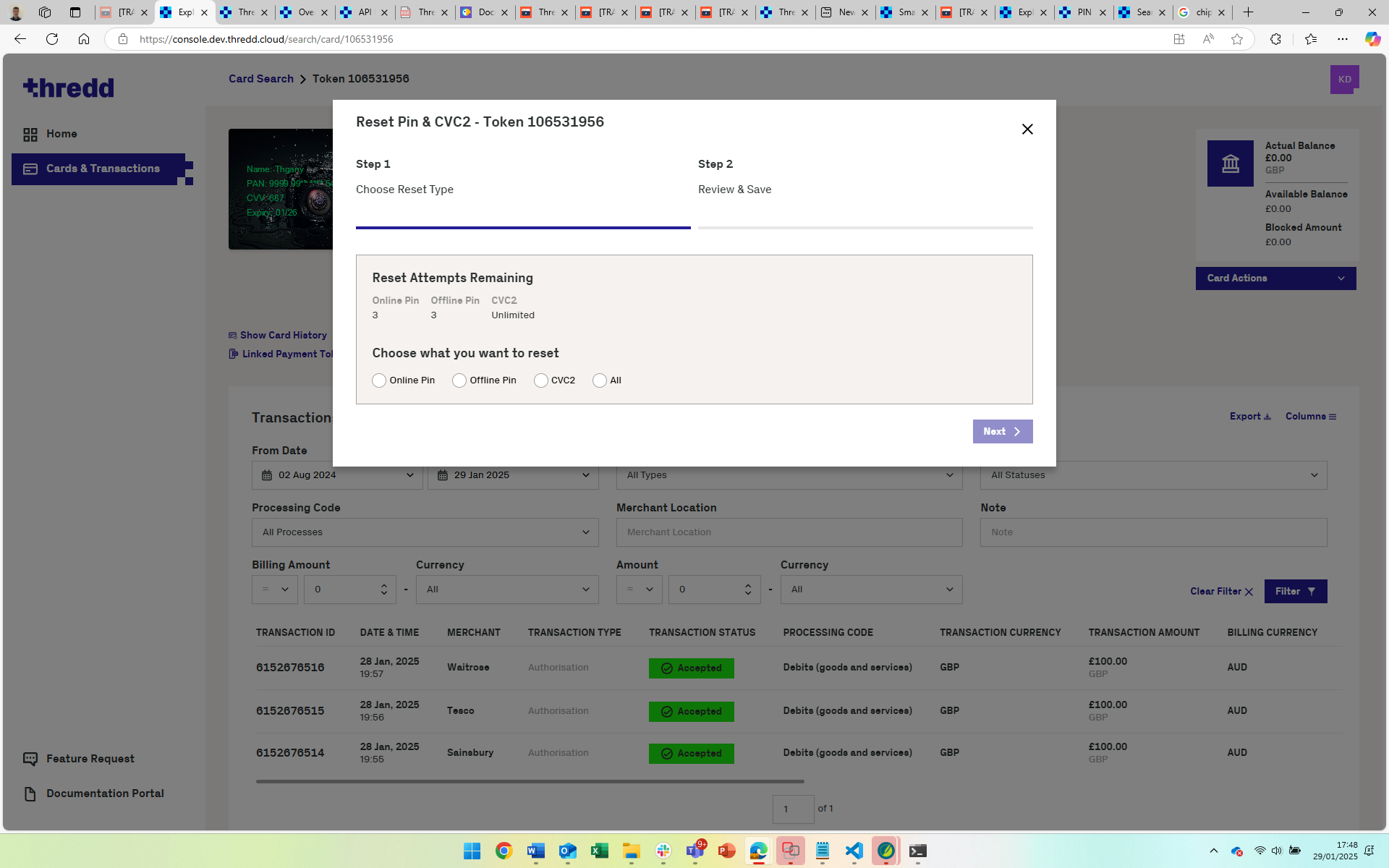

The number of permitted online and offline PIN retries are set to 5. CVC2 allows an unlimited number of retries. In some situations, these numbers may be different, and you can reset these for the cardholder. Note that a cardholder uses an Online PIN for online transactions, while they use an Offline PIN on a chip and PIN device.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Select an entry.

-

Go to Card Actions > Pin & CVC2 Services.

-

Click Next to review PIN retries in the Review Card Status page. The page shows the number of reset attempts remaining. It also shows you the option that asks you what you want to reset.

-

Choose Online Pin, Offline PIN, CVC2, or All

-

Click Next to go to the Review & Save step.

-

When reviewed, click Save.

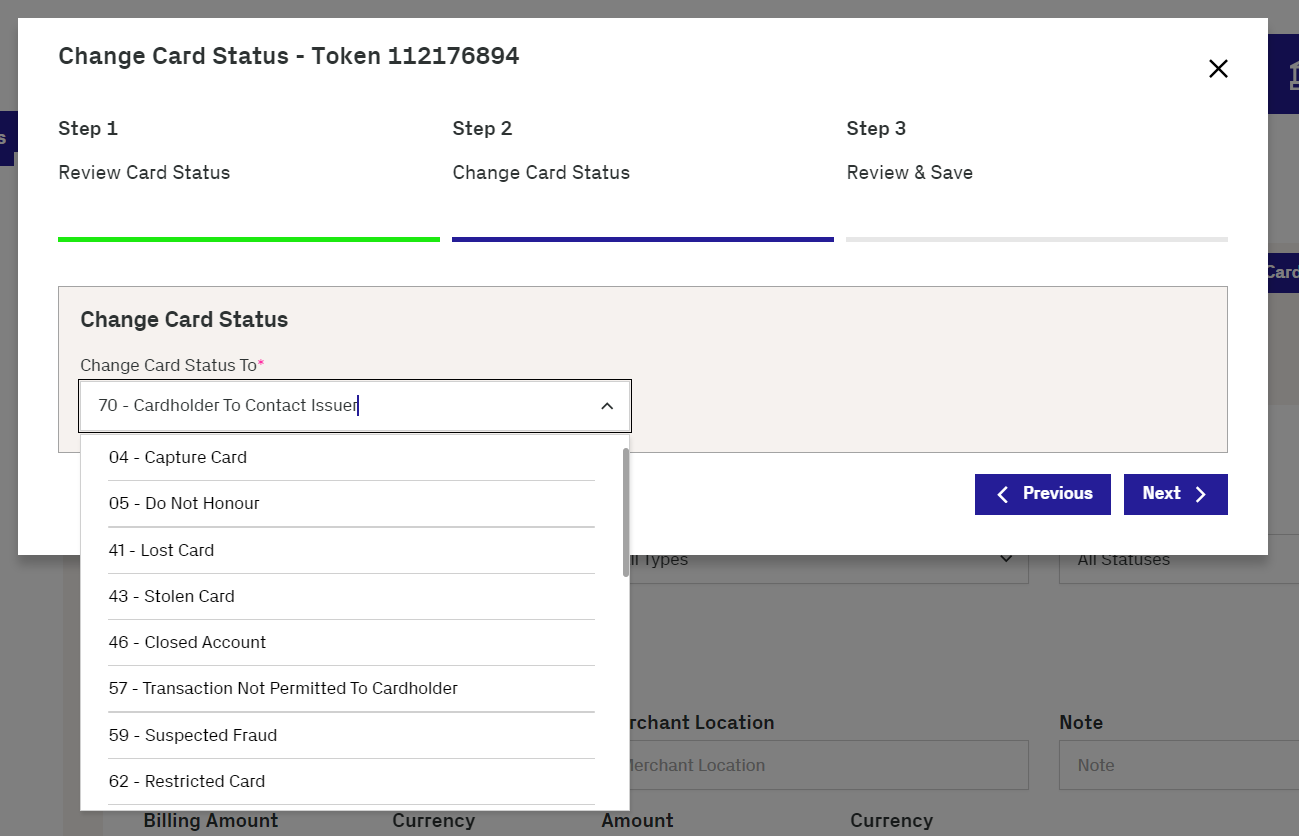

In some situations, you may need to block a card, for example, a KYC check highlighted certain issues behind the cardholder's activities.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click an entry.

-

Go to Card Actions > Change Card Status.

-

In the displayed page, click Next.

-

Select any of the following reasons from the drop-down list.

- 04 - Capture Card

- 05 - Do Not Honour

- 41 - Lost Card

- 46 - Closed Account

- 59 - Suspected Fraud

- 62 - Restricted Card

- 63 - Security Violation

- 70 - Cardholder to Contact Issuer

- 98 - Refund Given to Customer

- G1 - Short Term Debit Block

- G2 - Short Term Full Block

- G3 - Long Term Debit Block

- G4 - Long Term Full Block

- G5 - Gps Protect Short Term Debit Block

- G6 - Gps Protect Short Term Full Block

- G7 - Gps Protect Long Term Debit Block

- G8 - Gps Protect Long Term Full Block

- G9 - IVR -Lost Stolen Block

For more details on the settings, refer to Appendix B: Card Status Codes.

- Click Next.

-

Review the settings and enter a note to record the change.

-

Click Save.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click an entry.

-

From the Card Details section, check the Card Status is not set to active.

A card can be blocked for the following reasons:

-

The fraud rules in Fraud Transaction Monitoring may deem a transaction on the card as suspicious.

-

The cardholder reported their card as lost or stolen.

-

The account for the card is closed or is in the process of closing.

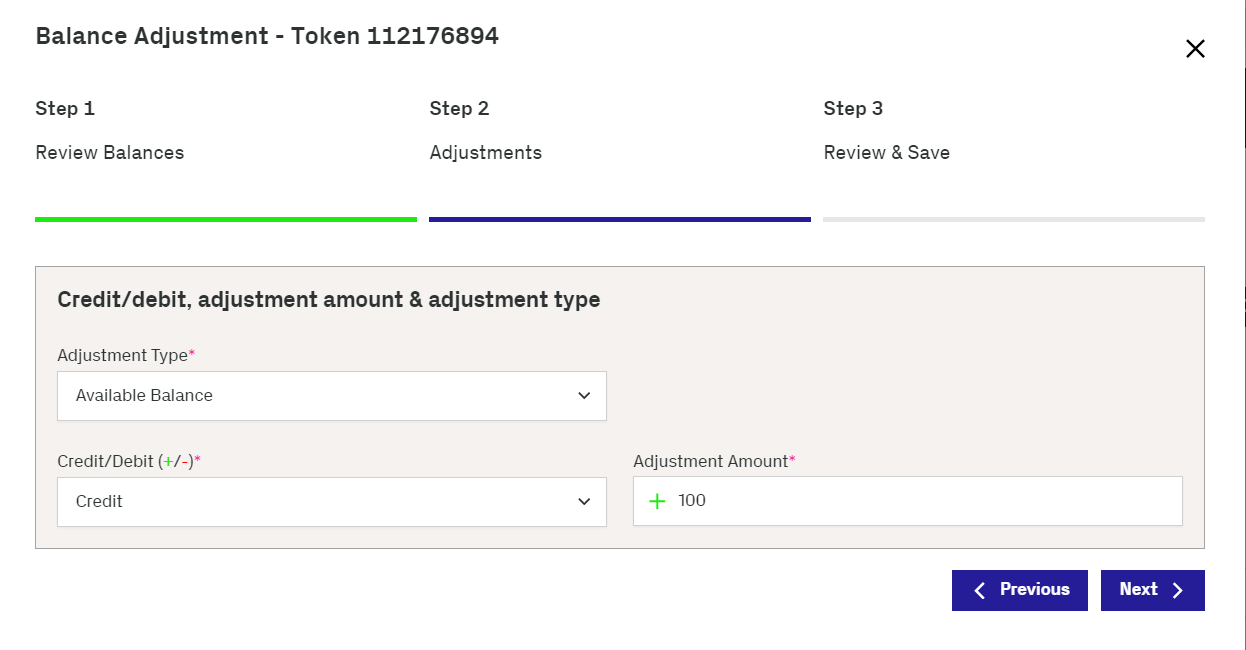

For refunding fees, you need to adjust the balance on the card. You can refund fees on an available amount or on a blocked amount.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click an entry.

-

Go to Card Actions > Balance Adjustment.

-

Review the balance information and click Next.

-

Select Available Amount or Blocked Amount in the Adjustment Type menu.

-

Click Creditor Debit under the Credit/Debit menu.

-

Enter the amount you want to adjust in Adjustment Amount.

-

Click Next and review the change.

-

Add a note for the change.

-

Click Save.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click an entry.

-

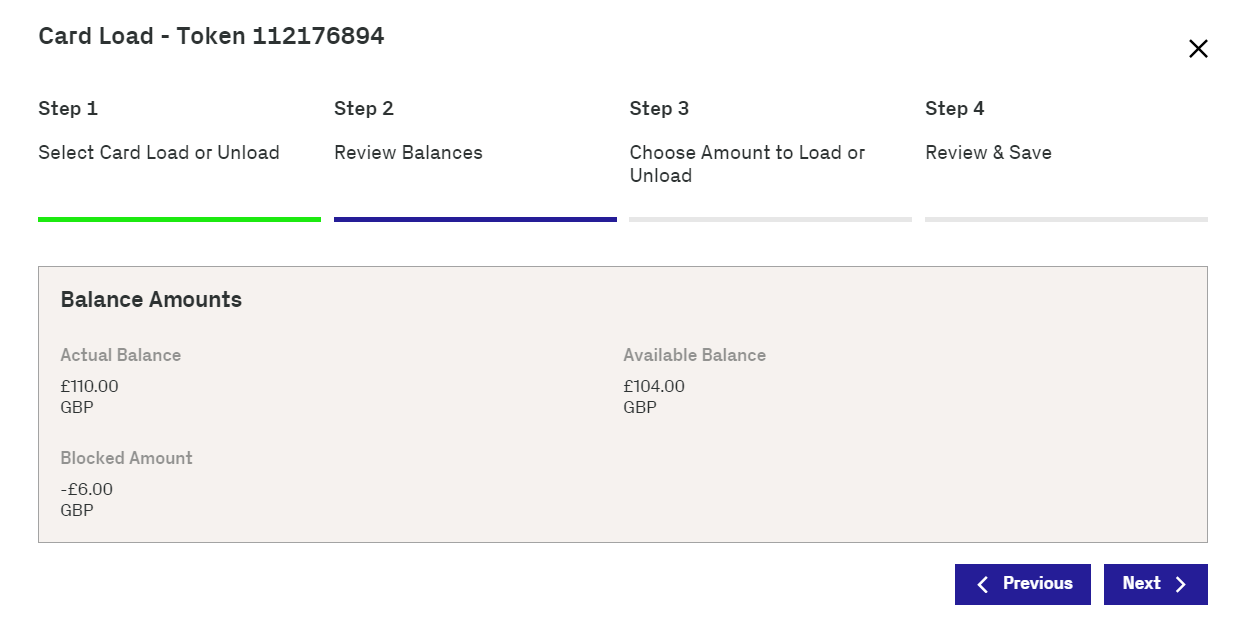

Go to Card Actions > Card Load/Unload.

-

Choose Load in the Select Card Load or Unload list and click Next.

-

Review the balance of the current amount.

-

Click Next and enter an amount in Load Amount.

-

Click Next and review the updated balance.

-

Add a note to record the change and click Save.

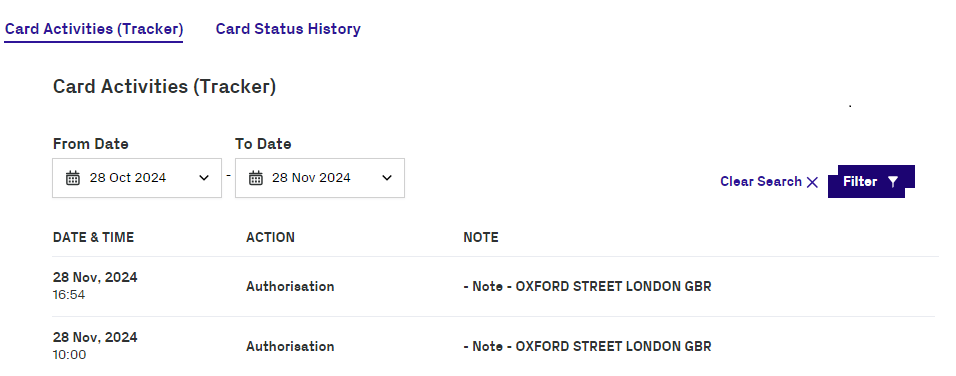

The card history provides details of activities performed on the card in Thredd Portal, changes made through the Thredd API, and the card status history. You can perform he below steps:

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click an entry.

-

Click Show Card History.

-

To view details of card activity, select a date range in the From Date and To Date fields and click Filter. The following shows an example:

-

To view details of card status changes:

-

Click Card Status History

-

Select a date range in the From Date and To Date fields.

-

Click Filter.

-

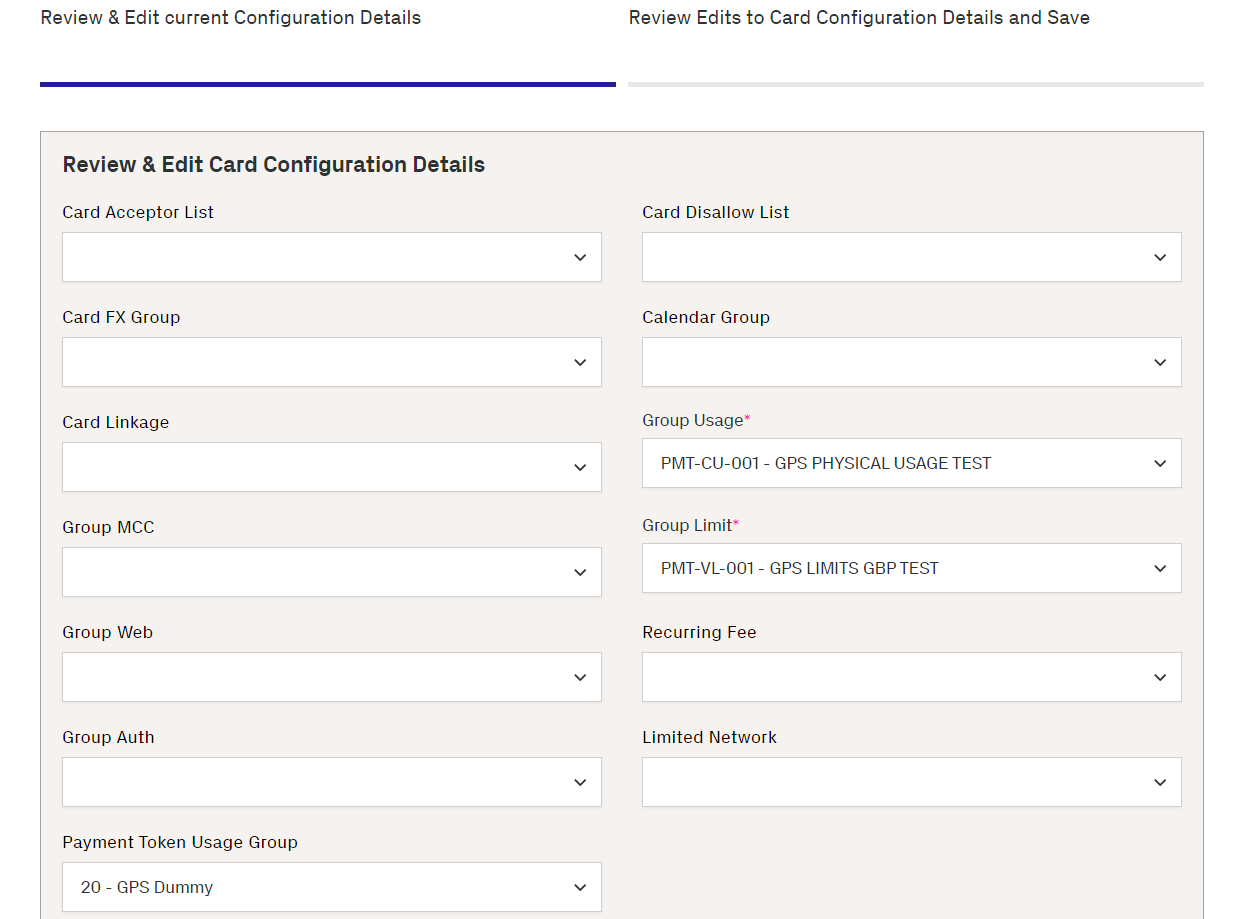

You can change the card disallow list through performing the below steps. However, before changing the card disallow list, Thredd must have already created the target list that you want to add. For setting up card disallow lists, contact Thredd's implementation team.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click an entry.

-

Go to Card Actions > Edit Card Configurations.

-

Under the Edit Card Configurations screen for the token, select an item in the Card Disallow List menu.

-

To confirm the change, click Review and Save.

-

Check the updated details and click Save.

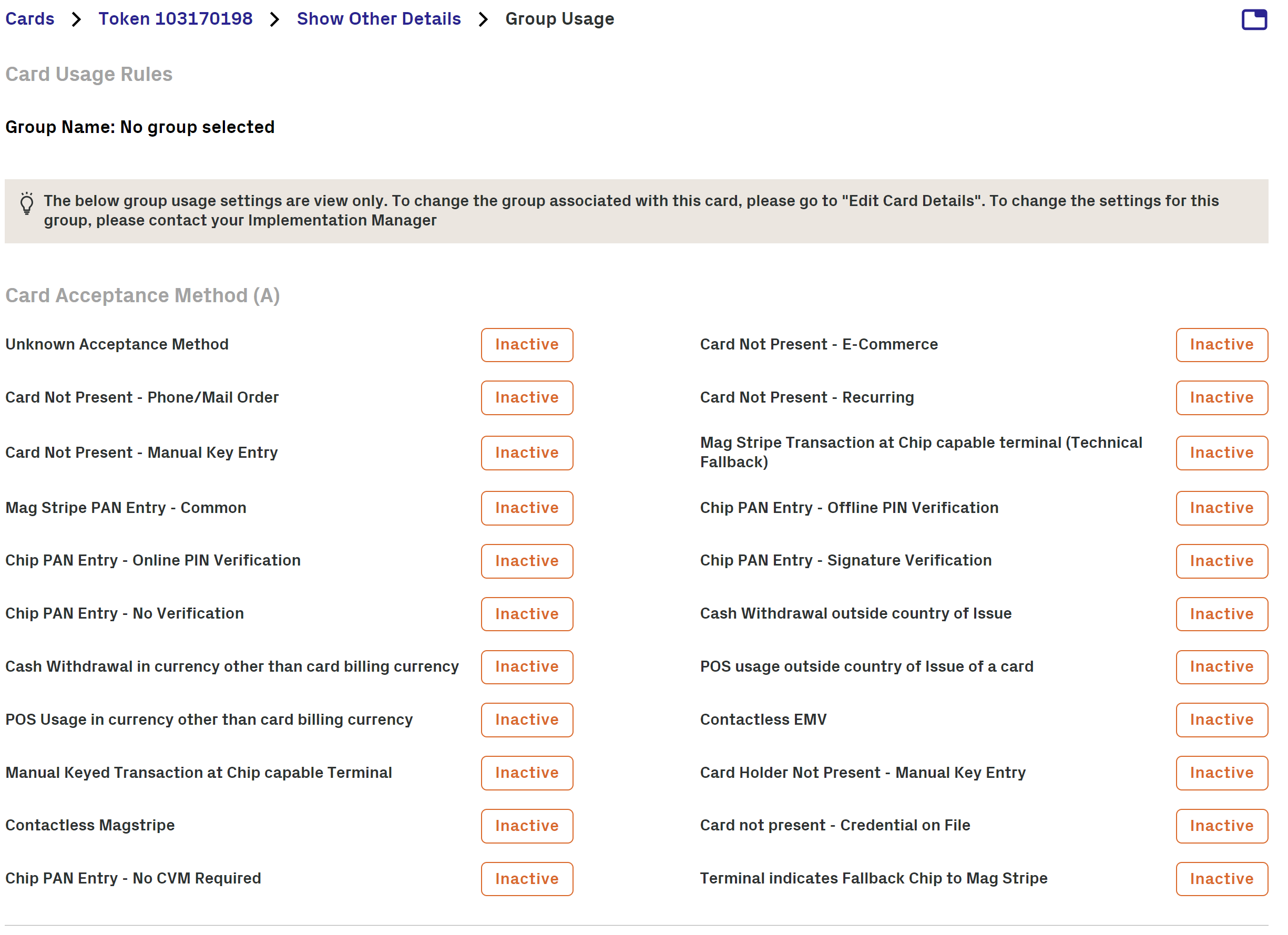

You can see all the Group Usage settings that have been configured for a card, categorised in to card group usage Rules, Card Acceptance Method, Transaction Type, Verification Checks, and Miscellaneous,

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click an entry.

-

Click the Show Other Details link. The Show Other Details window displays.

-

Under Card Configuration Details, Click the Group Usage link. The Group Usage window shows the inactive and active card usage rules under various categories. The following example image shows the group usage rules for Card Acceptance Method.

For more details, see Appendix I: Card Usage Rules.

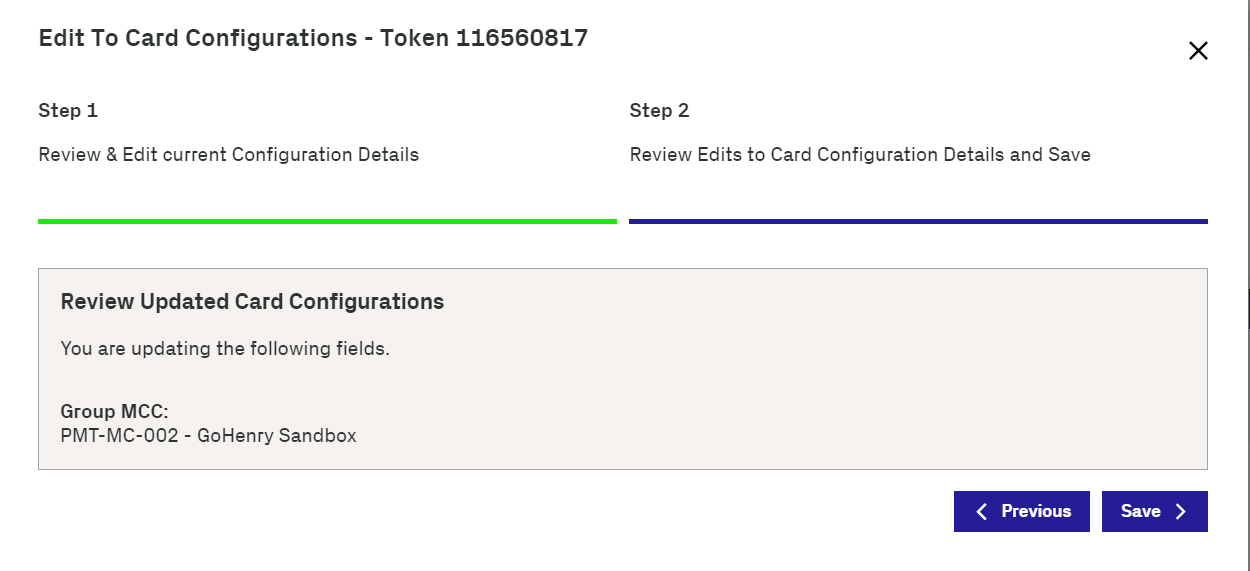

You can update the Group MCC which allows or disallows card acceptance (auths) based on one or more merchant category codes (MCC).

Note that changing a group requires Thredd to have first set up the group with the relevant categories.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click an entry.

-

Go to Card Actions > Edit Card Configurations.

-

Select a group in Group MCC.

-

To confirm the change, click Review and Save.

-

Check the updated details and click Save.

You can change the limit held on the card. For example, you can alter the maximum balance that the card allows.

Note that changing a group requires Thredd to have first set up the relevant groups and the individual limits.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click an entry.

-

Go to Card Actions > Edit Card Configurations.

-

Under the Edit Card Configurations screen for the token, select another group in Group Limit.

-

To confirm the change, click Review and Save.

-

Check the updated details and click Save.

You can change the usage group on a card to another one that is available. For example, a region may have a specific PAN entry method that is listed in a different usage group.

Note that changing a card group requires Thredd to have first set up the group, and the individual settings

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Select an entry.

-

Go to Card Actions > Edit Card Configurations.

-

Under the Edit Card Configurations screen for the token, select another entry in Group Usage.

-

To confirm the change, click Review and Save.

-

Check the updated details and click Save.

Changing the Card Usage group may require Issuer sign off.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Select an entry. If a card is a Multi-FX card, the card image includes the text labelled 'MFX'. There are also details of 3 other wallets with the balances of each one.

Note that, if you know its number, you can also enter the card token in Token from the Home page.

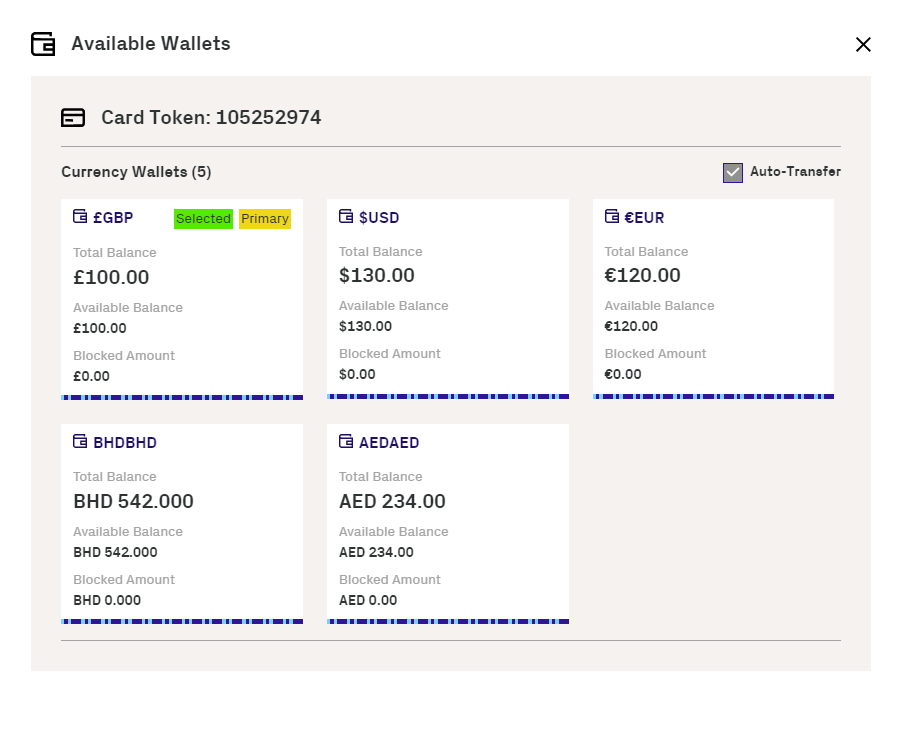

A Multi-FX wallet includes details of the total and available balance, blocked amount, and its associated currency. A Multi-FX card can have up to 5 wallets of a unique currency.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Select an entry.

-

Show wallet details. In the Currency Wallets section, click either the Show all wallets or the Show other details link. When you click the Show all wallets link, the Available Wallets screen appears (as shown in the following example).

Note that, if you know its number, you can also enter the card token in Token from the Home page.

You can see the live spend limits on a card. This includes data on the spend amount as a proportion of the limit and the spend frequency. The limits exist in the following categories:

-

Cash transactions

-

Card loads

-

Amount paid in

-

Transactions made through POS

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click Show Other Details under Card Details.

-

In the displayed window for cardholder details, click the link under Group Limit in Card Configuration Details.

-

View the details in Group Limit Settings.

Note that, if you know its number, you can also enter the card token in Token from the Home page.

Viewing Transactions

Thredd Portal allows you to view details on recent transactions that have happened in one or more cards.

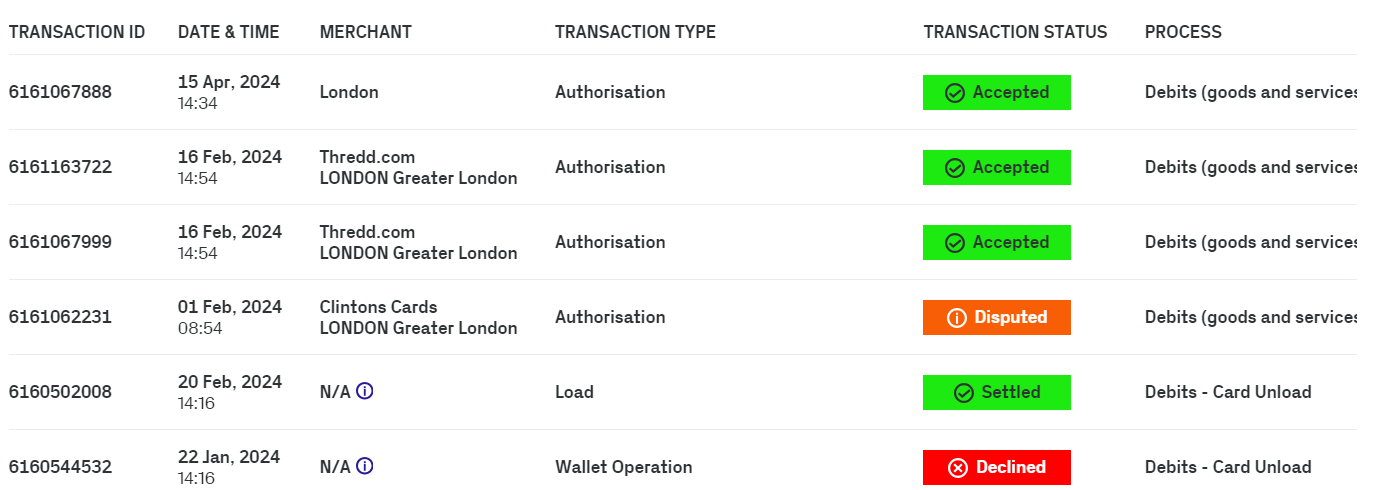

A transaction status indicates the current state of a transaction (for example an authorisation). You can view the transaction statuses to filter your card transactions. The statuses are as follows:

|

Status |

Description |

|---|---|

|

Accepted |

The authorised amount on a transaction is blocked, where the funds are reserved for the transaction and are no longer available for other uses. |

|

Cleared |

The issuer transfers the requested settlement amount on the transaction to the acquirer. This is in the form of clearing files containing presentments. |

|

Disputed |

The transaction is disputed, for example, the customer has raised a chargeback with the issuer. |

|

Processing external host |

EHI is processing the transaction, but has not yet responded to Thredd. |

|

Declined |

The transaction has been declined, for example, due to the amount of the authorisation exceeding the allowed limit. |

|

Rejected |

The transaction is rejected in certain rare scenarios. |

|

Processing |

The transaction is in processing, but where a final status is still pending. For example, the transaction is in the process of being added to the database. |

|

Removed |

The authorised amount on a transaction is unblocked in instances where the reversal on an authorisation has failed. |

|

Settled |

The transaction has been settled where the authorised and cleared funds have been transferred between the Issuer and the Acquirer. |

|

Reversed |

The authorisation on the transaction has been reversed, for example, when a customer cancelled payment. |

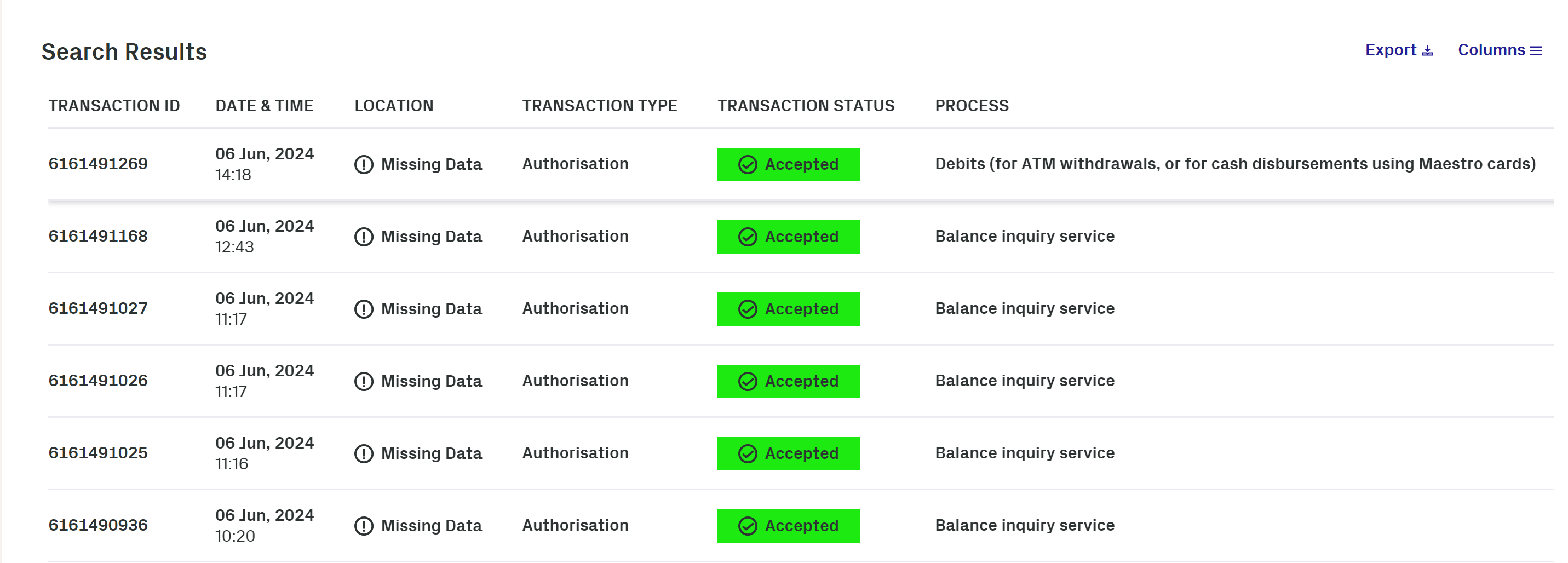

Thredd Portal can display up to 10000 transaction results from a request, where the results are paginated.

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

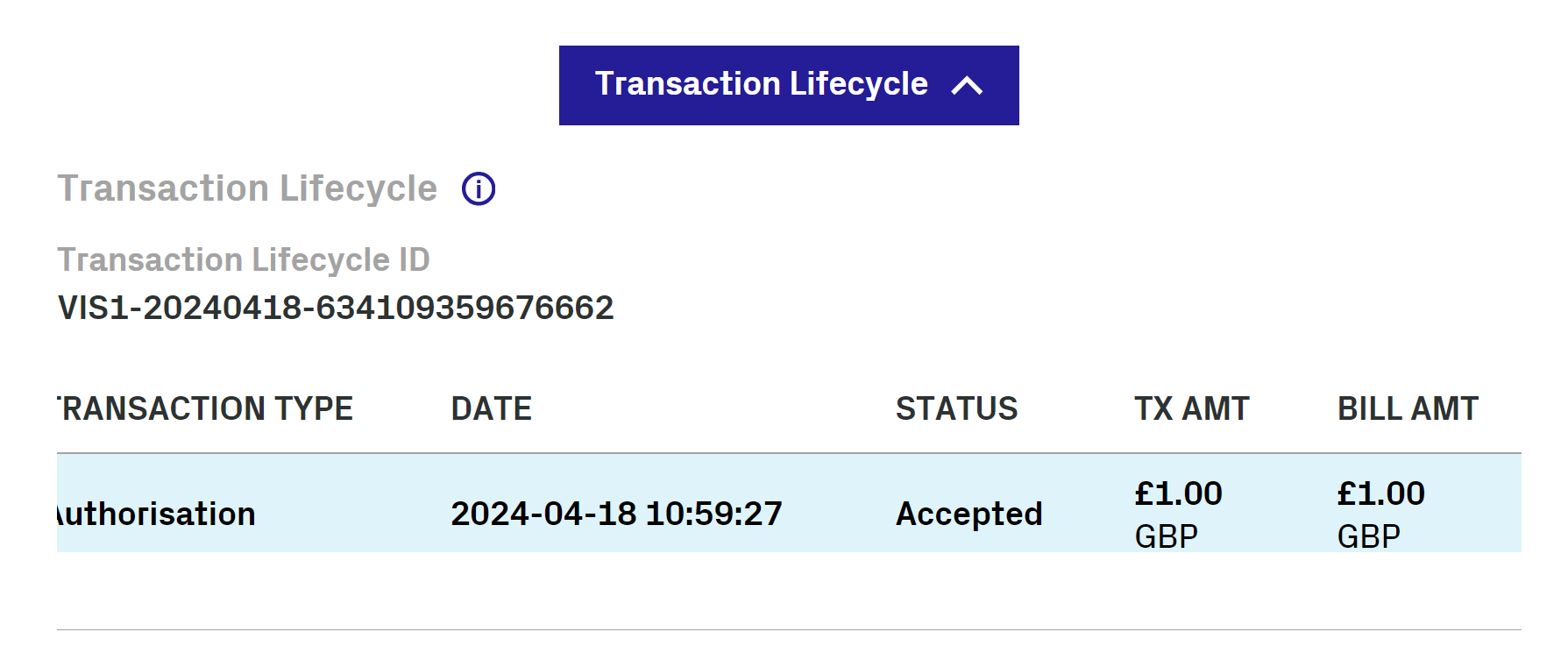

Click an entry.

-

In the displayed window to the right, scroll-down and click the Transaction Lifecycle button.

-

View details of the entry.

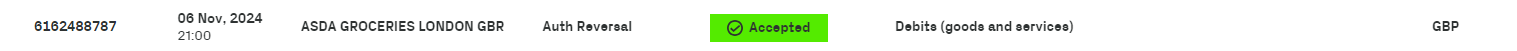

If Thredd has not received a presentment for an authorisation, which is normally within a 7-day period, the transaction expires. The period is usually longer (up to 30 days) for merchants using pre-authorisations, such as car hires and hotels. The acquirer sends a Reversal to Thredd. These are the steps you can follow to check for a reversal:

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

View a transaction with the Transaction Type of Auth Reversal.

A presentment is a stage in a transaction where the funds authorised on a card are captured and deducted from the cardholder’s account. You can check if the transaction is a presentment by following the below steps:

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

View a transaction with Presentment in the Transaction Type column.

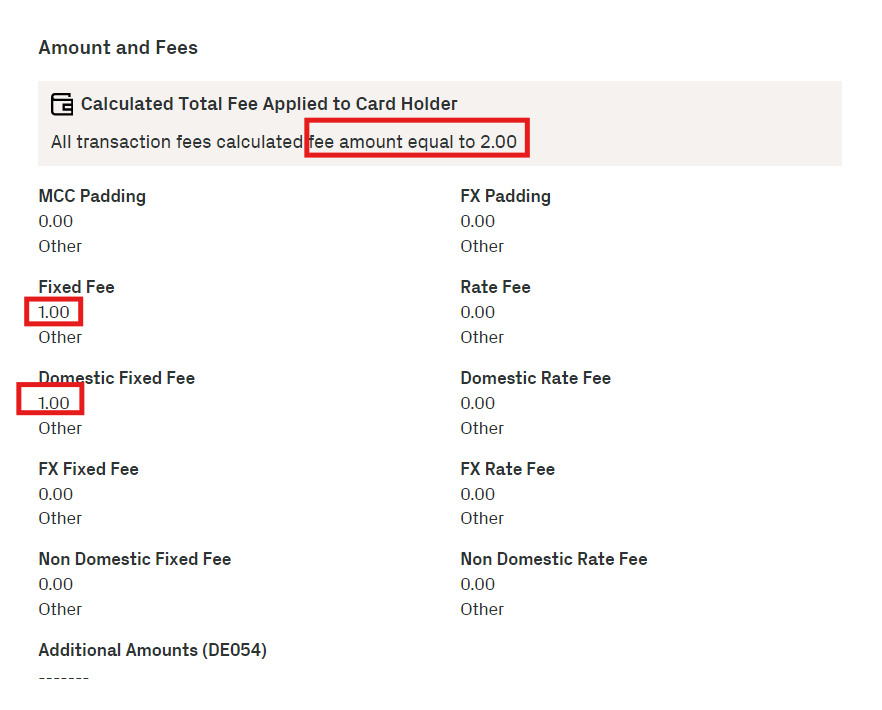

You can view information on a transaction, including the total amount and its breakdown. The following example shows a total amount of 2.00 that consists of a Fixed Fee of 1.00 and a Domestic Fixed Fee of 1.00.

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

Click an entry.

-

In the displayed window to the right, scroll-down to Amount and Fees.

Note the text for the total amount and the individual entries, such as MCC Padding, Fixed Fee, and Domestic Fixed Fee. The following shows an example.

Time lags in a presentment showing in Thredd Portal may be due to delays from the merchant or the acquirer in sending the presentment.

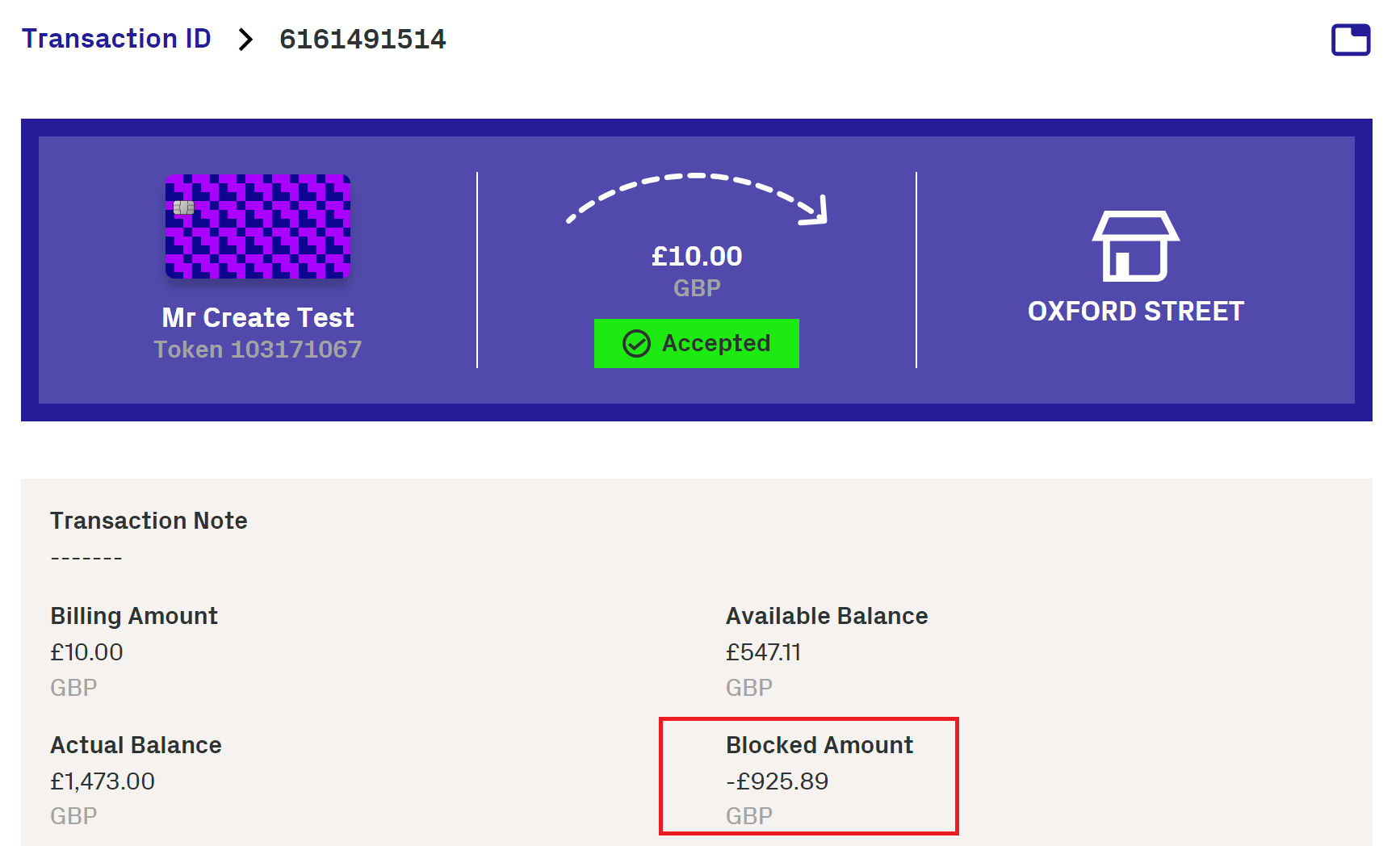

The blocked amount is the total amount reserved to complete transactions.

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

Click a relevant transactions entry.

-

View the blocked amount under Blocked Amount next to the Card Details section.

An available balance is the amount on the card that the cardholder can use immediately.

The billing amount is the sum of money billed for a transaction by a merchant in the card's currency. While a transaction amount is the sum of money recorded when the transaction takes place in the local currency. The billing amount may consider the exchange rates.

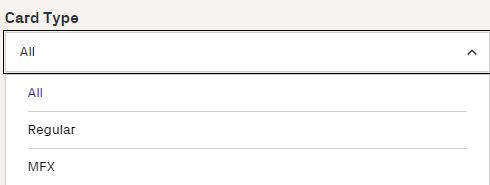

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Click Advanced Search.

-

Under the Card Type list, Select Multi-FX

-

Click Search. Transactions that have the Multi-FX card type appear.

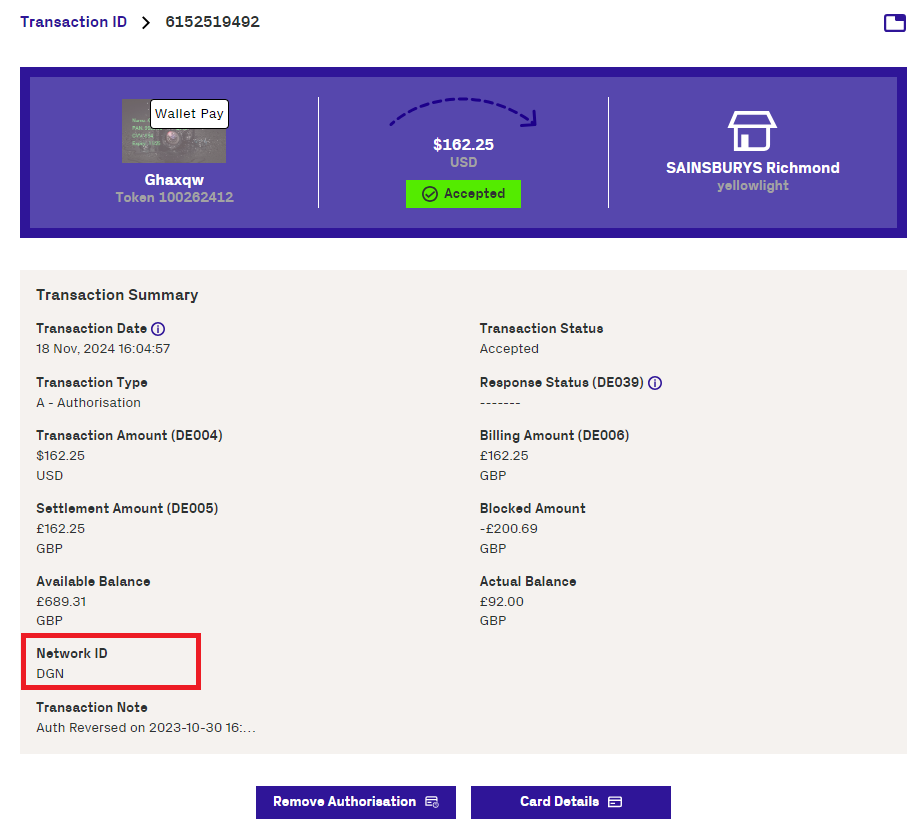

As well as Mstercard and Visa, Thredd supports the processing of debit cards on the DGN network. If a card token uses the DGN network, Transaction Summary information shows the card network associated with the card transaction as DGN.

- Click Cards and Transactions and Cardholder Search Terms (next to the Search button).

- Enter the First Name and Last Name of the cardholder with any of the following details:

- Phone

- Date of Birth

- Address Line 1

- Postcode

- Card Status

- Product Name

-

Click Search.

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

Click a relevant transactions entry.

-

On the Transaction Summary section, note the Network ID as DGN.

Note that, if you know its number, you can also enter the card token in Token from the Home page.

Thredd Portal lists the transactions that have been sent to your systems through EHI. EHI offers a way to exchange transactional data between the Thredd processing system and the Program Manager's externally hosted systems. EHI provides a real-time transaction notification data feed and payment authorisation control.

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

View the list of transactions.

Entries for transactions that are sent to EHI may also be indicated in the Note column. These transactions may be approved or rejected by EHI.

You can find Information on how the transaction was authenticated, the cardholder present/not present status and fraud details.

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

View the list of transactions.

-

On the displayed page, scroll down to the Other Details section.

-

Click on the expand arrow for Thredd POS Data. Details of the POS transaction appear in a window.

You can check if Fraud Transaction Monitoring was used on a transaction by checking the Note entry for a transaction in Thredd Portal. Fraud Transaction Monitoring enables the configuration of fraud rules where alerts are triggered under specific conditions.

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

Click a relevant transactions entry.

-

Under the Note column, check for details indicating that Fraud Transaction Monitoring was run for the transaction.

-

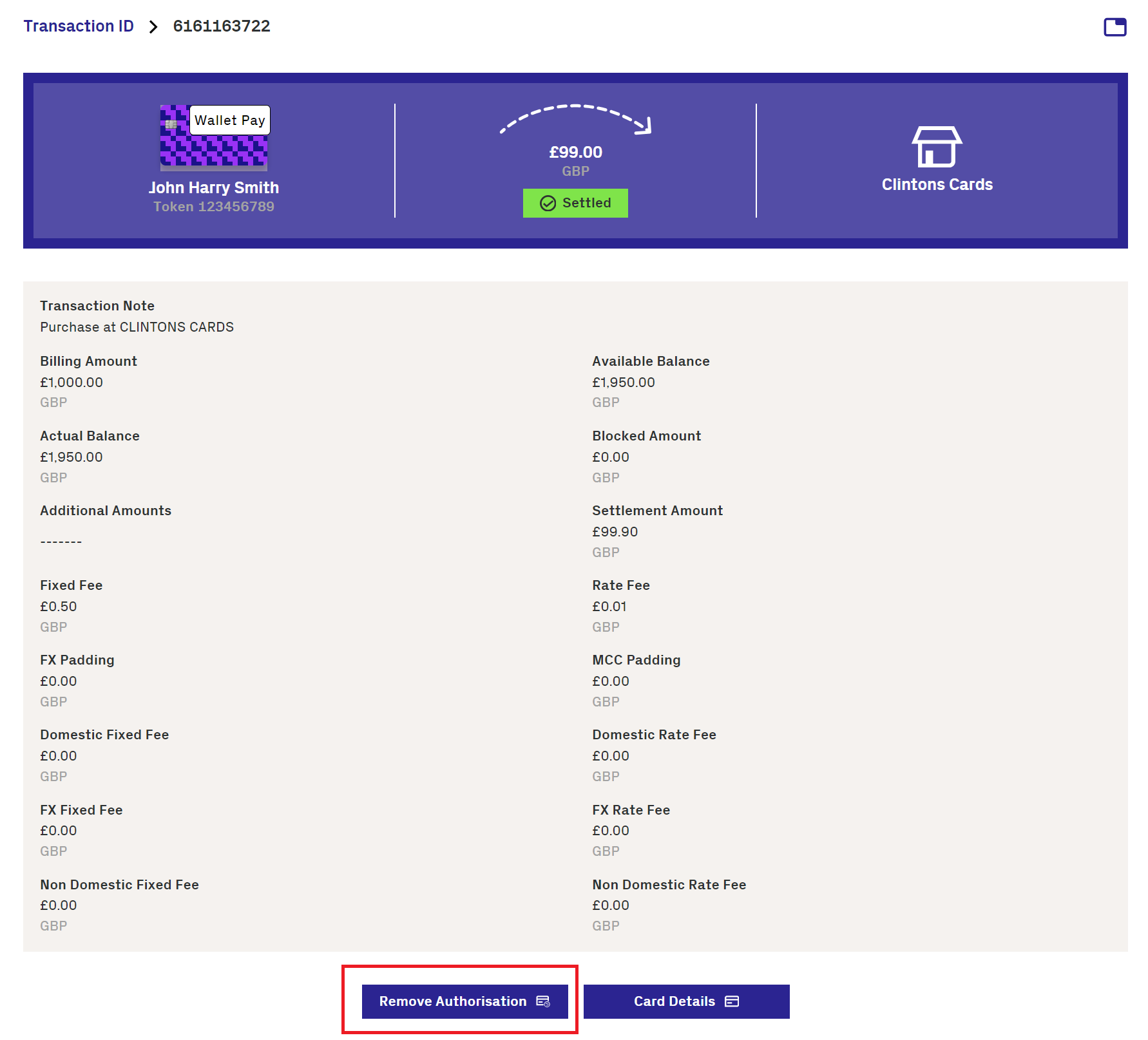

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

Click a transaction entry where the Transaction Type is Authorisation.

-

In the displayed window showing details of the transaction, Click Remove Authorisation.

- In the Remove Transaction Authorisation window, review the amount that you want to remove and enter a reason in Notes.

- Click Save. The authorisation is removed.

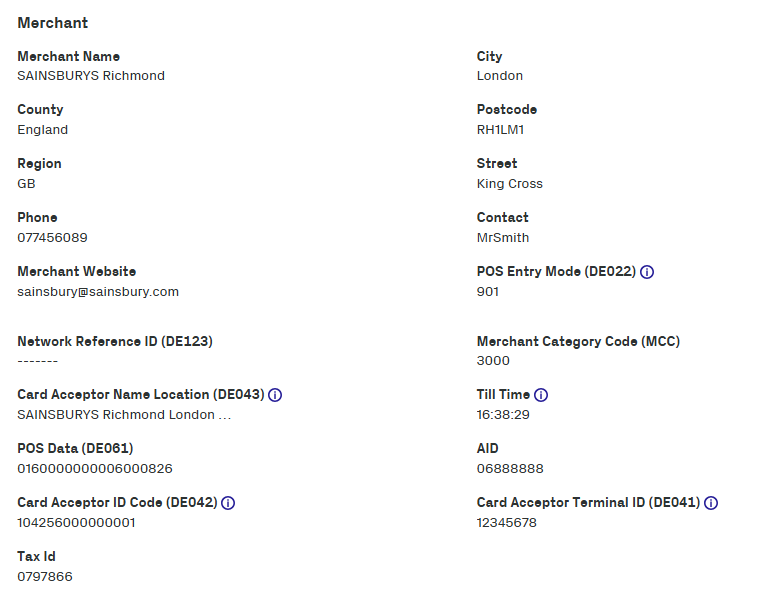

You can find details of the merchant that accepted the transaction, including the name and location of the merchant. There are also details on the transaction that took place at the merchant. For example, POS entry mode (DE022) includes information on how the cardholder was authenticated and the cardholder present/not present status.

-

Click Cards and Transactions.

-

Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

-

Click Search.

-

Click an entry from the transaction results that is marked as Authorisation

-

In the displayed window, find details of the merchant including:

-

Merchant name

-

City

-

County

-

Postcode

-

Region

-

Street

-

Phone

-

Contact

-

Merchant website

-

POS Entry Mode (DE022)

-

Network Reference ID (DE123)

-

Merchant Category Code (MCC)

-

Card Acceptor Name Location (DE043)

-

Till Time

-

POS Data (DE061)

-

AID

-

Card Acceptor ID Code (DE042)

-

Card Acceptor Terminal ID (DE041)

-

Tax Id

-

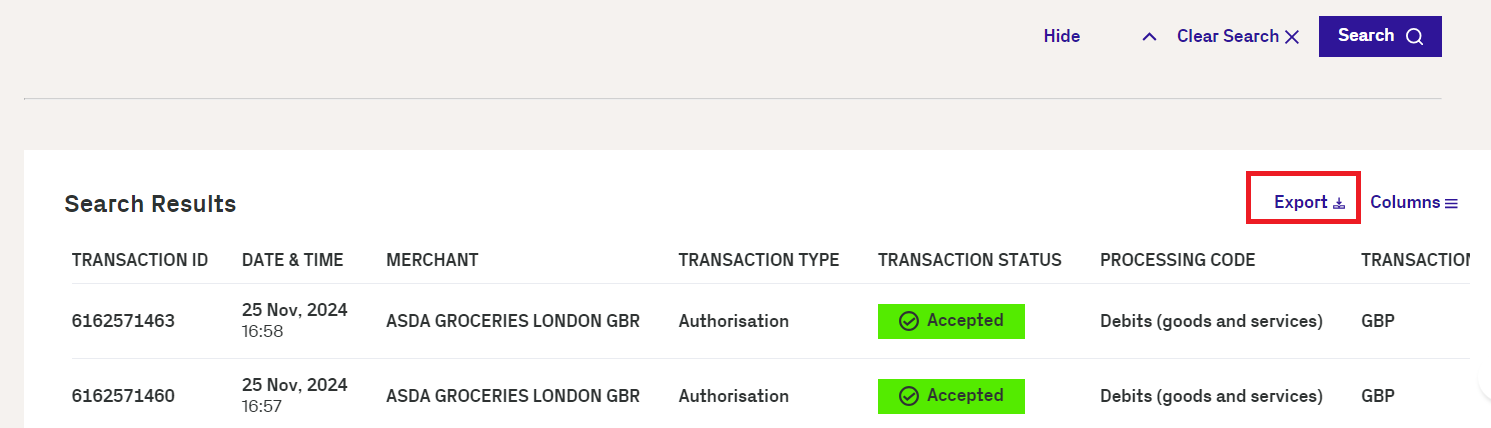

You can export transactions that have been filtered from a transaction search to a .CSV file. The .CSV file is available for download.

- Click Cards and Transactions.

- Click the Transactions tab.

-

Find transactions from a day, month, and year in Date between 2 times over a 24-hour period. If required, then filter the search.

-

Click Advanced Search and enter details in any of these search filters:

- Transaction Type

- Transaction Status

- Processing Code

- Merchant Location

- Note

- Billing Amount and Currency

- Transaction Amount and Currency

- Card Type

- Click Search.

- Click Export in the Search Results section.

- Observe the CSV file that has been downloaded.

Exporting transactions to a CSV file is available for all Thredd Portal roles except Read-Only.

Transaction Declines

Thredd Portal allows you to find out details on various types of transaction declines.

From the list of transaction results, Thredd Portal shows entries with the Declined status in the Transaction Status column.

You can also find information on why the transactions was declined which is recorded in the Transaction Note. This includes transactions where the decline was initiated by either Thredd or the client (your programme). Declines initiated by the client include EHI transactions.

The cardholder transaction note shows as "disallowed list" because the merchant (card acceptor id) is not allowed for the transaction. This is per the card acceptor disallowed list assigned to the card.

Solution: You can associate the card to a card acceptor list that allows transactions from the merchant through the below steps:

-

Identify the card number for the transaction.

-

Go to Card Actions > Edit Card Configurations.

-

Select a Card Acceptor List.

-

To confirm the change, click Review and Save.

-

Check the updated details and click Save.

Solution: Load funds onto the card.

-

Identify the card token for the transaction.

-

Go to Card Actions > Card Load/Unload.

-

In the window, select to load the card and click Next.

-

Review the balances for loading and click Next.

-

To confirm the change, click Review and Save.

To resolve this issue, you may need to change the Group Usage for the card. You should confirm that this is the right course of action, as it may require that you receive sign-off from the Issuer.

-

Identify the card token that you identified for the transaction.

-

Go to Card Actions > Edit Card Configurations.

-

Enter a different Group Usage.

-

Review the balances for loading and click Next.

-

To confirm the change, click Review and Save.

You should follow the below steps:

-

Enter the card token that you identified for the transaction.

-

Check the Expire date on the image of the card against the Card Status, which shows as Expired.

-

Advise the cardholder on next steps, for example, how to renew the card.

A transaction may be declined due to fraud. You may need to contact Thredd to investigate the fraud. You can also change the status of the card from 05 - Do Not Honour to 00- Active through the following steps:

-

Enter the card token that you identified for the transaction.

-

Check the transaction list to identify entries in the Notes field indicating that fraud has been captured in Thredd's Fraud Transaction Monitoring system.

-

To allow the transaction to be accepted, go to Card Actions > Change Card Status.

-

Click Next.

-

Select the following status code from the check box: 00 - Active.

-

Click Next.

-

Click Save.

If the transaction is declined because it failed the MCC group check, you should consider permitting transactions from the MCC by updating the entry in Group MCC. Contact Thredd to update the MCC group.

To change the group limit, do the following:

-

Enter the card token for the identified transaction.

-

To allow the transaction to be accepted, go to Card Actions > Edit Cardholder Configurations.

-

Under the Edit Card Configurations screen for the token, update the group in Group MCC.

-

To confirm the change, click Review and Save.

-

Check the updated details and click Save.

This description indicates that the authorisation value (bill amount) is higher than the maximum amount per transaction limit in the Limit group assigned to the card. You can update the transaction limit setting on the card to allow higher value transactions that do not exceed the limit.

To change the group limit, do the following:

-

Enter the card token for the identified transaction.

-

To allow the transaction to be accepted, go to Card Actions > Edit Cardholder Configurations.

-

Under the Edit Card Configurations screen for the token, update the group in Group Limit.

-

To confirm the change, click Review and Save.

-

Check the updated details and click Save.

This reason indicates that EHI didn't respond in the agreed time where a timeout happened.

If the client has selected Gateway Processing with STIP (Mode 4 ), Thredd approves or declines based on the product configuration, as the host is unavailable. If another EHI mode is selected, such as Gateway Processing (Mode 1) or Cooperative Processing (Mode 2), Thredd declines the transaction. You can do the following:

-

Investigate why the External Host did not respond in time.

-

Contact Thredd to assist in any further investigation.

This indicates that the authorisation was declined by your systems which are connected to EHI. Check your systems for the decline reason.

Check the external host for the decline reason.

Smart Client Migration

If you are a Smart Client user, you will need to migrate to Thredd Portal. Smart Client provides the same card management functions, but using a legacy Windows interface.

Q. Migration normally takes a few days to complete. This requires setup which Thredd will complete. However, clients will need to provide details to help Thredd perform the setup steps.

Yes, you can continue to use Smart Client during the migration period.

Thredd Portal is been designed with self-service in mind. Users can enter their email and be provisioned on Thredd Portal by the User Admin role within your organisation. You are in control of who has access to which roles within Thredd Portal.

Secure Access with SSO

You will need to configure secure access to Thredd Portal using Thredd's Identity Provider (IDP). The steps are as follows:

- Thredd adds a ‘User Admin’ for your organisation to the Identity Provider (this information is supplied by the client).

- You can then add your organisation, assign roles and add users in the Identity Provider - this is done by the ‘User Admin’ role which you have chosen in your organisation.

For more information, see the Connecting to Thredd Guide.

A member of our Engineering Security Team can be able to support you during your SSO integration should this be required, however, the process has been designed to be completed with minimal set-up.

You will need to configure secure access to Thredd Portal using Thredd's Identity Provider (IDP). The steps are as follows:

- Thredd adds a ‘User Admin’ for your organisation to the Identity Provider (this information is supplied by the client).

- You can then add your organisation, assign roles and add users in the Identity Provider - this is done by the ‘User Admin’ role which you have chosen in your organisation.

For more information, see the Connecting to Thredd Guide.

A member of our Engineering Security Team can be able to support you during your SSO integration should this be required, however, the process has been designed to be completed with minimal set-up.

No, all clients must connect to Thredd Portal using Single Sign On (SSO).

Feature Requests

If you want any new features or updates to existing ones, you can enter details in the Feature Request form in Thredd Portal.

Fill in details on the Feature Request form. This includes the:

- Priority level of the issue, for example, Major if the change request is important.

- Description of the problem that you face when using the current Thredd Portal functionality.

- Description of the feature that you require to address your needs.