1.4 The role of Thredd in the Payments Ecosystem

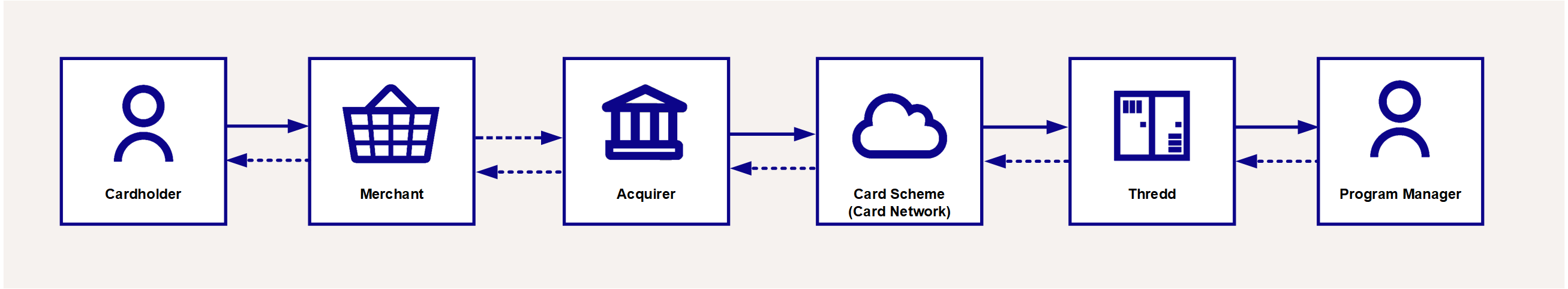

Thredd is an issuer-processor![]() Third party agent certified by the card scheme to accept and process card network transactions on behalf of the issuer., enabling program managers to launch their card programme and connect to scheme network participants using our platform.

Third party agent certified by the card scheme to accept and process card network transactions on behalf of the issuer., enabling program managers to launch their card programme and connect to scheme network participants using our platform.

Figure 7: Role of Thredd in the Payments Ecosystem

In addition to theThredd Platform and suite of products and services, we provide detailed consultancy and support to program managers at all stages of their programme, from conception and design, through to live launch.

Thredd does not hold end-customer funds and does not fall under the regulations for financial service providers. Thredd is fully compliant with the Payment Card Industry Data Security Standards (PCI DSS), which enables us to hold and process sensitive cardholder information.

1.4.1 Thredd Platform

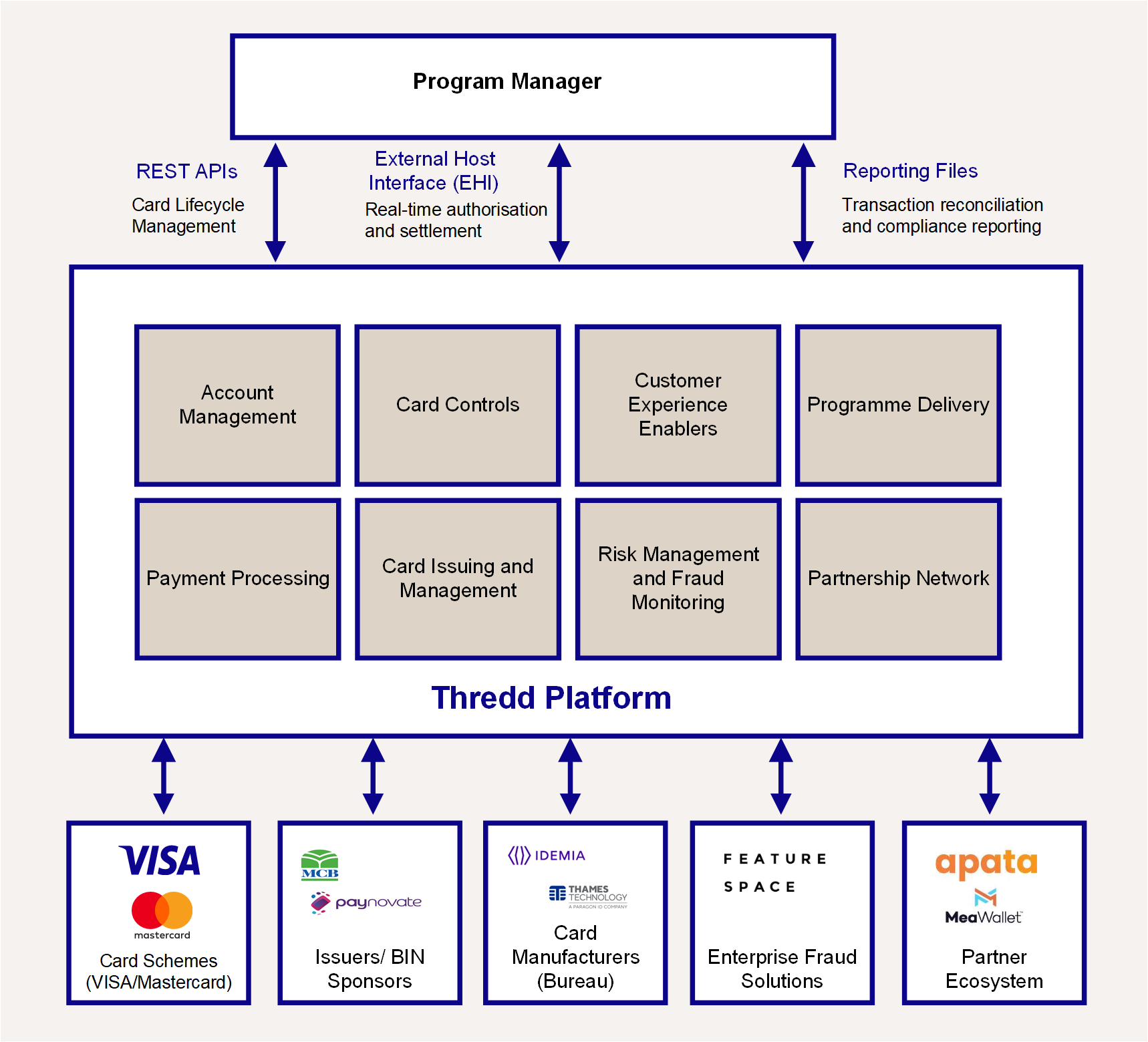

The Thredd Platform provides a comprehensive, robust and reliable solution for card payment processing.

The Thredd platform is integrated with worldwide payment networks and has existing partner relationships and connections that reduces the time required to launch a card program. You can leverage the Thredd payments ecosystem, thus reducing the amount of time-consuming and costly licensing, regulatory compliance, commercial agreements, infrastructure and connections.

Figure 8: Thredd Platform

Thredd offers a global service, across Europe, North America, the Middle East and Asia Pacific regions, enabling you to expand your product offering as you grow. Thredd currently supports Visa and Mastercard and Discover global payment networks, as well as smaller networks that use the Mastercard Network Exchange (MNE), such as STAR and Pulse1. Our cloud-based processing centres ensure resilience, scalability, reliability and fast processing, in whatever region you are processing.

More Information

Find out more about the role of Thredd and what it is like to work with Thredd, using the links below.