1.1 Introduction to the Card Schemes

1.1.1 What is a Scheme?

Card schemes are payment networks that enable cards such as prepaid, debit and credit cards issued by the scheme to be used in the regions and countries where the scheme operates. Each card scheme sets its own rules and regulations and promotes its own brand. The schemes are regulated by the financial authorities in the regions in which they operate.

Typically, cards used on the scheme’s network will be co-branded with the scheme’s logo; the schemes also provide private labelled card![]() A card which features the program manager’s card brand only (without the Visa or Mastercard logo). products, which do not require scheme branding1.

A card which features the program manager’s card brand only (without the Visa or Mastercard logo). products, which do not require scheme branding1.

Terminology: In this guide we refer to a Payment Network as the infrastructure over which payments take place and a Card Scheme as the card payment organisation that regulates and controls activity on the payment network and promotes its own brand.

1.1.2 Global and Local Schemes

Over the years there has been a proliferation of both local and global card schemes.

Global card schemes offer their services globally, so that a card issued with their account numbers and branded with their logo can be used in many countries across the globe, not just in the region in which they are issued. The main global card schemes supported by Thredd are listed below.

-

Mastercard

-

Visa

Other global schemes:

-

Union Pay

-

Amex (American Express)

-

Diners Club

-

JCB

Local card schemes issue payment instruments which are local to a country or region and can only be used in that region. Examples include BORICA (in Bulgaria), BOLETO (in Brazil) EFTPOS (in Australia and New Zealand), Network for Electronic Transfers (NETS) in Singapore and Rupay in India.

1.1.3 History of the Major Card Schemes

Let’s take a brief look at the history of the two main global card schemes supported by Thredd.

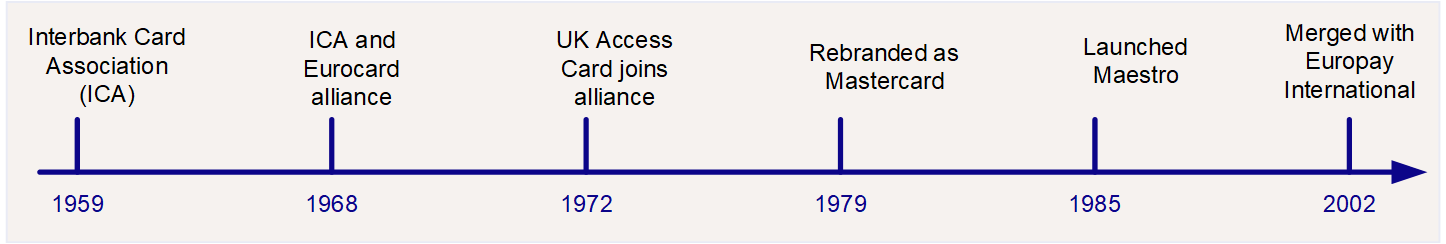

Mastercard was created in 1959 when several regional US banks formed Interbank, which later became the Interbank Card Association (ICA). In 1968, the ICA and Eurocard formed an alliance that provided access to each other’s network. The UK Access card joined the ICA/Eurocard alliance in 1972. In 1979, ICA was rebranded as Mastercard and the Access card became part of Mastercard. In 2002 Mastercard merged with Europay International.

Figure 1: Mastercard Timeline

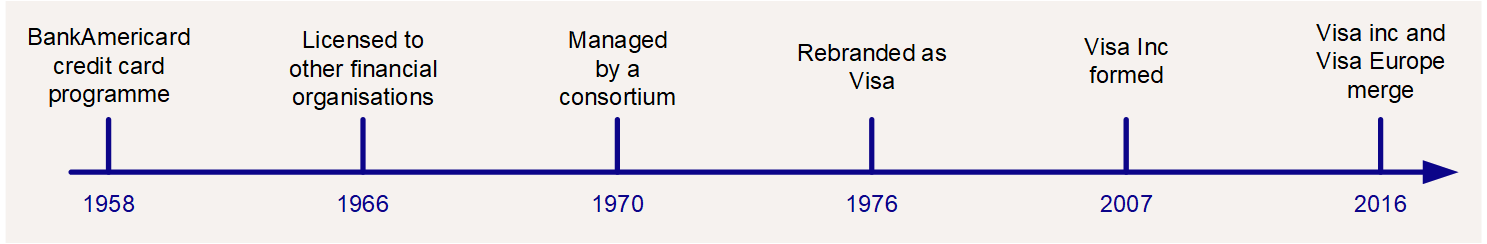

Visa was launched in September 1958 by Bank of America as the BankAmericard credit card programme.

In 1966 the programme was licenced to other financial organisations, and in 1970 a consortium of issuer banks took over its management. In 1976 the programme was rebranded as Visa. In 2007 Visa formed a global corporation, Visa Inc, while Visa Europe remained member-owned. In 2016 Visa Inc and Visa Europe became one global entity. Visa is currently the world's second largest card scheme (after China UnionPay).

Figure 2: Visa Timeline

The card schemes are constantly evolving, offering new products and services, and expanding their networks through merges and acquisitions. Partnering with a flexible and adaptive issuer-processor like Thredd helps you to keep up to date with the latest card scheme changes and leverage new scheme services.

1.1.4 Becoming a Scheme Member or Participant

To become a scheme member or network participant, you need to sign up to the scheme, be approved by them and contribute to scheme operating costs. There are two types of member licences:

-

Principal licence: The issuer has a direct relationship with the scheme and full autonomy over their issued cards

-

Affiliate licence: The issuer is given access to certain features, such as scheme portals, but needs a principal member to sponsor their application

1.1.5 The Role of Thredd within the Scheme

Thredd is certified by Mastercard and Visa and can provide direct connections to their networks as a third-party agent.

Thredd acts as an issuer-processor![]() Third party agent certified by the card scheme to accept and process card network transactions on behalf of the issuer. on behalf of our customers. We receive transactions from Mastercard and Visa and help our customers (card program managers) to process and authorise these transactions. We also connect to other linked systems to support additional payment processing needs around security, fraud protection, payment authentication, mobile payments, tokenisation and dispute management.

Third party agent certified by the card scheme to accept and process card network transactions on behalf of the issuer. on behalf of our customers. We receive transactions from Mastercard and Visa and help our customers (card program managers) to process and authorise these transactions. We also connect to other linked systems to support additional payment processing needs around security, fraud protection, payment authentication, mobile payments, tokenisation and dispute management.

Thredd is not an issuer or a BIN sponsor![]() An issuer that allocates a BIN or a BIN range to their program manager customer, to enable the program manager to launch a card programme., but we have existing relationships to many issuers, who are set up in our systems.

An issuer that allocates a BIN or a BIN range to their program manager customer, to enable the program manager to launch a card programme., but we have existing relationships to many issuers, who are set up in our systems.