Transaction Matching

Transaction Matching compares all the transactions within an Authorisation file (Non-Clearing) with all the transactions in a Settlement file (Clearing). The matching processes considers a set of variables between the Auth and Settlement to confirm a Match. If there is no match, it will be listed under Unmatched.

The set of Matched and Unmatched transactions are available under each day of Activity Reconciliation to provide easy access to the list and to deliver a summary. It can be common for a day to be Reconciled but still have Unmatched transactions.

How Does Transaction Matching Work?

Transaction matching uses the unique transaction ID to locate and compare authorisation messages to financial presentment messages. The following fields are compared:

-

Transaction date

-

Token ID

-

Acquirer Reference Number

-

Authorisation type

-

Authorization ID

-

Reference number

-

Authorisation amount & currency

-

Settlement amount & currency

If these details match, the transaction is marked as matched. If a matching authorisation record cannot be located for a financial message, the transaction is shown as unmatched. For more details on the matched fields, see Transaction Matching Fields.

Viewing Matched and Unmatched Transactions

-

Select Finance > Transaction Reconciliation > Transaction Matching from the menu.

The Transaction Matching page appears.Depending on which screen you are in, you can also navigate to the Transaction Matching page through these other routes: 1) From the Activity Reconciliation page, by selecting records for specific dates and the matching status that you want to view. The records are automatically filtered. 2) By clicking the Transaction Matching Quick Actions button from the Automated Back Office dashboard. 3) By clicking the Finance > Transaction matching from the left-hand menu in the Collections page.

-

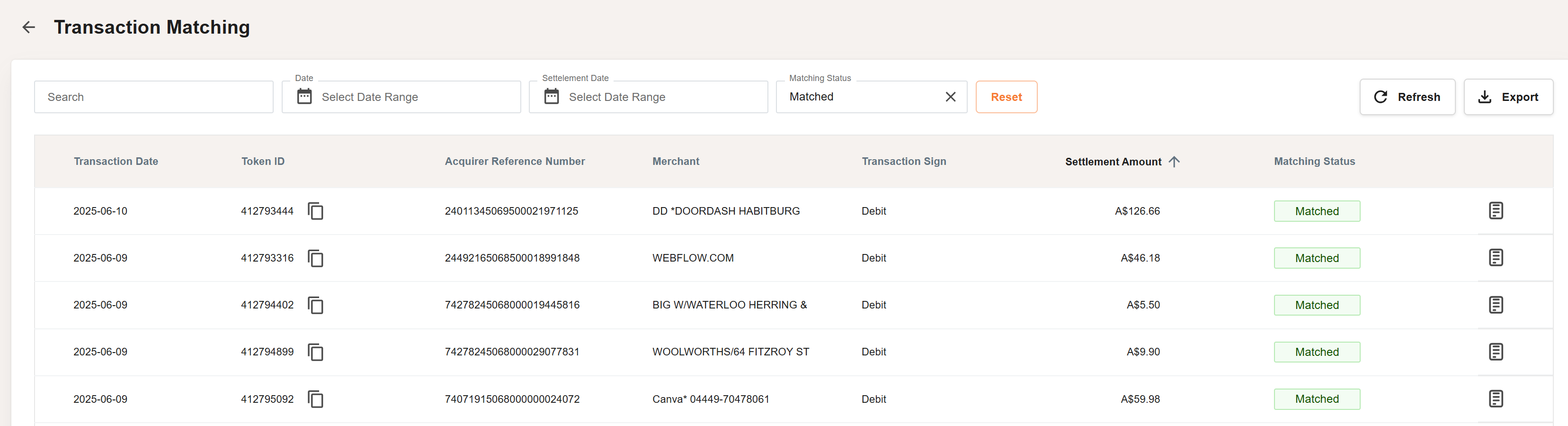

You can search for a particular transaction using Token ID, ARN, or Settlement Amount.

-

Use the Date field to refine a date range for a transaction.

-

Use the Settlement Date field to refine a date range for a settlement date.

-

Select either Matched or Unmatched from the Matching Status drop-down list.

-

Click the

icon for the record to view further details of the matched and unmatched transactions. See Viewing the Transaction Lifecycle.

icon for the record to view further details of the matched and unmatched transactions. See Viewing the Transaction Lifecycle.

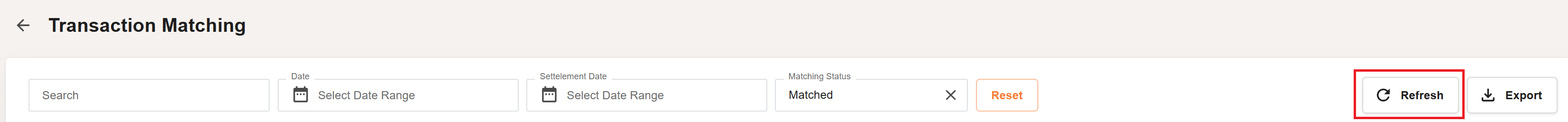

Figure 17: Transaction Matching page - showing details of the transaction records for the specified date(s)

Exporting Transaction Matching Records

-

To export your transaction matching records into a CSV file, click the Export button.

If successful, the message Exported data successfully is displayed.

If the export failed, the message An error occurred while exporting your data is displayed. -

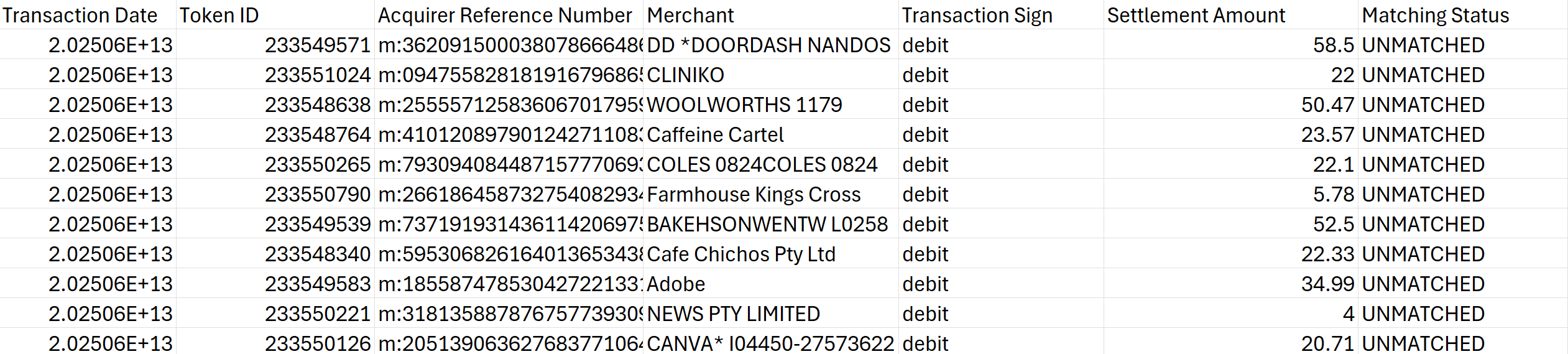

Save your data to a suitable location. See the example below.

Figure 18: Example of a CSV file containing exported transaction matching records

Refer to the table below for details of column headings.

|

Field |

Description |

|---|---|

|

Transaction Date |

The transaction date (in YYYYMMDDHHSS format). Note: Clicking the relevant cell with the date shows it in YYYYMMDDHHSS. By default, the date appears in scientific notation. |

|

Token ID |

The token ID of the card. |

|

Acquirer Reference Number |

The 23-digit Acquirer Reference Number (ARN), which uniquely identifies the Acquiring bank. |

|

Merchant |

The merchant name. |

|

Transaction Sign |

Whether the transaction is a credit or a debit. |

|

Settlement Amount |

The settlement amount in the issuer's default settlement currency. |

|

Matching Status |

The matching status: matched or unmatched. |

Refreshing Fee Data

To receive the most recent transaction data, click the Refresh button. This button is located towards the top of the screen as shown as follows.