Product Enhancements

Thredd continues to provide enhancements across all the pillars of the Thredd Platform.

Risk Management

Below is a list of recent enhancements to our risk management and fraud transaction monitoring portfolio.

Fraud Transaction Monitoring

-

New Reporting functionality available on the Fraud Transaction Monitoring Portal. Using a powerful and fast backend database with report visualisation capabilities, the reports enable customers to manage operations, analytics, and solution-specific needs all in one place.

-

New Scam Transaction Monitoring service now available. See Scam Transaction Monitoring.

-

Fraud Transaction Monitoring Reseller version — allows issuers to offer Fraud Transaction Monitoring to their Program Manager clients

For more information, see the Fraud Transaction Monitoring Guides.

Real-time Event Alerts

Thredd now supports webhooks, which you can use to notify your cardholders of important events such as:

-

Real-time fraud events

-

Real-time card status payment event notifications (such as card loads and unloads)

Webhooks can also be used to provide your fraud analysts with fraud metrics, to measure how our fraud solutions are impacting your key performance indicators.

For more information, see:

3D Secure via Apata

3D Secure via Apata is our new 3D Secure service, offering improved flexible configuration options and more authentication methods. For more information, see the 3D Secure (Apata) Guide.

For clients in regions not supported by Apata, we continue to maintain our 3D Secure service via Cardinal. For more information, see the 3D Secure (Cardinal) Guide.

Card Issuing and Management

We continue to enhance our API to support the needs of customers when issuing and managing the cards. Newly released endpoints include:

-

Support for Customised Card PANs. The Customised Card APIs provide a personalised user experience for cardholders, allowing digital banks and fintech companies to offer their users the ability to choose the last six digits of their card number. See the Cards API Website: Customisable Card Number.

-

New Load/Unload Card for Issuers. This new endpoint enables issuers to load and unload cards for their sponsored programs. See the Cards API Website: Load and Unload Card for Issuer.

-

New endpoint for retrieving Apata card-level configuration. Available to customers using our 3D Secure (Apata) service. See the Cards API Website: Get 3DS Configuration. For customers using SOAP web services, see the Web Services Guide: 3D Secure Get Card Level Configuration (Apata).

For information on new API fields and other enhancements to the Thredd API, see the Cards API Website: What's Changed?

For customers using SOAP web services, see the Web Services Guide.

Customer Experience Enablers

Digital Wallets

-

Update to Orange Flow guidance when using Apple Pay. See Tokenisation Service Guide: How Tokenisation Works.

-

Release of Thredd's In-app push-provisioning service, for clients who are not PCI-DSS level 1 compliant. See Tokenisation Service Guide: How Tokenisation Works

-

Support for Click to Pay. Click to Pay introduces a new option for cardholders to pay online using a token instead of their card details. Cardholders can choose Click to Pay at checkout to send a merchant a token based on their name, phone number, and email address that is used for authorisation. See the Tokenisation Service Guide: Click to Pay.

-

Rewrite and reorganisation of the Tokenisation Service Guide, to introduce new use cases and appendices. See the Tokenisation Service Guide.

-

Updates to fields and enhancements to the API documentation for tokenisation. See the Cards API Website: Introduction to Tokenisation.

Payment Processing

Transaction Control using the External Host Interface (EHI)

The Thredd External Host Interface (EHI) is a system which coordinates payment authorisation and financial messages processed on the Thredd Platform, and communicates with your external systems in real-time, to support the payment authentication process. We provide three different flavours of EHI messaging:

-

XML format

-

JSON format

-

Single Message System (SMS)

SMS is a new format of transaction processing to support US Networks debit card processing.

We are continually enhancing EHI to support the needs of our clients. For example:

-

New field values and options

-

New response codes, processing codes, merchant category codes and currency codes

-

Support for Card Scheme mandates and Compliance-related updates

-

New appendices and transaction examples

-

Guide content updates, corrections and enhancements

For more information, see the External Host Interface (EHI) Guide.

Transaction Reporting

We continue to enhance the reports we provide to Program Managers and Issuers. We offer new Global transaction XML reporting formats for splitting transaction reports between real-time authorisation (non-clearing) and Financial (clearing) messages, to provide more timely and focused reporting. See the Global Reporting guides.

We can now provide reporting for enhanced Level 2 and Level 3 data on Commercial Cards. For more information, please contact your Account Manager.

Visa Multicurrency Settlement

Thredd’s multicurrency settlement service enables issuers to settle transactions with Visa in multiple currencies, providing flexibility and efficiency in international financial operations. You can choose from over 20 settlement currencies and assign a default currency for different transaction currencies.

For more information, see the Visa Multicurrency Settlement product sheet.

Enhancements for the Visa Account Updater Service

Visa Account Updater (VAU) is a service offered by Visa that allows issuers to advise merchants of changes to a cardholder's details. This service minimises the occurrence of outdated card information for a cardholder that could lead to declined transactions. For more information, see Visa Account Updater Service.

Enhancements for the Account Status Inquiry (ASI) Service

ASI is a message type that allows the merchant to check the Card Validation Code (CVC) and, if address details are provided, to optionally use the Address Verification Service (AVS). If the ASI checks are successful, Thredd responds with an 00 approval to the merchant. For more information, see Account Status Inquiry (ASI).

Program Delivery

Thredd Connectivity Framework

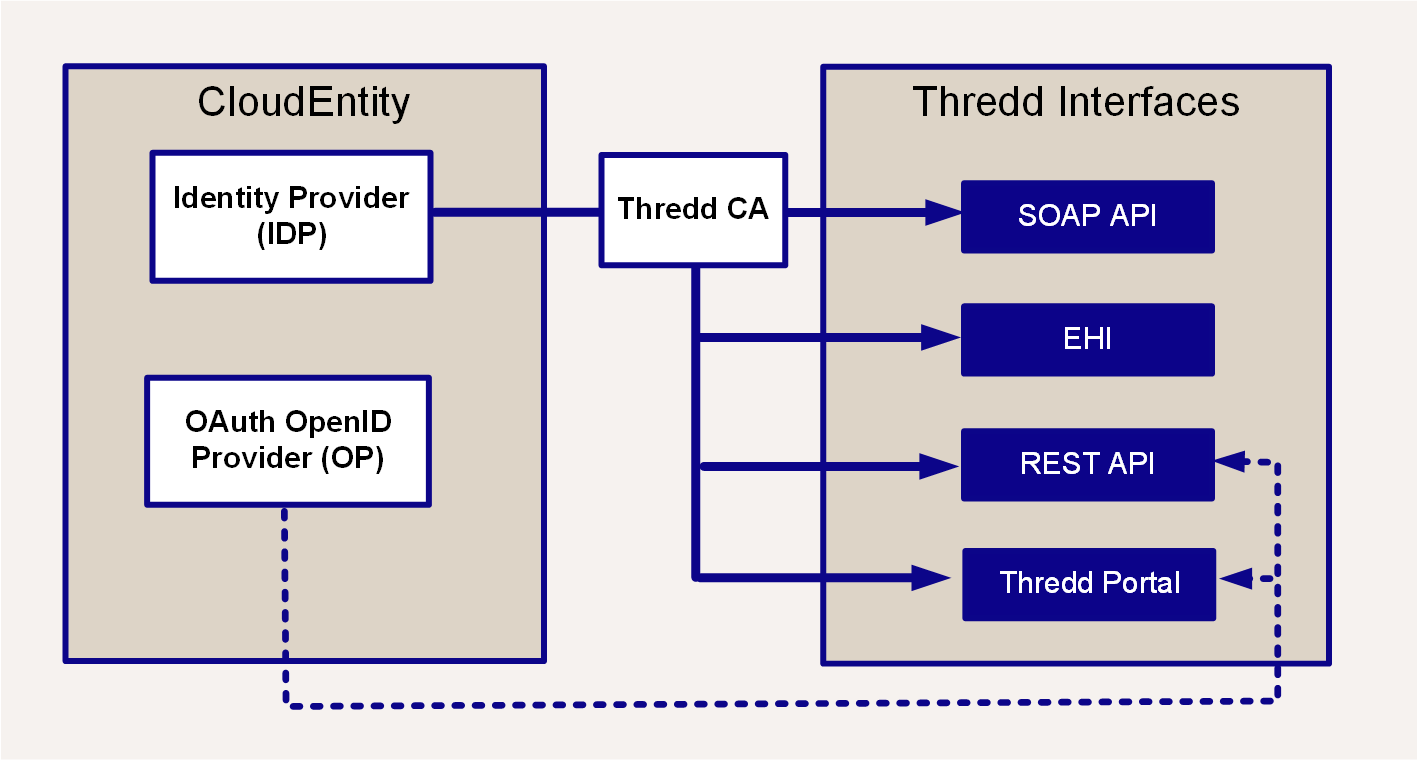

The Secure Connectivity Framework enables highly secure access to Thredd’s resources. The main components of this improved way of connecting to Thredd services includes:

-

CloudEntity — a Software as a Service (SaaS) capability which acts as the Identity Provider (IDP) for Thredd’s interfaces (including Thredd CA and Thredd Portal), and as an OAuth OpenID Provider (OP) for the registration and management of customer applications, generation and validation of access tokens, and for the enforcement of access control policies.

-

Thredd CA — This is Thredd's Certificate of Authority that is a SaaS capability for the creation and management of certificates:

-

Transport Certificates — for establishing secure connections between resources.

-

Signing Certificates — for the creation of signed messages, used for authentication of clients, and non-repudiation and authentication of notifications.

-

-

mTLS Termination — on-premise infrastructure enabling the establishment of Trust Chains when clients present Thredd-issued Transport Certificates at the point of attempting to connect to protected resources.

Figure: Thredd Secure Connectivity Framework

Release status: available. For details, please contact your account manager.

Find out more:

Cards Scheme (Network) Mandates

The Thredd Platform is regularly updated to comply with the Card Scheme Mandates relating to issuer-processor systems. Most of these updates are implemented seamlessly on our platform, without needing you to do anything.

Where a Card Scheme mandate requires a functional change to the Thredd platform that may impact the card operations of our customers, we provide you with 30-60 days advanced information using a Thredd Pre-Release Notification (PRN).