4.11 Dynamic CVV2

The Card Verification Value 2 (referred to by Visa as CVV2 and Mastercard as CVC 2) is a 3 digit code displayed on the back or front of the card. The cardholder must enter or provide the CVV2 during a card-not-present transaction, as a way of verifying that they have the card in their possession. Since the CVV2 is a static number, this makes it more susceptible to fraud.

With dynamic CVV21, the default CVV2 value linked to the card record is ignored; the CVV2 value is verified during transaction authorisation against another value which your systems dynamically supply to the cardholder (e.g., via their card app or SMS). This can improve the security of card-not-present transactions.

4.11.1 How it works

Thredd assigns a static CVV2 to the card record when it is generated. If Dynamic CVV2 is enabled, then we by-pass our CVV2 value checks during the authorisation stage and send the transaction to your systems through EHI to authorise or decline. You should then ignore the card's default CVV2 value, and check the CVV2 value in the EHI transaction record against the dynamic value you provided to your cardholder.

Dynamic CVV2 is only available on Gateway Processing (mode 1) or Gateway Processing with STP (mode 4), where you approve the transaction.

4.11.2 How to Configure

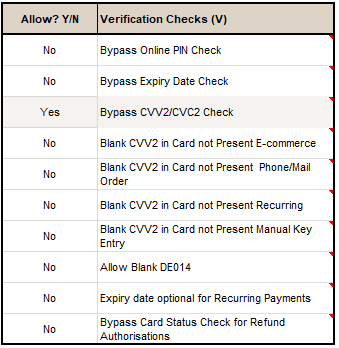

In the Card Usage Rules tab on your Product Setup Form (PSF), in the Verification Checks (V) box, set the Bypass CVV2/CVC2 Check field to Yes.

Thredd will not verify the CVV2 and instead this will be sent over EHI for you to verify and approve.

Figure 19: Card Usage Groups: Verification Checks

If you want Thredd to ignore the default value for Dynamic CVV2 with printed cards and print the card without a CVV2 field, you must discuss this with your Card Manufacturer. For more information on configuration options and card designs for physical cards, see the Physical Cards Guide.

If using Dynamic CVV2 with virtual cards, then you can configure your Virtual Image to not display the CVV2 field. For details, see the Virtual Cards Guide > Virtual Card Image Design.

Dynamic CVV2 can be set at card level by assigning the Card Usage group to the card, and therefore can be applied to cards already issued (the cards must be on a product where you are on Gateway Processing - modes 1 and 4).

To be able to check that the VV2 value is included in the EHI Authorisation message, confirm with your Implementation Manager that you require the send CVV2 option to be enabled on your EHI Configuration. See EHI Configuration Options.

Large merchants such as Paypal and Amazon may not send CVV2. If you specify that a CVV2 response is mandatory, then this may cause declines. We therefore recommend that in your Card Usage Rules you set the Allow Blank CVV2 in Card not Present E-commerce to Yes. See The Physical Cards Guide > Cards Usage Options.

During the transaction authorisation stage, we recommend that your systems do not decline a blank CVV2 value where the transaction originated from a large merchant such as Payal or Amazon2.

4.11.3 Checking the CVV2 at the Authorisation Stage

During transaction authorisation (using Dynamic CVV2):

-

The cardholder enters the CVV2 value provided to them by your systems (e.g., via phone app, SMS, web portal or smart card).

-

The Merchant includes the CVV2 value in the authorisation request.

-

When Thredd receives the request from the card scheme, we bypass the CVV2 value checks (as Bypass CVV2 is enabled in the card Usage Group). Thredd then takes the clear CVV2 value and encrypts it.

-

The Authorisation request is sent to your systems to validate the CVV2 value, along with any other checks; your systems must return an approve or decline decision.

-

Thredd returns your response to the card scheme.

The CVV2 validation result is provided in the 0110 authorisation response message, in the F44.10 field for Visa and in the DE048.87 field for Mastercard.

4.11.4 CVV2 Processing at the Card Scheme

Check with your Implementation Manager for relevant CVV2 processing options that should be configured at scheme level.