2.1 Card Payment Instruments

This section provides a brief overview of the types of card payment instruments.

2.1.1 Prepaid and Debit Cards

Prepaid cards are loaded with a prepaid amount that is available for the cardholder to spend. The card is not allowed to go into negative balance, and you can provide a facility to enable your cardholders to load additional funds to the card if required.

Thredd prepaid cards provide a simple and effective way to rapidly launch a card service.

Debit cards allow the cardholder to make payments up to the available amount in their account. Payments that take the card over the available balance may be declined. The card may have a credit facility or overdraft associated, allowing the cardholder to spend more than they have loaded to the card, which typically results in additional charges1.

Thredd debit cards provide all the functionality of a typical debit card.

2.1.2 Gift Cards

Gift cards are similar to prepaid cards, as they are loaded with a prepaid amount that is available for the user to spend and the card is not allowed to go into negative balance.

The gift card may be restricted for use to specific locations or merchant stores.

Gift cards can be private labelled![]() A card which features the program manager’s card brand only (without the Visa or Mastercard logo). and are not tied to usage by a specific cardholder (anyone with the gift card can use it). They typically benefit from reduced regulatory and licensing requirements due to low value load limits and restrictions on the types of spending.

A card which features the program manager’s card brand only (without the Visa or Mastercard logo). and are not tied to usage by a specific cardholder (anyone with the gift card can use it). They typically benefit from reduced regulatory and licensing requirements due to low value load limits and restrictions on the types of spending.

2.1.3 Credit Cards

Credit cards are linked to a credit facility that can be paid back later. The cardholder can make payments up to the available credit limit set for their credit card account. Payments that take the card over the available limit may be declined and/or result in additional card charges. Credit cards are commonly used for certain types of bookings, such as hotel and accommodation, car hire and flight bookings.

On the Thredd platform there is no distinction between a debit and a credit card. The Thredd card must always hold a sufficient balance to enable a card payment.

Thredd provides the option to support credit payments via our External Host Interface (EHI) product (see External Host Interface). In this use case Thredd does not maintain a record of the card balance and the program manager must provide the payment authorisation decision.

2.1.4 Multi-currency Cards

A multi-currency card is linked to multiple currency wallets and enables the cardholder to pay in any desired currency. The cardholder typically has the ability to load funds into the different wallets. Thredd provides support for multi-currency e-wallets2.

2.1.5 Virtual Cards

Virtual cards are a popular payment instrument with Thredd program managers. You can offer your customers a virtual card as an easy means to make payments online or in-store using a mobile phone. The virtual card can be activated, loaded with funds and is available for immediate use by the customer (compared to a physical card, which needs to be printed and delivered).

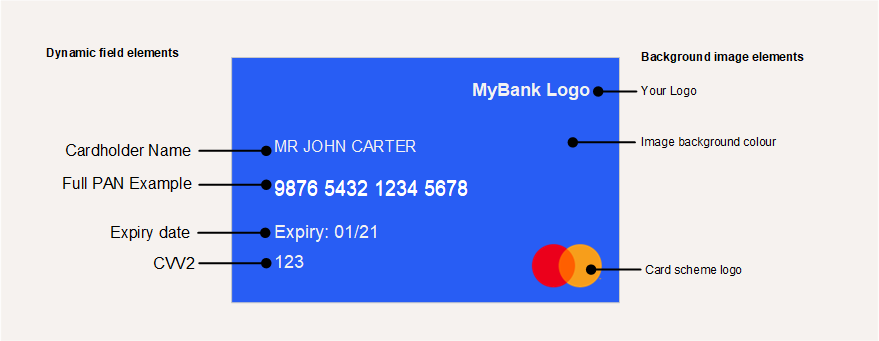

The virtual card image can be customised to your brand and requirements. See the example below.

Figure 9: Virtual Card Configuration

For co-branded cards featuring the card scheme’s logo, each scheme has specific requirements on how their logo is used3.

Offering virtual cards enables you to launch your card programme quickly, without the need to go through the costs and time of implementing physical cards through a Card Manufacturer![]() Company that prints newly issued physical cards and sends to cardholders..

Company that prints newly issued physical cards and sends to cardholders..

Virtual cards can be single use for enhanced security (the card is blocked as soon as the transaction has taken place).

For more information, see Virtual Cards.